National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

April – May 2025

Contents

- Tax Season 2025 by Lincoln Rice and Chrissy Kirchhoefer

- War Tax Resistance Poem by by Cathy Deppe

- Counseling Notes: Items Exempt from Seizure 2025 • Shrinking IRS under Trump

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions “Who’s Afraid of the Taxman?” Panel on Zoom • Choose Democracy and War Tax Resistance • WTR Workshop with NEWTR and Black Response Cambridge • Nuclear Resister Table at Fair • Ignite Peace through War Tax Resistance • Code Pink NYC Features War Tax Resistance • WTR Workshop in Eugene, Oregon • WTR Workshop in Madison, Wisconsin • WTR Workshop at Holiday Party for Los Angeles Group • Taxpayers Against Genocide Case Dismissed

- NWTRCC News: NWTRCC National Conference: Resisting Together (May 2 – 4, 2025) • NWTRCC Hosted Counselor Training in February

- New Audio Documentary on Wally and Juanita Nelson by Lincoln Rice

- OPINION Moral Compromise By Joshua Wrolstad

- UPDATED RESOURCE New Edition of War Tax Resistance Guidebook

Click here to download a PDF of the April/May issue

Tax Season 2025

By Lincoln Rice and Chrissy Kirchhoefer

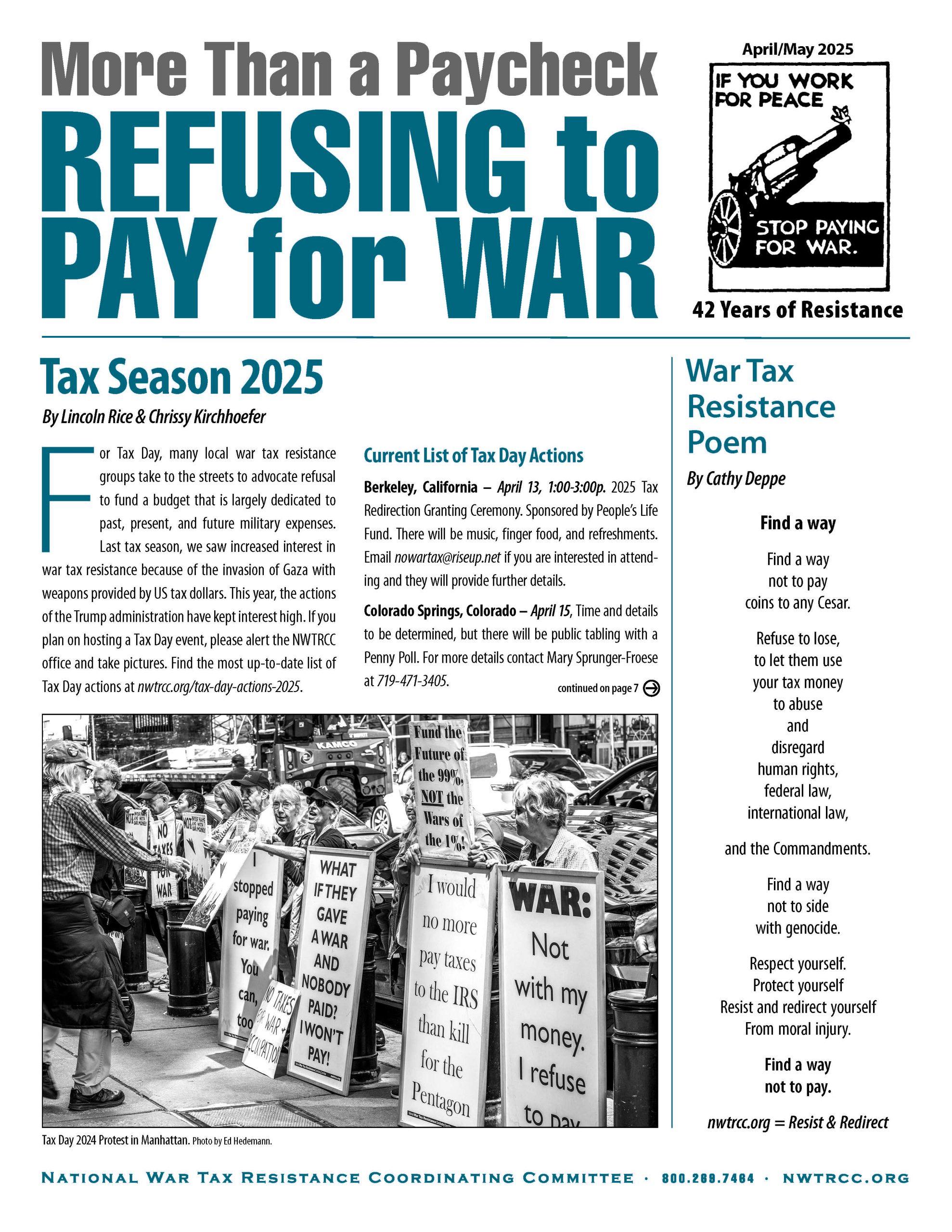

Tax Day 2024 Protest in Manhattan. Photo by Ed Hedemann

For Tax Day, many local war tax resistance groups take to the streets to advocate refusal to fund

a budget that is largely dedicated to past, present, and future military expenses. Last tax season,we saw increased interest in war tax resistance because of the invasion of Gaza with weapons provided by US tax dollars. This year, the actions of the Trump administration have kept interest high. If you plan on hosting a Tax Day event, please alert the NWTRCC office and take pictures. Find the most up-to-date list of Tax Day actions at nwtrcc.org/tax-day-actions-2025

Current List of Tax Day Actions

Berkeley, California – April 13, 1:00-3:00p. 2025 Tax Redirection Granting Ceremony. Sponsored by People’s Life Fund. There will be music, finger food, and refreshments. Email nowartax@riseup.net if you are interested in attending and they will provide further details.

Colorado Springs, Colorado – April 15, Time and details to be determined, but there will be public tabling with a Penny Poll. For more details contact Mary Sprunger-Froese at 719-471-3405.

