National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

February – March 2025

Contents

- Lawyer Peter Goldberger Speaks on Legality of Refusing to Pay Federal Income Taxes

for Genocide

- The Cost of War Games by Chrissy Kirchhoefer

- Counseling Notes: 2025 IRS Standard Deduction and Taxable Income Level • Bank Levy on a Long-Time Resister • Late Filing Fee for Forgetting to Sign Tax Return • 1099-K Reporting Threshold Change

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- War Tax Resistance News Tax Payers Against Genocide By Chrissy Kirchhoefer

- NWTRCC Upcoming Events and News Mark Your Calendars! National NWTRCC Conference on Zoom: May 2 – 4, 2025 • Help keep NWTRCC Strong and Growing! Nominations Open for NWTRCC’s Administrative Committee (AdComm) • WTR 101s Popular in December Upcoming WTR Sessions

- In Memoriam Glen Anderson • Remembering Randy Kehler By Brayton Shanley • Betsy and Randy By Suzanne Belote Shanley

- PROFILE Fear of the IRS By Larry Bassett

Click here to download a PDF of the February/March issue

Lawyer Peter Goldberger Speaks on Legality of Refusing to Pay Federal Income Taxes for Genocide

Peter Goldberger Speaking at NWTRCC Conference at Earlham School of Religion in November 2014. Photo by Ruth Benn.

[Editor’s Note: The following remarks were made by Peter Goldberger at a National Lawyers Guild war tax resistance workshop over Zoom on April 4, 2024. Goldberger addresses three subjects: the legality and ethics of counseling illegal activity; the particular risks faced by legal professionals contemplating participating personally in tax resistance; and the argument by certain activists that it is legal to refuse to pay one’s federal income taxes based on international law, since some of these taxes are being used to support genocide in Gaza. The subheadings were added by the editor.]

Providing Advice on Illegal Activity

I assume most of the people in the audience today, as at any Guild event, are themselves lawyers. And I’m sure we also have law students and legal workers participating. Some of you may be interested in providing counseling and support to others who are moved to consider tax resistance, even if you do not plan to participate in it directly yourself. There was some concern expressed in the discussions leading up to today’s event about whether there’s some ethical restriction on giving advice to people who are talking about engaging in civil disobedience or other illegal activity. I want to say very clearly that if done professionally, counseling with respect to planned illegal activity is not an ethical concern. In fact, that has been a significant part of my own practice for the last forty years, and I don’t think anyone has suggested that my practice is other than entirely ethical.

To “counsel” is not to recommend or encourage. I always say, “As a lawyer, I suggest that you do not break the law.” “As a lawyer, I also recommend, if you are deeply moved to break the law for some reason, that you do it with your eyes open and with full and accurate awareness of the consequences that may befall you, as well as of the benefits that it may bring to you in terms of your conscience and your self-esteem.”

Many people have engaged in civil disobedience and direct action of various kinds knowing full well that it’s illegal. This includes quite a few lawyers, who participated because they’ve balanced the benefits that they perceive to come to them from doing what they believe to be the right thing against the risks and consequences of engaging in illegal action. Helping people to make those decisions, as long as you don’t aid and abet the commission of a crime by recommending it or suggesting a way of carrying it out, or rendering material assistance to the criminal action, is entirely proper within the realm of legal counseling.

Even in ordinary legal practice, clients often want to know where the line is between legal and illegal activity. You have to be able to talk with people about what they are thinking about. If you can identify the line between legal and illegal conduct, you may think it’s prudent to recommend that people not go up to and put their toe right on that line in one context or another. But people may want to go right up to the line, and they’re legally entitled to go right up to the line. So they have to know where the line is. That’s what it means for the law to draw a line, as Oliver Wendell Holmes once said. And so telling people about risk is a perfectly valid form of legal counseling.

