We recently updated the text version of our Practical War Tax Resistance #6 pamphlet, Organizational War Tax Resistance, and will update the print version sometime in the future. In this pamphlet, we feature stories about businesses and nonprofits that support their employees and independent contractors in war tax resistance, and get into the details of organizational approaches to WTR.

One of our affiliates, the National Campaign for a Peace Tax Fund, has a webpage with war tax resistance statements from its board members David Bassett, H.A. Penner, and Richard N. Woodard. David Bassett writes,

“I am willing to pay the full amount of my federal taxes, if the government would provide that my tax payments will be used only for non-military purposes. My strong preference is to adhere to the nation’s laws, so long as these do not cause me to act against my conscience. Since this is not at present possible, I and my wife began (in 1970), along with others in our community, (and now with others in this nation, and internationally), efforts to change the federal tax laws, to recognize the principle of conscientious objection to military taxation (COMT), thus extending the already-recognized principle of conscientious objection to military service (COMS).”

And our affiliate Center on Conscience & War has a webpage with organizational war tax resistance statements, mostly from churches and religiously affiliated organizations.

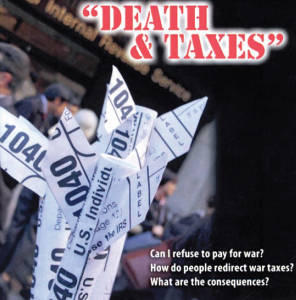

Watch our 30-minute documentary, Death and Taxes, for more stories about how people integrate their personal convictions with their work lives. In particular, starting at 12:40, Ruthy Woodring talks about working as an independent contractor for Pedal People.

Watch our 30-minute documentary, Death and Taxes, for more stories about how people integrate their personal convictions with their work lives. In particular, starting at 12:40, Ruthy Woodring talks about working as an independent contractor for Pedal People.

And if you’ve written a letter to your employer, client, church, or other organization expressing your war tax resistance views, and wouldn’t mind having an excerpt of it shared in our upcoming Tax Day video, check out this call for submissions (now due by Feb 10).

Post by Erica