How to Resist Collection, or Make the Most of Collection When It Occurs

This is publication is one of a series of “practicals” that offer ideas, tips, and information for individuals who want to cut off their financial support for the U.S. war machine or are currently practicing war tax resistance. Earlier pamphlets in this series discuss how to control income tax withholding and whether or not to file an income tax return. The full list of the “Practical Series” is at the bottom of this file or here.

Many people believe they should resist military spending by refusing to pay federal income taxes. This publication describes what the Internal Revenue Service does to collect unpaid taxes, and what war tax refusers can do to prevent collection, or to cope with it when it happens. Dealing with IRS collection efforts is a central part of the war tax resistance commitment. Some tax refusers who live below a taxable income or work for income that is not reported to IRS may never hear from the tax collectors. Most other war tax resisters (WTRs) face IRS collection efforts from time to time. How we respond to collection is as important, for some, as the initial decision to resist. We continue our witness against militarism when we confront and interact with the tax collectors. It makes sense philosophically and practically for WTRs to plan ahead on how they will act if the IRS comes knocking.

Some war tax refusers take active measures to prevent collection; others allow it to take place. Either path offers opportunities to witness against militarism. Which path to choose is a personal decision according to individual motivations and circumstances.

THE IRS COLLECTION PROCESS

For the IRS, the first step on the road to collection is a tax assessment. The government has to establish that, as of a specific date, a specific amount of tax is owed for a specific year. Most U.S.taxpayers assess their own taxes by the act of filing an income tax return. Many WTRs also participate in this self-assessment process. Other resisters do not file a return, which has the practical effect of avoiding or delaying assessment. However, the government can file a return in the name of a non-filer, and make an assessment based on available information about the non-filer’s income. To do this the IRS uses information from W-2 and 1099 forms submitted annually by employers and other income payers. IRS-generated tax claims are then mailed to non-filers with a demand for payment. The date of “final assessment” on such claims is significant. Whether a return is filed voluntarily or by IRS action, the government has ten years from the date of assessment to collect the tax owed. If ten years pass, the unpaid tax becomes legally uncollectible. The only exception is the unusual situation when the IRS initiates court action to prolong the collection period.

After assessment, the IRS sends the tax resister several computer-generated payment notices. These escalate in severity of tone, trying to persuade the resister to pay up. If they don’t produce payment, the IRS will send by certified mail a “Final Notice,” and if you do not pay within 30 days, they may seize your bank assets, wages or other property. Though they can begin enforced collection 30 days after mailing the Final Notice, it often takes several months, or longer, before they get around to active collection attempts.

The IRS usually moves against wages or bank accounts first, because they are the easiest assets to locate and seize. If the agency attempts to seize wages or other compensation, a levy notice will be sent to the resister’s place of employment. This levy remains in effect until the total amount of tax owed, plus interest and penalties, is paid in full. A portion of the resister’s weekly earnings is exempt from levy. In 2025, the weekly amount exempt from levy is $288.46 for a single taxpayer, plus $98.08 for each qualifying dependent. (For updated figures see IRS Publication 1494, Table for Figuring Amount Exempt from Levy, irs.gov/pub/irs-pdf/p1494.pdf.)

Levies from bank accounts apply only to the amount that you have on deposit on the date that the levy is served on the bank. The IRS can levy the same account multiple times, but it has to serve the bank each time.

The IRS can also seize property owned by the resister, such as land, a house, a business, or a car. Jointly owned property, in general, is not immune from seizure. The rules on jointly owned property vary according to the common property laws of each state. Any war tax resister who owns property individually or jointly should contact a war tax resistance counselor for detailed advice about IRS seizure powers and procedures. In general, the IRS does not seize valuable property to satisfy small tax obligations (not exceeding $5,000), but exceptions may be granted in certain cases or the guidelines may shift with the political climate. Up to 15% of each Social Security check, unemployment benefits, and certain other federal payments can be seized through the Federal Payment Levy Program. An agent who is active on an individual case can also take addition steps to attach a continuous levy to Social Security payments; up to about 50% of each check can be seized until the debt is paid by IRS accounting.