Washington, District of Columbia – April 4, 7:30pm. “Breaking Free from the War Machine: Stories of Tax Resistance.” Panel discussion with Veronica (Ronnie) Fellerath-Lowell, John Reuwer, and Josephine Guilbeau. In-person event only at the Dorothy Day Catholic Worker, 503 Rock Creek Church Rd NW. For more information, contact Kathy Boylan at 202-882-9649 or <href=”mailto:kathyboylan5@gmail.com”>kathyboylan5@gmail.com

.

Brunswick, Maine – April 1 , 11:30a-1p. Leafleting outside the Brunswick post office. Sponsored byPeaceWorks. More information will be listed at peaceworksbrunswickme.org/events.html.

St. Louis, Missouri – April 15, Time and details to be determined. For more details contact Chrissy Kirchhoefer at outreach@nwtrcc.org.

Ithaca, New York – April 15, Time and action to be determined. For more information, contact Mary at moongoddessmary58@yahoo.com.

Manhattan, New York – April 15, Noon-1:30pm. Vigil, music, and leafleting at IRS office at 290 Broadway (off Duane St.) Details being finalized as this goes to press. Sponsored by NYC War Resisters League and more groups TBA. For more information, warresisters.org/demonstrations or email nycwrl@nycwarresisters.org.

Eugene, Oregon – April 15, 12-1p. Tabling outside the Eugene Public Library (100 W. 10th Ave). For more info, email suebarnhart2@gmail.com.

Portland, Oregon – April 5, 3-5p. Tax Day Redirection Ceremony at St. Andrew Catholic Church (Oscar Romero Room), 806 NE Alberta St. There will also be snacks, presentations, and community building. For more information, see @OCPeaceFund on Instagram.

Portland, Oregon – April 15, 7:30-9a. War Resisters League-Portland will hold “Burma-Shave” style signs on bridges for the morning commute. Signs provided. RSVP John at jgrueschow1@gmail.com.

Brattleboro, Vermont – April 15, 12-5pm. WTR Information Tabling outside of the Brattleboro Food Coop, 2 Main Street. Sponsored by Taxes for Peace New England. They will provide written material, answer questions, and provide advice to help people resolve their predicament of paying for wars at the expense of their consciences. For more info, contact Daniel Sicken at 802-387-2798.

Harrisonburg, Virginia – April 12, Noon. Shenandoah Valley Taxes for Peace will meet next to the Harrisonburg Farmers Market (228 S Liberty St.) to publicly redirect their resisted war taxes. For more info, contact Tim Godshall, 540-908-8194, timgodshall@gmail.com.

