At my very first NWTRCC meeting in 2008 in Eugene, we met a local couple who had resisted $50 of their taxes as their first foray into war tax resistance. Along with their return, and a check for the total tax amount minus $50, they enclosed a letter explaining their reasons for resisting.

Unfortunately, the couple received an alarming-looking letter from the IRS, accusing them of making a “frivolous” argument about why they weren’t paying their taxes. The letter threatened them with a $5,000 frivolous filing penalty if they did not re-file their taxes. Even though the couple complied, and paid the $50 they had resisted, the IRS fined them $5,000 each. Eventually, by contacting the Taxpayer Advocate and their elected representatives, they were able to get the fine dismissed.

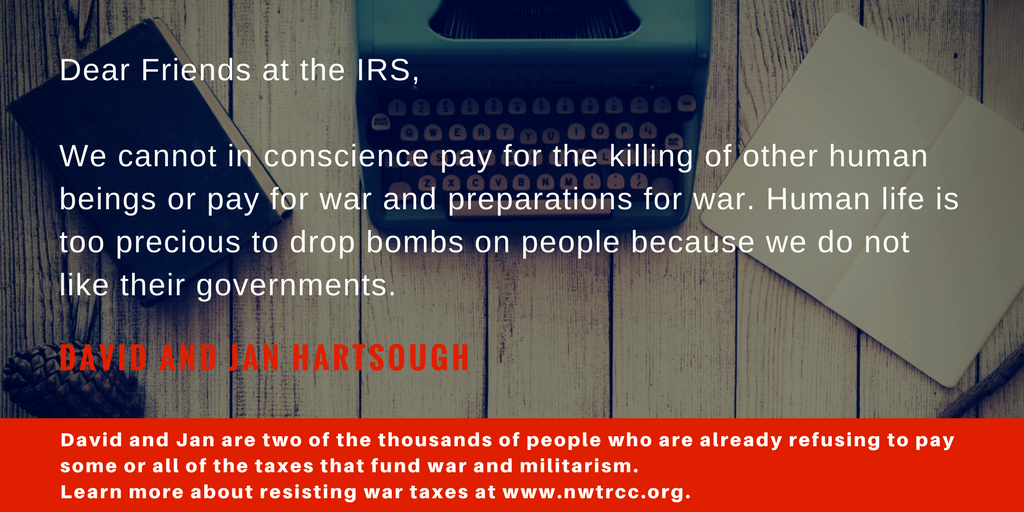

An excerpt of a letter enclosed with a tax return. When your letter enclosed with the tax return does not make any “frivolous” legal arguments about why you are not paying the tax, the IRS’ own rules state you should not receive a penalty.

Today, as long as they don’t make arguments the IRS considers “frivolous,” war tax resisters enclosing separate correspondence with a properly filled out tax return are not supposed to receive a frivolous filing penalty or threat of penalty. (Read our page on frivolous filing for more details and links to other resources.)

However, in the 1980s, due to US military engagement in Central America, war tax resistance increased significantly. Many resisters were contesting frivolous filing penalties (which at the time were $500 rather than $5,000). In the Winter 1988 issue, the Conscience and Military Tax Campaign’s newsletter, Conscience, ran an article by Jay Sordean giving many statistics on the situation through 1985:

Frivolous Filing Update

…As of November, 1983, there were 31 lawsuits being filed throughout the U.S. in response to frivolous fine penalties. As of May Day, 1984, there had been 8 losses, 5 settlements, and one win (the taxpayer had included a letter stating the correct amount of tax due with the “frivolous” 1040 form.)

By March 1984, approximately 4,000 to 5,000 taxpayers had been fined with FF, at least 130 of them being conscientious wtrs [sic]. Forty lawsuits against the IRS were filed.

By the winter of 1984, there were suits in all five IRS regions. The frivolous penalty has been assessed in an unclear, undefined and inconsistent manner. [my note: and this has held true to this day!]

One recent case was that of Vinton Deming, editor of Friends Journal, who was assessed a FF for filing an income tax return with an objection to war taxes. In the Federal District Court appeal attorneys Jay Rosner and Peter Goldberger negotiated a settlement. The $75 fee and court filing costs and miscellany were granted in cash by a Justice Department lawyer. The government didn’t want the case to be publicized, but the lawyers refused to agree to that.

If you’re a war tax resister with questions about your own frivolous filing penalty letter, read our page on this subject, which includes many more stories. Then contact NWTRCC or a local war tax resistance counselor if you need additional assistance or information!

Post by Erica Leigh

We remember resistor Karl Myer who Initiated what he called cabbage patch resistance in response to the frivolous filing penalty. He filed frivolous returns repeatedly and amassed a large backlog of penalties that were not collected. I am sure Karl’s story must be found someplace on the NWTRCC website.

Yes, thanks! Karl’s story is on our Frivolous Filing page linked in the blog post!

365 daily protest tax returns for the year 1983, filed in 1984, to 365 different IRS offices around the U.S., raising a variety of peace and social justice grievances on Federal priorities and budgeting. 280 got back to the regional enforcement office, and I was fined $500 each, for a total of $140,000. In early 1985, when the IRS seized my station wagon used for carpentry work, and sold it at auction for $1000, the news went viral in Chicago and nationally, including stories in the Wall Street Journal, Washington Post, Los Angeles Reader, and many smaller papers, and in electronic media. Unfortunately, this action did not spark a mass movement of military tax protest, as early actions by a few of us in the 60’s sparked a mass movement of draft card burnings to protest the Vietnam War. In planning this action, I had hoped that would be a result.

The $1000 was all the IRS ever succeeded in collecting, and the claims became legally uncollectible after ten years. The IRS has never bothered me since, though I continue to earn taxable income every year, haven’t filed tax returns for the other 58 years of my 59 years of open public war tax refusal. The only year I didn’t earn taxable income was 2001 when I spent six months in Federal custody for trespassing at the School of the Americas and was paid only $18.48 for my work in a prison cafeteria. Across my 59 years of 100% income and phone tax refusal, the IRS has only succeeded in collecting a total of about $1268, out of many thousands claimed, even after they slammed me in prison for nine months of a two year maximum sentence in 1971-72 for war tax refusal agitating.

Keep on trucking. The U.S. has the largest military budget ever, and, I think, more hot wars going than ever before: Yemen, Afghanistan, Syria, Iraq, and drone bombings in Pakistan, Somalia, Libya, and who knows how many other countries.