Some property is exempt from levy, such as personal and household belongings up to a value of $6,250; books or tools of the trade, business or profession of the resister up to $3,125 (2025); court ordered child support payments; certain annuity and pension benefits; certain service-connected disability payments; workers compensation; and certain public assistance payments. Note that a number of these categories are qualified by the word “certain.” (§6334c, IRC) (For additional details, see IRS Publication 594, Understanding the Collection Process, irs.gov/pub/irs-pdf/p594.pdf, or free from IRS offices.)

PREPARING FOR THE POSSIBILITY OF COLLECTION

For most war tax refusers the ideal is to prevent collection of refused taxes. However, it is wise to prepare oneself for the possibility that the IRS may collect some or all of the unpaid tax. If possible, resisters should join or form a local support community of people who will help spiritually, physically, and financially, if any of them faces enforced collection. While a local support group is best, there are mutual aid groups within some religious denominations, and there are some regional and national support organizations. Some groups, like the War Tax Resisters Penalty Fund, share the financial burdens of interest and penalty assessments when the IRS collects from their members.

Individual resisters may also prepare to survive enforced collections through personal savings made for that purpose. These savings may be in the amount of the refused taxes, but some people believe in giving away their refused taxes to socially useful causes. People who do this would be wise to budget for savings that they could draw on in the event of IRS collections. Most resisters want to invest such savings in socially useful ways.

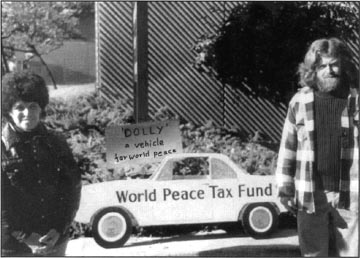

War tax refusers in many communities have established “Alternative Funds” for collective deposit and use of refused war taxes. Such funds usually provide an option for WTRs who wish to place their refused taxes in escrow to be available for reimbursement in case of IRS collections. The interest earned is usually given away to organizations working for peace and to meet other human needs. Sometimes the principal is used for revolving loans to peace and justice organizations. You can get a list of Alternative Funds in the U.S. from the publishers of this leaflet.

Some war tax converters invest their “collection day” savings in Community Development Financial Institutions that support housing and work opportunities for low income people in the U.S. and developing countries. Information about such constructive investment opportunities can be obtained from the Opportunity Finance Network, 123 South Broad Street, Suite 1930, Philadelphia, PA 19109, ofn.org. Some loans to charitable organizations may not be reported to the IRS; check with the exempt organization of your choice to see if they are required to report.

Holding tax resistance savings in conventional bank accounts has two disadvantages: 1) Banks report interest earnings to the IRS using your Social Security number; this is the main way by which the IRS locates bank deposits for seizure; 2) Banks invest much of their reserves in U.S. Treasury notes, thus financing the very things you are unwilling to finance with your taxes. Many other bank investments support militarism and oppression at home and abroad.

Savings and investments that do not pay interest are not typically reported to the IRS, but a levy notice sent directly to a financial institution will reveal non-interest bearing accounts.

Through a combination of group support, mutual aid, and personal savings, resisters can be prepared to weather IRS collections. Even better would be to prevent collection. Ways to accomplish that are the subject of our next section.

PREVENTING COLLECTION

Compensation for Labor. The most reliable way to prevent collection of labor earnings is to be self-employed, or to be employed in small alternative enterprises that do not report their wage payments to the IRS. This is an important strategy for effective, long-term war tax refusal. There are many trades and professions that offer viable opportunities for self-employment, while avoiding the tax reporting and withholding system. These include the building trades, private practice in medical, psychiatric and counseling professions, home-based computer and accounting services, home nursing and child care, art, writing, etc. (See Practical War Tax Resistance #4 on self-employment.)

People who have the flexibility to move quickly from one job to another can readily frustrate the IRS collection system. If you quit a job as soon as IRS levies your wages, they will often give up on trying to collect from you, or it might take them months or years to catch up with you at a new place of employment.

Another strategy is to reduce your wages to the level at which they are exempt from seizure by arranging part-time employment when you are levied. Some companies that value the work of a conscientious tax refuser will agree to increase the non-wage compensation of the employee by paying the entire premium for comprehensive medical insurance, or providing other benefits. If an employee wishes to continue full-time work, such employers will sometimes agree to donate the difference between the full-time salary and the weekly amount that is exempt from seizure, as a company donation to charitable causes selected by the war tax refuser.