Milwaukee, Wisconsin – April 12, Noon-1pm. Protest against federal tax dollars for war, US Army Reserve, 5130 W. Silver Spring Dr. Sponsored by Milwaukee War Tax Resistance, Casa Maria Catholic Worker, Peace Action Wisconsin, and Welfare Warriors. For more info, contact Lincoln or Mikel, Casa Maria at usury_sucks@hotmail.com or (414) 344-5745.

Check out another website for Tax Day actions:

The Global Days of Action on Military Spending (GDAMS) are taking place again this year, April 10 to May 9. This year, they “are witnessing the dramatic consequences of escalating global militarization.” Find a list of all the actions at demilitarize.org.

War Tax Resistance Poem

By Cathy Deppe

Find a way

Find a way

not to pay

coins to any Cesar.

Refuse to lose,

to let them use

your tax money

to abuse

and

disregard

human rights,

federal law,

international law,

and the Commandments.

Find a way

not to side

with genocide.

Respect yourself.

Protect yourself

Resist and redirect yourself

From moral injury.

Find a way

not to pay.

nwtrcc.org = Resist and Redirect

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

Items Exempt from Seizure

In February, we updated our War Tax Resistance Practical Booklet #3: How to Resist Collection, or Make the Most of Collection When It Occurs. In the process of updating this booklet, Ruth Benn noted that the amount of personal property exempt from levy had actually decreased. For example, personal and household belongings exempt from levy fell from $8,940 to $6,250. Books or tools of a trade, business, or profession of the resister dropped from $4,470 to $3,125. Court ordered child support payments; certain annuity and pension benefits; certain service-connected disability payments; workers compensation; and certain public assistance payments are also exempt from levy. Note that a number of these categories are qualified by the word “certain.” (§6334c, IRC) (For additional details, see IRS Publication 594, Understanding the Collection Process, irs.gov/pub/irs-pdf/p594.pdf, or free from IRS offices.) Lowering the valued amount of exempt physical property has little practical effect at the moment since no physical property items have been seized from a war tax resister since the mid-1990s.

Shrinking IRS under Trump

The Biden administration had a strong relationship with the IRS and was slowly rebuilding its workforce. That has quickly changed under Trump. In late February, the IRS began laying off nearly 7,000 IRS employees. Most were recent hires under the Biden administration and were still on probation.

These firings at the IRS coincide with Trump’s offer to federal workers—including IRS employees—to voluntarily resign with the promise of receiving pay and benefits through September 30, 2025. Many workers who turned in their notice at the IRS were informed that those in taxpayer services and information technology were essential employees until May 15, 2025. In essence, they could not leave their positions until May 15th so as to facilitate a smooth tax filing season. Nevertheless, it appears that many more IRS employees plan on leaving after May 15.

Many Thanks

Thanks to each of you who has donated in early 2025! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: New England War Tax Resistance