Increased Risk for Lawyers Engaging in Illegal Activity

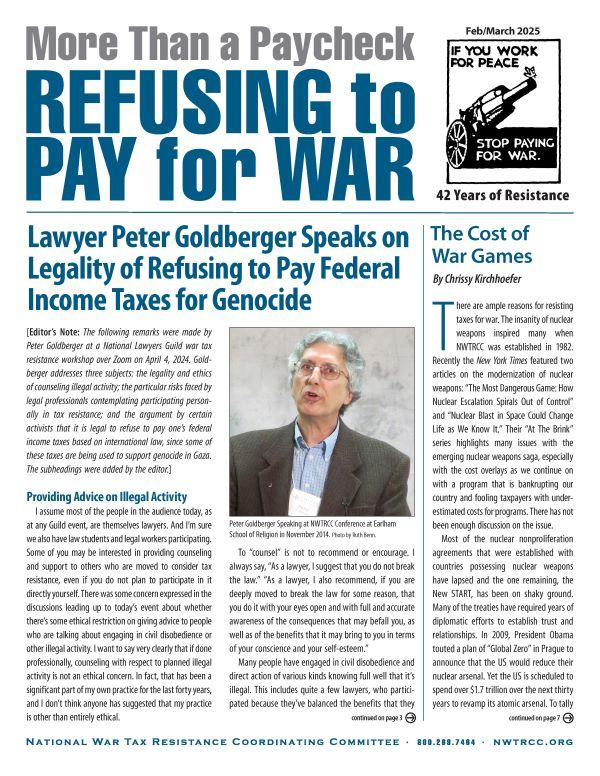

A Tax Court ruled that the Nuremberg Principles did not justify A. J. Muste’s tax refusal. A. J. Muste speaking in Central Park in the 1960s. Photo by Bernard Gotfryd, located at Library of Congress.

Now, let’s talk about lawyers who may choose to engage in non-payment of tax. First, I think we all probably know that failure to pay all the tax that is due under the law is actually a very common circumstance, including among lawyers, usually not for good reasons, but just for selfish or careless reasons. And of course, very few get in trouble, maybe with the IRS, rarely with the Bar, and almost never are they prosecuted. But as Lincoln Rice mentioned a few minutes ago, the chances of being prosecuted for doing any given thing if you are a lawyer is higher than doing that same thing if you are not a lawyer. And I think that’s true of other professionals as well. I mean the ratio of accountants and lawyers who don’t pay their taxes and wind up being prosecuted is higher than of other professions, and much higher than the risk faced by the average person.

Civil Disobedience as a Part of the American Law Protest Tradition and the Legality of Refusing to Pay for War

There is a tradition in American history of people being motivated to resist taxes on account of their opposition to all war or to particular wars going back at least to the Revolution. This is a respected, honored piece of American law reform protest tradition in the category of civil disobedience. It’s not a new phenomenon. Probably the best known early instance is the opposition to the Mexican War in the 1840s by Thoreau and the other transcendentalists. Peace movement scholars say the high point of US anti-war tax resistance was the refusal by many thousands of people to pay what was then an excise tax on long-distance phone calls, which Congress had enacted explicitly to raise more money to pay for the American War in Vietnam.

And because it’s not new, some of the legal or legalistic arguments that Suad Abdel Aziz mentioned at the beginning of today’s program are also not new.

Most important, I want to be sure that you know that in 1961 the Tax Court held that avoiding complicity as a war criminal under the Nuremberg Principles did not justify A. J. Muste, the founder of the Fellowship of Reconciliation, and one of the great nonviolent activists of the ’50s and ’60s, in refusing to pay his income tax over the development and testing of nuclear weapons.

The same argument was made many times in the 1970s over the Vietnam War. There were certainly good arguments that the Vietnam War was unconstitutional, that war crimes were being committed in the use of the weapons against civilian populations, causing widespread civilian deaths in Vietnam. Many people claimed at that time that they had a privilege or a right under international law, even a duty, to avoid complicity that included refusing to pay taxes, at least half of which were going to support and carry on that war. But those arguments were considered, and absolutely universally rejected, in every court decision in which they’ve come up. The matter is considered settled to the point that financial penalties for frivolous litigation are commonly imposed by the Tax Court on those who try to advance the argument now, and making that argument in submissions to the IRS to justify an understatement of income or of tax due can likewise result in a frivolous filing penalty.