Preventing collection in the workplace often requires tenacious commitment and imaginative solutions. (See Practical War Tax Resistance #6 on organizational WTR.) Self-employment in many occupations often involves accepting lower levels of sustained income.

Bank or Credit Union Accounts. To some extent it is possible to protect deposits from IRS seizure. The IRS learns the location of all interest-bearing accounts because financial institutions are required to report interest payments to the IRS. Collection can be prevented by removing all deposits from interest-bearing accounts as soon as you expect or receive a “Final Notice” to pay from IRS. If you remove the deposits in cash and deposit them elsewhere, you can avoid leaving a paper trail from one institution to the next. Banks and credit unions are required to report to the Treasury Department individual deposit or withdrawal transactions of currency (not personal checks) of $10,000 or more per transaction. To prevent such reports people may withdraw or deposit cash money in amounts of less than $10,000 at any one time and spread out over a period of weeks or months. For businesses and trades, requirements are more strict and include cash transactions within one year that are clearly related. See IRS Publication 1544, Reporting Cash Payments of Over $10,000, irs.gov/pub/irs-pdf/p1544.pdf.

If the IRS is working hard to find your assets, they may ask employers to provide them copies of the front and back of checks paid to you in order to track where you cash or deposit payments. (If you are using someone else’s bank account, this might put them at risk of having their funds seized also.) Collection agents may also focus on banks in the immediate vicinity of your home to discover the location of bank accounts, which could turn up a non-interest bearing account. Using a bank that is in another neighborhood or town could offer added protection.

A collection officer visiting your home asking for payment (a rare occurrence these days) might see bank correspondence in an open mailbox, or might question your landlord or neighbors about your assets. Therefore, some cautious tax refusers use a post office box or a friend’s address as a banking address and pay their rent and utility bills with cash or money orders. Others ask friends or family to write checks for bills and reimburse them with cash. In addition to depositing refused tax dollars, some war tax resisters have used alternative funds as savings accounts for their money.

If you live on cash and purchase money orders to pay bills, you usually have to stay below $3,000 at a time before the vendor asks for your name and Social Security number as a requirement of the sale.

Security Deposits. A refundable security deposit is an asset belonging to you. The IRS can serve a levy on your landlord and seize your security deposit (although we have not heard of this happening in many years). You can protect against this by arranging to pay your rent two months in advance, in lieu of having a refundable security deposit.

Motor Vehicles. The IRS discovers the ownership of motor vehicles by checking registrations with the Secretary of State of your state, or by finding a vehicle parked at your home and seizing it on the assumption that it belongs to you. When the IRS is actively pursuing collection, you can protect your vehicle by always parking it far enough from your home or place of employment that a collection officer is very unlikely to find it. Many war tax refusers have their vehicle registered in the name of an agreeable relative or friend who has no outstanding liabilities. Transfer of title should be done well before the IRS asserts claims against you, since they may seize a vehicle if they have reason to believe that you are using someone as a “nominee” to hold title to your vehicle; they can keep the vehicle unless you prove that it is not actually yours.

Personal Property and Tools of Your Trade. Approximately $6,250 of your personal property and household goods is exempt from seizure (2025). The IRS rarely attempts to enter homes and seize personal belongings, except in the case of people who are quite wealthy and owe the IRS large sums of money. Approximately $3,125 of your tools of trade are exempt from seizure (2025). Professionals or tradespeople who need expensive equipment to carry on their self-employment business might consider having their equipment and business facilities owned by others, and leasing it from the owners; or the equipment and facilities might be owned by a nonprofit cooperative or corporation.

Real Estate. IRS seizure of physical property, such as houses and land, is very labor intensive and rarely results in revenue close to what the properly is worth. The last seizure of a property held by a war tax resister was in 1996. Still, IRS power to seize physical assets is frightening to many potential resisters.

The most vulnerable real estate is a home that you live in and use as a mailing address, although the IRS has a policy of not seizing a person’s primary residence unless collection is in jeopardy. Particularly in larger cities, you might be able to protect your home by never using it as a mailing address for any employment or banking relationships and by having an unlisted telephone number. This is the concept of “sanctuary address.” If you always used the address of a discreet and supportive tax refusal colleague as an address for all employment, banking, and other official transactions, the IRS would never know where you actually lived. This method isn’t foolproof, but it certainly throws significant roadblocks in the way of IRS collection efforts. Experience shows that IRS collectors give up rather quickly when they run into several dead ends, because they can’t waste too much time on any one case.

