by David M. Gross

In mid-April, people across the United States struggle to fill out their federal income tax returns. This shared calamity has created something of an inverted holiday season — with grumbling about paperwork and frustration towards government bureaucracy replacing the “peace on earth, goodwill to men” of the Yuletide.

But at a church in Berkeley, California, this past April, people were handing over their taxes with a smile. They were members of the group Northern California War Tax Resistance, and they were smiling because their checks — averaging more than $1,000 apiece — were not made out to the federal government, but to twenty-seven local groups including the Bay Area Community Land Trust, the Berkeley Food Pantry, the Biketopia Community Workshop, Oakland Sustaining Ourselves Locally, People’s Community Medics, and the Sustainable Economies Law Center.

The money came from a war tax resisters’ “alternative fund” called the “People’s Life Fund” — one of more than a dozen such funds in the United States. The Fund’s annual mid-April “granting ceremony” brought together representatives from each of the recipient groups, who accepted their checks and briefly summarized their work for the benefit of the other attendees.

The People’s Life Fund (like most other such funds) accepts deposits from war tax resisters of the money they are refusing to pay to the government. The fund holds the money in alternative financial institutions like credit unions and socially-responsible investments. If the government manages to seize the resisted taxes from the resister, he or she can reclaim the money from the Fund. Meanwhile, any investment returns from the deposits are distributed to local groups in these annual granting ceremonies.

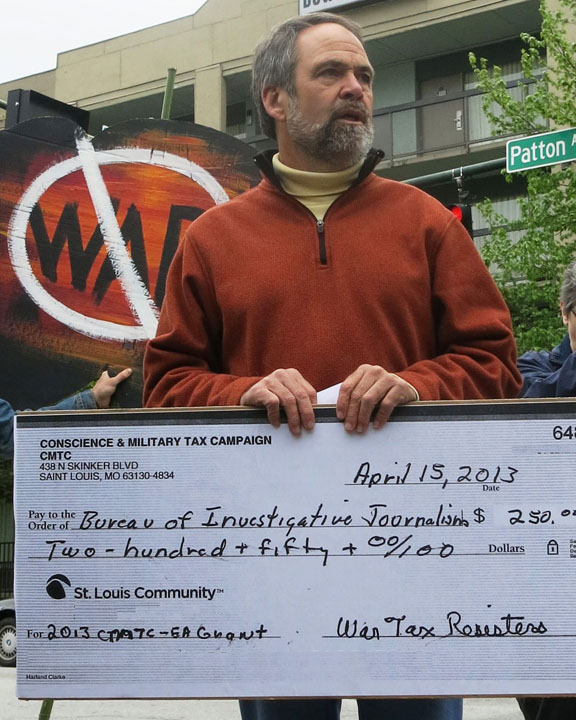

“Redirection” has a long history in American war tax resistance. American war tax resister Bill Ramsey says it reminds him of Gandhi’s “constructive programme” with which the commander of the Indian resistance movement worked to strengthen grassroots Indian institutions at the same time he was trying to weaken British imperialist ones:

The spinning wheel was the center of Gandhi’s constructive program. Redirection is the war tax resistance movement’s spinning wheel. The “constructive program” is positive action that builds structures, systems, and processes alongside the obstructive program of direct confrontation to or noncooperation with oppression. When we redirect our war taxes, we invest in imaginative and positive projects in our communities and around the world.

At first, redirection was largely practiced by individuals, and in an ad hoc manner. For example, in 1968, war tax resister Irving Hogan stood outside the Federal Building in San Francisco and redirected his federal income tax dollars one at a time by handing them out to passers by. “I want this money to be used for the delight, not the destruction, of men,” he said. “Here: go buy yourself a beer.” But today redirection is frequently coordinated by local or national war tax resistance groups.

Some have used redirection to strengthen the anti-war movement. One group used its alternative fund to create a scholarship for college students who had been barred from government financial aid because they refused to register for the military draft. Another made an interest-free loan to a legal defense group that was supporting a group of military draft resisters who were on trial.

Traditional charity and relief organizations have also been recipients of redirected taxes. In 2008, a national effort called the “War Tax Boycott” redirected $325,000 in federal taxes from the U.S. Treasury to two organizations: a health clinic in New Orleans struggling with the aftermath of Hurricane Katrina, and Direct Aid Iraq, which provided medical care to refugees from the American war.

War tax resisters aren’t just redirecting their money. Many American war tax resisters resist by deliberately lowering their income below the level where the federal income tax applies. They do this by working fewer hours of paid employment and by simplifying their lives so that they can live on less money. Such resisters no longer have an amount of income tax to redirect, but they can redirect their time instead. One low-income resister, Clare Hanrahan, wrote: “I believe that redirection of time and presence provides a personal and potent contribution to the common good, a gift of self that has more dimensions than money alone. I redirect each time I give my time and energy in support of good work within my community.”

In recent years more ties have developed between American war tax resisters and the grassroots or “solidarity economy” — a model that is currently being spearheaded by Spain’s “comprehensive disobedience” (desobediencia integral) movement. National War Tax Resistance Coordinating Committee (NWTRCC) made “economic disobedience” the theme of its last national gathering, and had fruitful exchanges there with the debt resistance group Strike Debt!, which has since incorporated a chapter on resisting “tax debt” into its Debt Resisters’ Operations Manual.

When Erica Weiland of NWTRCC delivered the keynote address at an April “economic disobedience” workshop in Eugene, Oregon, she said:

When we heard about this work in Spain, it was clear to us that war tax resistance is economic disobedience, the refusal to cooperate in an economic system that is built on war, militarism, and the perpetuation of human suffering. It was also clear to us that a variety of movements that also practice economic disobedience are allied with us in this struggle. When people refuse to pay debts to ruthless debt collectors, resist foreclosure, set up bartering networks that don’t report bartering as income, set up gift economies that avoid the IRS bartering regulations, organize lending circles for low-income borrowers, counsel high school students on alternatives to military service, squat abandoned houses, organize tent cities for the homeless regardless of bureaucratic and inhumane regulations, and struggle against corrupt landlords and employers, we are engaging in economic disobedience. The economic system we live under is not set up to support us, so we should withdraw our support from the system whenever feasible.

American war tax resisters are withdrawing from the warfare state and the economic model it enforces and are committing themselves with all of their strength and all of their resources to the creation of a more just system in which we can live with dignity. In doing so, they are blazing the trail that leads to this better world we all yearn for.

David M. Gross is the author of 99 Tactics of Successful Tax Resistance Campaigns (2014).