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

Tax Resistance Ideas and Actions

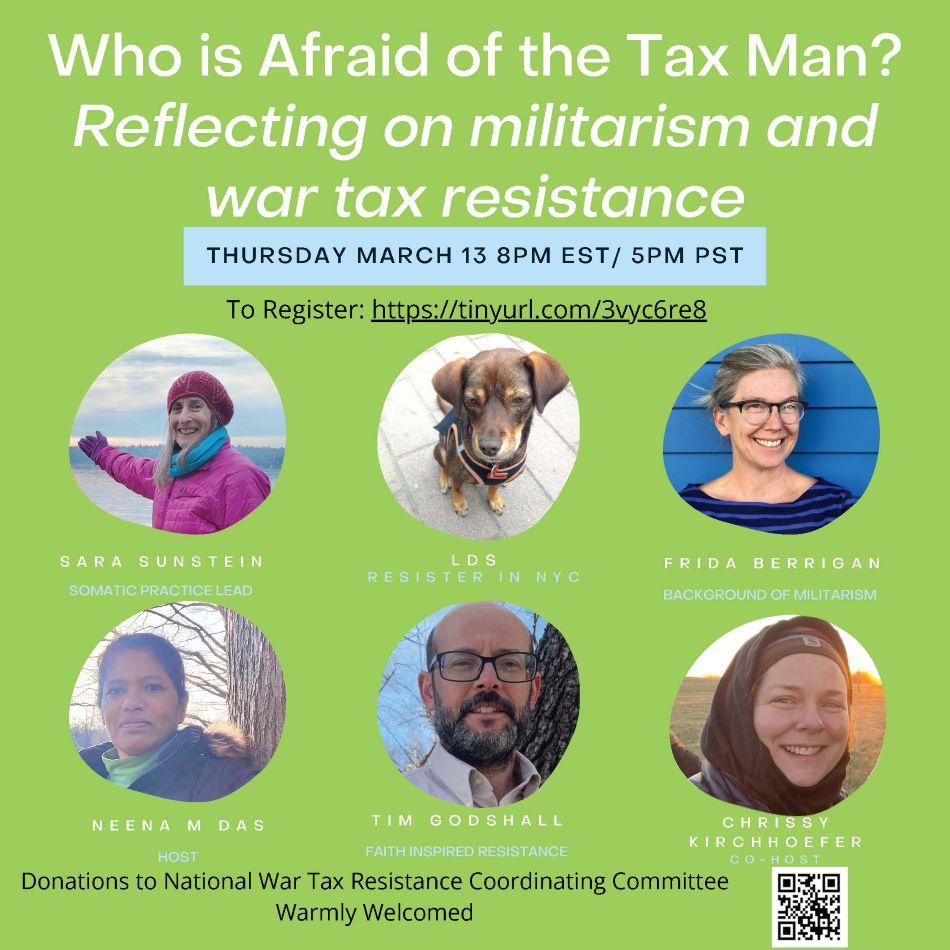

“Who’s Afraid of the Taxman?” Panel on Zoom

NWTRCC sponsored a panel discussion, “Who’s Afraid of the Taxman?” that addressed issues of what holds us back from resisting paying for war. Frida Berrigan began the discussion by giving an overview of military spending. Chrissy Kirchhoefer gave a history of NWTRCC and WTR in the US. Tim shared his experience as a person resisting within the context of a faith community and then L brought it all home by asking the question, “How do we practice resistance over time?”

The idea for the panel emerged from Neena, who has been resisting in the NYC area and wanted to explore the concept of fear in holding people back from resisting paying money to the IRS. The panel was quite different from the standard introduction to war tax resistance that NWTRCC has been hosting on a near monthly basis since October 2023. During the panel, someone from the NWTRCC network led the group in some somatic practices so that we could ground our bodies with the information shared.

-Report by Chrissy Kirchhoefer

Caption: Nuclear Resister Tabling in February 2025. Photo courtesy of Nuclear Resister.

Nuclear Resister Table at Fair

Nuclear Resister Tabling in February 2025. Photo courtesy of Nuclear Resister.

The Nuclear Resister tabled at the Tucson Peace Fair and Music Festival on February 22, 2025. In the accompanying photo, Russell Lowes and I talked to some people about how wonderful it is that Leonard Peltier is finally out of prison and about a March 11 protest to say NO to Tucson Electric Power’s plans to look into building new nuclear power plants in Arizona. Our booth also featured a Penny Poll, which had a lot of interest!

-Report by Felice Cohen-Joppa

Choose Democracy and War Tax Resistance

Image from Choose Democracy’s “No Taxes to a King” Campaign

NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer have been offering war tax resistance workshops on an almost weekly basis this entire tax season. Some have been official NWTRCC offerings and others resulted from groups inviting someone from NWTRCC join their session.

Our most popular WTR 101 session this year was on the evening of February 20, when we had over 200 people join our Zoom session. The timing for this session seemed to coincide with mounting frustration over Trump’s first month in office and the actions of his administration. Leading up to that session, the group Choose Democracy (choosedemocracy.us) had reached out to NWTRCC to inquire about promoting war tax resistance as a method to resisting fascism in the US. And the week before the session, they began promoting a pledge online that people could sign. The pledge includes the following three points:

- We empathetically say NO to the current administrative coup. We will encourage everyone to stop the coup.

- We will learn about tax resistance and other forms of noncooperation.

- We do not intend to pay money to a King. Therefore we will consider our options to redirect our funds from the federal government to directly support critical services.

Choose Democracy advertised our February 20th session and asked if they could say a few words after the workshop. Over 100 people from the group stayed after the workshop to hear about the work of Choose Democracy and how they were currently promoting war tax resistance. We hope to continue this fruitful collaboration. Choose Democracy’s online pledge can be found at actionnetwork.org/groups/choose-democracy.