A Community Defends A Home

IRS attempts to seize the home of Betsy Corner and Randy Kehler of Colrain, Massachusetts led to sustained community resistance on the part of taxpayers and war tax refusers alike. After eleven years of frustration at not being able to collect taxes from the couple, the IRS “seized” and tried to auction off the small farmhouse. The community successfully organized against the auction, and the IRS was forced to buy the house itself. Randy and Betsy and their daughter continued to live in their home for the next two years, but in 1991 the IRS evicted the family and jailed Randy for contempt of court. A well-prepared network of local affinity groups and supporters from around the country immediately reoccupied the house, and maintained a continuous occupation of the property despite its subsequent sale to a young couple. Through these actions, unprecedented public attention was brought to the war tax resistance movement and the issues of military spending which fuel our efforts. A settlement was made in 1993, and the house was purchased by the land trust on which it was located.

A more reliable and conventional strategy is to have title to all land and houses held by trusted friends or relatives who are not tax resisters themselves or do not have income that is subject to federal taxes. This can be a spouse, if the spouse does not have unpaid tax liabilities and does not file a joint income tax return with the tax resister. (But be cautious about this. Ownership by a spouse might create a problem in some states where all marital property is regarded as community property. There can also be problems with transferring property to someone else if you already owe money to the IRS.)

Some war tax resisters have given their property to a child in trust and pay rent to the child/owner of the property (legal advice will be needed to set up such a trust). Another strategy is to have land and houses owned by a Community Land Trust, which can offer a long-term or lifetime lease to housing residents. For more information on this concept, contact the Schumacher Center For New Economics, 140 Jug End Road, Great Barrington, MA 01230, (413) 528-1737, centerforneweconomics.org.

Inherited Property. According to the IRS, most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return and are not subject to federal estate taxes (rules vary within each state as far as state taxes go). In 2016, an individual can leave heirs up to $13,990,000 without having to pay federal estate tax (state laws may differ). War tax refusers faced with an inheritance of that size would find it impossible to forestall payment of federal estate taxes, which must be paid from the estate before it is transferred to the heirs.

If an estate is filed with the IRS, there may be an opportunity for assets to be seized to satisfy unpaid tax liabilities of the heirs, but this is somewhat unclear. If the WTR has tax liens in the same country where the estate goes to probate, the possibility is stronger that money would be turned over to the IRS before the beneficiary gets it.

The main problem for resisters comes when the inheritance is received. Those with a tax debt may find it difficult over time to protect inherited assets from seizure, and some, such as stock sales, may result in a 1099 issued to the beneficiary at the end of the year, signaling to the IRS a bump in income.

WTRs who expect to inherit property, or wish to pass on property to their own heirs, would do well to prepare for this situation many years in advance, and to discuss their conscience issues thoroughly with relatives who may be involved. In some cases, receiving an inheritance in the form of non-taxable gifts over a period of years before the death of the benefactors might offer advantages. This is a common practice in estate planning, and an individual can give up to $19,000 per year to any beneficiary, without being liable for federal gift taxes. A married couple can give up to $38,000 per year.

Some WTRs who do not believe they should benefit personally from inherited wealth have renounced legacies, before taxation, by arranging for the estates to donate their share directly to nonprofit organizations selected by the WTR, but such an arrangement would need to be worked out with other beneficiaries. (See Practical War Tax Resistance #7 “Health Care and Income Security” for more on inheritance issues and ideas.)

A General Disclaimer. Some of the tactics discussed in this section on preventing collections might be construed as criminal violations of §7206(4) of the Internal Revenue Code, which states in part that any person who removes, deposits or conceals any property on which levy is authorized, with intent to evade or defeat the collection of the tax, will be guilty of a felony, with a maximum penalty of $100,000 fine and three years in prison.

We know of no criminal prosecution of any war tax resisters for using any of these methods to prevent the collection of taxes, so the line between legal noncooperation and possible criminal concealment is difficult to define. Criminal prosecution seems extremely unlikely at this time. It is costly, and the IRS prefers to strengthen tactics that result in certain revenue.

