It’s hard to concentrate on day-to-day tasks of late. What with the weather, projects piling up around the house, worrying about the present and future, worrying I’m not doing enough, worrying that whatever I do is so minor in the face of it all…

I’ve been to the U.S. Mission to the UN a few times to stand in support of the Veterans for Peace and allies who are in the midst of a 40-day fast for Gaza. They began the fast and a presence at the UN (with fasters in other states around the country too) on May 22 and the final day is June 30. Wow. Forty days is a long fast. They are caring for each other, and some of them are doing impressively well (interview with fasters). Some days later former VFP President Mike Ferner told his own tougher but courageous story, which you can read here.

For those who are not ready to food fast, there’s always “fasting” from federal taxes and – most importantly — to be as public as possible about it. There is so much militarism to oppose: the arming of Israel; the bombing of Iran, the arming of Ukraine along with the rest of the world; the troops on the border and on the streets of LA; the frightening, masked, anonymous ICE agents in workplaces, courts, schools. But whether you are thinking about tax resistance because of war and militarism or because of just about everything this administration is doing and represents, the process is the same.

We’re halfway through the tax year, but it’s not too late to keep some money from the government. The tax withholding system for employees and estimated taxes from self-employed people fund what we protest in the streets. Why loan them money?

- If you are salaried and have federal tax withholding from your paycheck, you can adjust your W-4 today in order to reduce your “donation” to this lawless administration.

- If you are self-employed and pay estimated taxes, cut back on what you pay. You might want to figure the federal income tax and the self-employment tax (Social Security/Medicare) amount separately; pay the Social Security amount if you choose and cut what you pay in federal income tax.

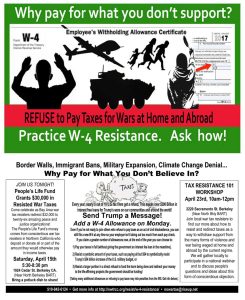

Eight years back Northern California War Tax Resistance promoted W-4 resistance with this flyer. There have been changes to the W-4 form since then, from “allowances” to “deductions” among other things, but the idea is to encourage workers not to give a loan for “what you don’t support.”

So — especially if you’ve been getting a refund from the IRS and want to strengthen your protest — now’s a good time to adjust your W-4 or estimated payments. Are there consequences? Next tax season you might end up owing taxes, at which point you can decide how much of it you want to pay. You could risk a fine for not paying enough in estimated taxes. You can read about other consequences of W-4 resistance here. But, does anything meaningful ever happen without consequences? For added courage, read the recent NWTRCC article about the IRS under the current administration.

When I was at the vets’ vigil last week I met a woman who has her own, creative one-woman street theatre action. Once a week she travels to some busy location in the city, gets a strip of cloth out of her bag, tears it in half, then pulls out a battery power source and a sewing machine, and sits and sews it back together! Elena calls it “We can mend for peace,” and you can find her here on Instagram.

I love people who just decide they have to do something more to counter the violence and then go out and do it — even if they are the only one.

— Post by Ruth Benn