-Report by Lincoln Rice

WTR Workshop with NEWTR and Black Response Cambridge

New England War Tax Resistance (NEWTR) and The Black Response Cambridge (theblackresponsecambridge.com) hosted a war tax resistance workshop on Zoom on the afternoon of February 27th. Seventy people attended the session. Particularly in the wake of the continuing horror in Gaza, The Black Response Cambridge had wanted to collaborate with NEWTR in hosting a WTR workshop. NWTRCC Coordinator Lincoln Rice offered the workshop and Mary Regan shared information about NEWTR and their alternative fund.

Ignite Peace through War Tax Resistance

On the afternoon of Thursday, February 6th, NWTRCC Outreach consultant Chrissy Kirchhoefer and Kit Miller of the M. K. Gandhi Institute for Nonviolence used Zoom to offer a war tax resistance workshop to an in-person potluck gathering hosted by Ignite Peace (ignitepeace.org) in Cincinnati, Ohio.

Code Pink NYC Features War Tax Resistance

Code Pink New York City, along with other groups, sponsors a monthly Pop-Up for Liberation series. These community events combine art, live music, culture, resource sharing, and political education for a unique community-building experience in neighborhoods around NYC. They aim to raise awareness about US/western imperialism, its impact on communities abroad and at home, and how we can build a local peace economy together. At their February 22nd event in Brooklyn, Ruth Benn led a teach-in on war tax resistance. The event also featured live music.

A few days later on February 27th, Ruth and others from NYCNYC War Resisters League and @tax.resistance.collective led another War Tax Resistance 101 session, also in Brooklyn.

WTR Workshop in Eugene, Oregon

On Saturday March 8th, the Oregon Community Peace Fund hosted a workshop on war tax resistance “as a valid tactic of solidarity and divestment.” WTR Sue Barnhart and others shared their expertise on tax resistance. The event was held at the Trauma Healing Project and the event also accepted donations for the Trauma Healing Project.

WTR Workshop in Madison, Wisconsin

On Saturday March 15th, World Beyond War UW-Madison hosted a three-hour war tax resistance workshop and organizing session. Longtime war tax resister Paula Rogge provided in-person support at this event and Lincoln Rice joined them on Zoom.

WTR Workshop at Holiday Party for Los Angeles Group

On the morning of Friday, December 20, 2024, Lincoln Rice used Zoom to join Interfaith Communities United for Justice and Peace’s (ICUJP) Holiday Party to provide a war tax resistance workshop as part of their festivities. ICUJP, a group located in Los Angeles, also gathered to celebrate their accomplishments over the year and gain strength from each other for the struggles and tasks ahead. Please consider hosting a WTR 101 workshop at your next holiday party!

Pic7- Taxpayers Against Genocide Logo

No Caption

Taxpayers Against Genocide Case Dismissed

[Editor’s Note: The following article is an edited version of multiple documents published by Taxpayers Against Genocide.]

In late December, over 600 taxpayers in Northern California filed a class action lawsuit against their representatives in Congress for their vote to allocate $26.38 billion as part of the Israel Securities Supplemental Appropriations Act.

On February 10, Judge Chhabria dismissed and closed the case. This is surely disappointing though not shocking. The sole reason the judge gave for dismissal was because we raised a “political” issue before the court and courts may only address “legal” issues. Taxpayers Against Genocide (taxpayersagainstgenocide.org) vehemently disagree with his finding. Our filing clearly demonstrates the legal nature of our complaint extensively.

It is fortuitous that he did not dismiss our case because we went “pro se.” Our “people’s response” was accepted as a valid document on the court record. Importantly, his dismissal said nothing about our case being frivolous; and he even admitted that there was an off-chance that we may be able to establish standing. The absurd logic is that the legislative and executive branches of government have the impunity to violate human rights, not to mention perpetrate genocide, without being held accountable by the judicial branch.

TAG is now launching an urgent campaign on the global stage. On April 7, we will submit a groundbreaking report to the UN Human Rights Council as part of its Universal Periodic Review of the US government, exposing systemic injustices and human rights violations. This spring, we will escalate our efforts by filing a formal complaint against the US government with the Inter-American Commission on Human Rights. These actions amplify the voices of Palestinians and those fighting against genocide and systemic violence within the US.