CONTEMPT OF COURT ISSUE

There are situations in which war tax resisters may face imprisonment for contempt of court. The IRS may issue a summons requiring a resister to supply information for the purpose of making an assessment or collecting unpaid taxes. Such a summons is legally enforceable. A resister may be brought before a federal judge, held in contempt, and placed in jail for refusing the judge’s direct order to furnish the requested information. However, resisters who have asserted a constitutional Fifth Amendment right not to provide information because it could later be used in criminal proceedings against them, have never been sentenced for contempt. A resister who receives an IRS summons should contact a war tax resistance counselor or the NWTRCC office immediately.

BEWARE OF SCAM CALLS

In recent years, taxpayers (or nonpayers) in the U.S. have been plagued by callers who demand payment of tax debts immediately “or the police will come to arrest you.” Thousands of dollars have been paid to these thieves by people frightened of the IRS. Do not respond to these callers. Ask for a number to call them back then check to see if it’s really an IRS number. Call the IRS yourself and ask if you are under collection — often there is no tax due. While the IRS does not make this sort of call — you should always receive a bill in the mail if you have a tax due — starting in 2016 Congerss is forcing the IRS to hire private collection agencies for some tax debts. Be sure to take all the information from any suspect caller and check it out thoroughly before assuming it is the IRS or an official collection agency hired by the IRS.

YOUR MOVE

We’ve offered some ideas on how to prevent collection of assets that are most commonly seized by the IRS. If you have other kinds of assets or need to get a deeper understanding of how to protect the assets mentioned above, you could do additional research on your own, or seek personal counseling from the network of war tax refusal counselors whose names are available from the publishers of this leaflet.

With imagination, thoughtful research, and determined commitment, it is possible to prevent the collection of tax claims by the IRS. Many tax refusers have prevented almost all collections from them — for periods ranging up to 50 years in the case of some of our older colleagues.

MAKING THE MOST OF COLLECTION WHEN IT OCCURS

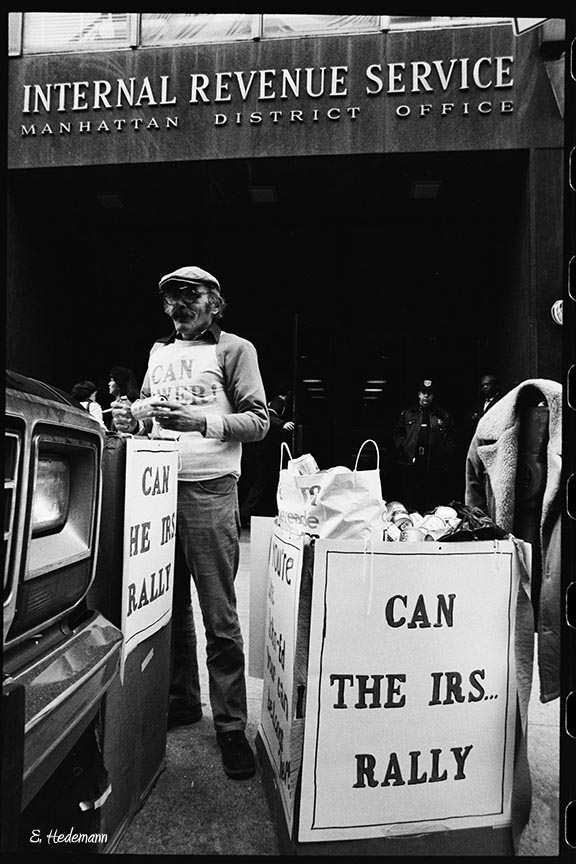

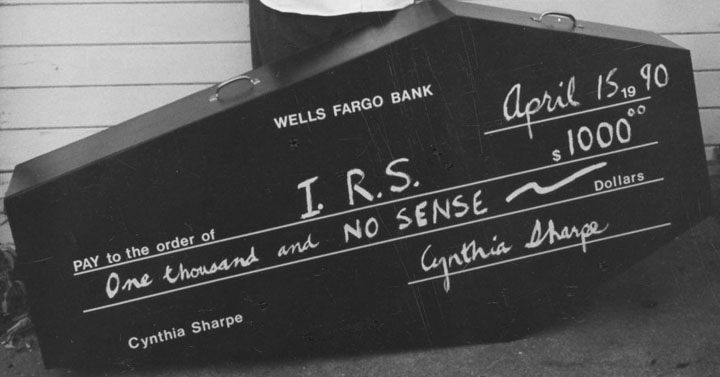

IRS collection actions provide a powerful opportunity for people to witness their convictions to the government and to the public. Many non-resisters have been moved to action by the resisters who are confronting the war tax collection system. It stirs people to see their colleagues and neighbors face a salary levy or a house seizure and auction, following their conscience in the face of difficult consequences.