I’m not saying that the argument is not theoretically correct or that a person might not rely on it. But I think I have a responsibility, because I know this to be true, to say that these precedents still exist and are unlikely to be reconsidered. No one contemplating tax resistance as a protest against war crimes should expect to be vindicated in court, even if they may be vindicated in the judgment of history.

[Editor’s Note: Peter Goldberger is an attorney in Ardmore, Pennsylvania, and the longtime legal consultant to NWTRCC. The entire recording of this session can be found here: youtube.com/@nlginternational]

The Cost of War Games

Bulletin of the Atomic Scientists set Doomsday Clock at 89 seconds to midnight. Photo is from their press release

By Chrissy Kirchhoefer

There are ample reasons for resisting taxes for war. The insanity of nuclear weapons inspired many when NWTRCC was established in 1982. Recently the New York Times featured two articles on the modernization of nuclear weapons: “The Most Dangerous Game: How Nuclear Escalation Spirals Out of Control” and “Nuclear Blast in Space Could Change Life as We Know It.” Their “At The Brink” series highlights many issues with the emerging nuclear weapons saga, especially with the cost overlays as we continue on with a program that is bankrupting our country and fooling taxpayers with underestimated costs for programs. There has not been enough discussion on the issue.

Most of the nuclear nonproliferation agreements that were established with countries possessing nuclear weapons have lapsed and the one remaining, the New START, has been on shaky ground. Many of the treaties have required years of diplomatic efforts to establish trust and relationships. In 2009, President Obama touted a plan of “Global Zero” in Prague to announce that the US would reduce their nuclear arsenal. Yet the US is scheduled to spend over $1.7 trillion over the next thirty years to revamp its atomic arsenal. To tally all that spending for nuclear weapons, which we hope will never be used, comes to almost $57 billion a year or $108,000 per minute for three decades.

Recently, Congress passed a defense spending bill for $1 trillion with overall US debt reaching $36 trillion. One of the resounding themes with the series on nuclear weapons was the need to have conversations on this issue, especially as so many of our resources are devoted to it. Few are aware of taxpayer spending on the programs as much of it is included in the Department of Energy budget. The whole prospect defies logic. The Mutually Assured Destruction (MAD) policy of the 1980’s has morphed into smaller, usable nuclear weapons. The push toward the modernization project amped up in 2010. It spans 23 states, or all 50 if you include the subcontractors.

Consistent themes with military contracts are cost overruns and delays. At least twenty central projects associated with the nuclear modernization effort are years behind schedule and billions over budget. Although the US and other nuclear nations have been reducing their nuclear warhead stockpiles, they continue to invest in their relevance as a nuclear deterrent.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

2025 IRS Standard Deduction and Taxable Income Level

As a reminder, Trump’s tax overhaul bill eliminated the personal exemption in 2018. Now there is only the Standard Deduction figure that sets the taxable income level.

| Category | Standard Deduction |

|---|---|

| Single | $15,000 |

| Married, Filing Jointly | $30,000 |

| Married, Filing Separately | $15,000 |

| Head of Household | $22,500 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,550 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,850.

A single person can earn up to $15,000 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1.50 for a hard copy from the NWTRCC office; read it free online at nwtrcc.org).

Payroll taxes for Social Security and Medicare begin to apply at a lower income level than one’s standard deduction. If you are self-employed and do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, these payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

Bank Levy on a Long-Time Resister

In December, the IRS levied the bank account of a long-time resister on the East Coast. Bank levies have been relatively uncommon the past fifteen years, but we expect to see a few more bank levies since the IRS seems to have finally recovered from the disarray it experienced during the pandemic.

The bank account in question was an interest-bearing account, which had interest reported to the IRS on a 1099-INT form on a yearly basis. The entire amount of the person’s tax debt was available in the account, so after twenty-one days, the full tax debt was sent to the IRS.

When a financial institution receives a levy, they are supposed to freeze all funds that are in the account when the levy notice is opened, even funds over and above the amount of the tax debt. In this specific case, the bank only froze the amount of the tax debt and made it a payable to the IRS to be transferred at the end of twenty-one days. The bank was incorrect in making the other funds available, but the war tax resister was not going to complain.