NWTRCC News

NWTRCC National Conference: Resisting Together

(May 2-4, 2025)

Our spring conference will be completely on Zoom. Friday evening will begin with our traditional social hour, but following a slightly different format. Each breakout room will have a topic for discussion that will be predetermined and attendees can choose which breakout room they want to join. If you have a suggestion for a breakout room topic, there is a space to include it with your registration.

Our first Saturday session will begin at 11a Eastern. The first session will feature the new audio documentary on the Nelsons, which is featured on page 6 of the newsletter. The following session will be a “Global Panel on War Tax Resistance,” in which representatives from war tax resistance groups from several countries will offer updates on their campaigns. So far, we have confirmations from Conscience Canada, ConscienceUK, Netzwerk Friedenssteuer (Germany), and Conscience and Peace Tax International… and we plan on adding more.

Saturday will conclude with concurrent WTR 101 & 201 sessions as well as a session on “Resisting Taxes in the Trump Era.” The details for this final panel are still being worked out and will partially depend on current events as the conference nears.

On Sunday morning we will hold our business meeting, which is open to all. If you have a proposal you would like discussed at the business meeting, please send it to the NWTRCC office before April 15. Go to the NWTRCC website (nwtrcc.org) for full schedule and registration information.

NWTRCC Hosted Counselor Training in February

On Saturday February 1st, NWTRCC offered its yearly war tax resistance counselor training on Zoom. This five-hour intensive session was attended by nine people. The attendees were a mix of some counselors looking for a refresh, some longtime war tax resisters wanting to take a deeper dive, and a couple people newer to war tax resistance. As a result of the session, we added another counselor in New York and one in Michigan, where we have not had a counselor in some time.

New Audio Documentary on Wally & Juanita Nelson

Juanita (far left) & Wally (far right) in front of IRS on Tax Day 1980.

By Lincoln Rice

The Nelson Legacy Project commissioned an hour-long audio documentary, Eyes on Freedom: Evolving Gifts of Simple, Nonviolent Living, produced by folklorists Carrie and Michael Nobel Kline along with production assistant Nicholas Boyer. As the Nelson Legacy Project website (nelsonhomestead.org) explains, this documentary “weaves together voices of people who knew the Nelsons and who were influenced by them. It also includes vintage audio recordings of the Nelsons themselves.” The sound quality of the recordings is excellent!

As they state on their website, “the Nelson Legacy Project has been working to maintain the Deerfield, MA homestead of Juanita & Wally Nelson while spreading their message of peace and simple living. NLP creates educational materials, hosts visits for people of all ages, and provides speakers for events which have a connection to the Nelson’s legacy of civil rights and peace activism, war tax refusal, subsistence farming, and simple living. We invite you to explore this website and connect with us to find out more about the Nelsons.”

The documentary premiered on Tuesday, February 7, at the Shelburne Falls Arms Library. If anyone is interested in setting up a listening event for their local area or on the radio, you can go to the nelsonhomestead.org website and click on “Get Involved” under the “Home” tab. A full list of upcoming events for the documentary can also be found on the “Get Involved” webpage.

There will also be three upcoming sessions hosted at the Nelsons Homestead on the afternoons of May 18th, May 30th, and June 8th. Registration for these dates can also be found on the “Get Involved” webpage.

Lastly, NWTRCC is happy to be hosting a listening session on Zoom at our upcoming conference on Saturday May 3rd, at 11a Eastern. After the screening, there will be Q&A with long-time war tax resisters Betsy Corner and Bob Bady, who were friends of the Nelsons. You can listen to the documentary anytime on the Nelson Homestead webpage.

OPINION

Moral Compromise

Joshua Wrolstad. Photo coutesy of Joshua Wrolstad

By Joshua Wrolstad

[Editor’s Note: NWTRCC is a big tent organization that is composed of people with various political beliefs. We welcome blog posts and newsletter submissions about war tax resistance from many points of view. The publication of personal opinions expressed in these articles should not be construed as an endorsement by NWTRCC, which makes decisions by consensus. This article was originally published as a NWTRCC blog and has garnered many comments.]

The “worse genocide” hypothetical is the dangerous new “lesser evil” iteration, obscuring the truth regarding the genocidal duopoly in the United States, and points to a dangerous precedent of previous moral compromise.