Many war tax refusers take their stand at the point when the government demands that they turn over taxes for the military by their own action. However, they may not believe that they have a conscientious obligation to carry their witness to the point of preventing enforced collection. They may not feel prepared to lose valuable family assets. A parent raising small children may decide not to sacrifice the family home to an IRS auction. Each war tax refuser has personal beliefs and life circumstances that determine how to respond to IRS collection efforts.

Even when resisters decide to allow enforced collection, there are actions they can take to protest collection and bring their message to the public. Support and assistance from other war tax resisters is very helpful in this witness. The IRS tries to deal with individuals and families in isolation, to create feelings of fear and powerlessness. Community is an effective antidote to this. Organized protests often generate extensive publicity about the idea of war tax refusal, and strengthen local communities of refusers.

Although the IRS rarely seizes vehicles or houses, when it does it must conduct a public auction or sealed bid sale to convert the property to cash. The IRS then deducts its claims for taxes and costs from the proceeds of the sale, and must return any balance left over to the tax resister. Local support communities have repeatedly used these auctions to create public awareness, by organizing large numbers of supporters to attend the sales and to submit creative alternative bids that highlight the ideas central to war tax refusal.

When wages or bank deposits are seized the money vanishes quickly. WTRs may not wish to focus public protest at their places of employment, so the occasions for organized public protests have not been as creative. However, community support for these WTRs is important. Some local groups pool resources in special funds to help fellow resisters who have been victimized by IRS collections. Sometimes they organize rent parties and other fundraising events.

CONCLUSION

This pamphlet summarizes the IRS collection process and the choices for war tax resisters. Many important details are not covered, and the laws, policies and practices governing IRS behavior change periodically. The National War Tax Resistance Coordinating Committee (NWTRCC) offers literature and counseling to help you when you feel a need for additional advice.

Here are some thoughts in closing: War tax resistance should be based on thoughtful conscientious beliefs. We believe it should not be done for personal gain, nor with the naive hope that world peace will prevail within a year or two and end the need for long-term witness and resistance against militarism. Advance knowledge and planning are the best ways to prepare for IRS collections. No one strategy of response is best or correct for all war tax resisters. Collection of unpaid taxes by the IRS does not mean a failure of resistance. Our determination to take a strong and open stand against militarism is one measure of our success. By refusing to do harm, by directing our resources to what we believe to be good, we are taking personal responsibility for trying to create a nonviolent human community.

Resources

Available from the IRS, 1(800)829-3676 or at irs.gov.

Publication 1: Your Rights as a Taxpayer

Publication 559: Survivors, Executors, and Administrators

Publication 594: Understanding the Collection Process

Publication 1494: Table for Figuring Amount Exempt from Levy

Publication 1544: Reporting Cash Payments of Over $10,000

Publication 910; Guide to Free Tax Services

Available from NWTRCC:

The issues discussed in this leaflet are covered more thoroughly in Chapters 6 & 7 of War Tax Resistance: A Guide to Withholding Your Support from the Military. Published by War Resisters League, March 2003 with annual update, 144 pages. ($14 postpaid)

Practical War Tax Resistance Pamphlet Series,

- Practical #1: Controlling Federal Tax Withholding

- Practical #2: To File or Not To File an Income Tax Return;

- Practical #3: How to Resist Collection, or Make the Most of Collection When it Occurs

- Practical #4: Self Employment: An Effective Path for War Tax Resistance

- Practical #5: Low Income/Simple Living as War Tax Resistance

- Practical #6: Organizational War Tax Resistance

- Practical #7: Health Care and Income Security for War Tax Resisters

- Practical #8: Relationships and War Tax Resistance

(Single copies #1-3 $1.00 each, #4-8 $1.50 each. Call for bulk rates.)

War Tax Resisters and the IRS, a brief outline of WTR motivations, methods and consequences. ($2.50 each from NWTRCC)

This brochure was produced by the National War Tax Resistance Coordinating Committee. NWTRCC is a coalition of local, regional, and national groups supportive of war tax resistance.

First Published 11/1995

Updated 2/2025