It was during the November 2024 National War Tax Resistance Coordinating Committee Conference that I was able to confirm a suspicion: many of my fellow War Tax Resisters default to the “lesser evil” rationale. I was shocked to learn that there was at least a sizable contingent of WTRs who voted for Kamala Harris. This revelation should be concerning to our group. Perhaps the ONLY irrefutable truth I feel I do understand about War Tax Resistance is that it places war, imperialism, capitalism, environmental destruction, and yes genocide, above any single issue. For me this truth is the moral essence of our activism and without it we are lost.

From the onset let me emphasize that I am in no way implying that the potential dangers represented by Donald Trump are either lesser or greater than what would have been a Kamala Harris Presidency. My criticisms are based off of the Biden/Harris administration which fomented, armed, and funded the genocide of the Palestinian people through the state of Israel.

Mandate for Genocide

The portion of the public that chose to vote for Kamala Harris represents a position mandating this genocide. Those forces which are profiteering from said genocide have embedded themselves within the duopoly. Those millions of votes for Kamala are a confirmation for the continued and future sale of weapons under a Democratic administration. The military industrial complex clearly understands that the terms, targeted drone strikes, proxy wars, and astonishingly now genocide, are not barriers to the continuation and expansion of militarization. The United States is leading with 40% of the total global arms trade.

This act of voting became an irrefutable indication of our willingness to compromise on a subject as unthinkable as genocide and war. Can we then assume that many within our ranks have been voting for Democratic Presidential candidates for multiple election cycles? If voting for Neocon Democratic Candidates like Hillary Clinton, Joe Biden, and most recently Kamala Harris has taken place within the WTR community, for me this compromise has the larger impact of diluting our morality on war and with it the conversation.

A New Generation of War Tax Resistance

For a new generation of WTRs, trying to find the inspiration to alter their lives forever, to live to the extent possible outside the compromise of war (and genocide) they will see this as a contradiction. For me it would be a contradiction to explain to them that during this bold step we take when we begin our WTR journey, we can and do still vote for Democratic war mongers, possibly even for multiple elections. Why should we push this hypocrisy that yes, we are emphatically and empirically against all forms of war and genocide, unless Donald Trump is running for president?

There cannot be a political range within the WTR movement from liberal to conservative when it comes to war and genocide. We cannot avoid talking about the dangers that voting for both Republicans and Democrats pose to life on this planet. We have to foster a community where compromise on genocide, war, imperialism, and the very real possibility of total ecological collapse are never contemplated especially in the very trivial act of voting. Those people protesting and putting their bodies on the line for the Palestinian people do not and will not understand this compromise. As the lines continue to be drawn this false bargain is and will continue to be a barrier to solidarity.

A Plea for Discussion

Hopefully this can be a continued discussion, which is the only way I have been able to formulate my position on this matter. I cannot be around what I can only describe as gas lighting by people willing to dilute the definition of genocide with clever apologies and false equivalencies. I get plenty of that from friends and family who fight tooth and nail to convince me that genocide and war abroad are comparable to other social problems we face in the United States today. I hear the exact same apologist rhetoric from supposedly radical WTRs as I do from “vote-blue-no-matter-who” liberals and it gives me an actual sick feeling in my gut.

Are we going to be a group forever aging out? Unwilling or unable to get in touch with the radical dialogue of our day? Can we cultivate an environment where the most difficult questions are asked and discussed? Can we approach the truth that there is not going to be meaningful change within the two-party duopoly and that those supposed individual saviors like Bernie Sanders, have and will only continue to sow confusion within our ranks. We must reject the allure of the Blue MAGA exceptionalism, as comforting as this false dream might be. I will hold out hope for the NWTRCC, but the truth is there are a wealth of groups that reject the lesser evil compromise completely and ultimately this is where you will find me.

Updated Resource

New Edition of War Tax Resistance Guidebook

We are happy to announce that the 6th edition of the book War Tax Resistance: A Guide to Withholding Your Support from the Military has just been published and is available on the NWTRCC and War Resisters League website for $20 plus shipping. It is the first update since the 2003 edition. It is the most comprehensive book available on war tax resistance, covering everything from legal issues to the history of war tax resistance, to the hows and whys. It was written by Ed Hedemann and Ruth Benn, who are longtime experts in the field of war tax resistance. Thanks to Ed and Ruth for the great care they put into updating this critical resource!

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org