Late Filing Fee for Forgetting to Sign Tax Return

We all forget to do things like sign a federal income tax return from time to time, but the penalty for forgetting to sign a federal tax return may be greater for war tax resisters. A long-time war tax resister on the West Coast sent in her paper return last April with her annual letter to the IRS about why she was not paying, but she forgot to sign her 1040 tax form.

At the end of July, the IRS returned the forms with a letter asking her to sign her tax return, which she did and she mailed her return back to the IRS. In January 2025, she received a letter from the IRS stating that she had received a penalty in excess for $1,000 for filing her tax return late.

Unfortunately, she was correctly assessed the penalty for not filing on time. The failure-to-file penalty is five percent of the tax owed for each month, or part of a month that your return is late, up to a maximum of 25%. This penalty is not usually enforced if someone forgets to sign their return, provided any tax payment due is included with the return. If payment due is not included with the return, the IRS has the discretion to assess this penalty. This is explicitly spelled out in IRS Policy Statement P-3-5; Approved: 7-26-2011.

1099-K Reporting Threshold Change

The 1099-K is used to report business income from third-party processors of financial transactions (e.g., Ebay, Uber, PayPal, Venmo, credit card companies). Until recently, the reporting threshold was at least $20,000 and 200 transactions. In 2024, this threshold dropped to $5,000. In 2025, it was going to drop to $600, but the IRS has now stated that for tax year 2025, the reporting threshold will be $2,500 and that this will drop to $600 in tax year 2026.

Many Thanks

Thanks to each of you who donated to our November appeal! Remember, you can also donate online through PayPal and Venmo (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.) It’s never too late to send that contribution to support our work.

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues: Birmingham War Tax Objectors

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

War Tax Resistance News

Tax Payers Against Genocide

By Chrissy Kirchhoefer

Taxpayers Against Genocide (TAG) recently hosted a national webinar in response to the overwhelming support of their efforts to raise awareness of the role of the US tax money in funding genocide in Gaza. On December 19th, over 500 taxpayers in Northern California filed a class action lawsuit against their representatives in Congress for their vote to allocate $26.38 billion as part of the Israel Securities Supplemental Appropriations Act in April 2024.

The lawsuit cites reports from Human Rights Watch and Amnesty International that came out two month prior to the April vote that “the Israeli government was systematically starving the people of Gaza through cutting off aid, water, electricity, by bombing and military occupation, all underwritten by the provisions of US military aid and weapons.”

While some TAG members were eager to share what they learned with others wanting to replicate lawsuits in their states, some spoke of wanting to take the next step and withhold their tax money and stop paying for genocide.

NWTRCC Upcoming Events and News

Mark Your Calendars!

National NWTRCC Conference on Zoom: May 2 – 4, 2025

Our first conference in 2025 will be on Zoom. We had initially hoped to hold it in Worcester, Massachusetts, but a number of factors prevented that from happening in May. We hope to have an in-person meeting in Worcester, Massachusetts later on this year (November 7-9, 2025). The agenda for the May conference is still in flux, but we plan on having more info on the website soon.

The NWTRCC business meeting is Sunday morning, May 4 (open to all).

Note: Proposals for the May meeting must be submitted to the NWTRCC office by April 15, 2025.

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC ’s Administrative Committee (AdComm)

The AdComm provides oversight for business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by Zoom in February and August). We need to fill two seats, and new members will be selected from the nominees at the May 2025 meeting. They serve as alternates for one year and full members for two years (three years total). Travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what is involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616

Milwaukee, WI 53205

800-269-7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2025

WTR 101s Popular in December and January

In December and January, NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer offered introductions to war tax resistance online. On Thursdays December 19th and January 16th, sessions were offered on Zoom at 7:30p Central. For each session, around 150 people registered and over 40 attended. Last year at this time, NWTRCC began to hold regular online WTR 101s because of increased interest after the invasion of Gaza.

One difference among attendees last year compared this year is that there seems to be less fear. A year ago, very few people shared their screens on Zoom and almost all questions were typed into the chat. Now, many more people share their screens and also unmute themselves to ask questions. Part of this change might be from a greater familiarity and trust with NWTRCC .

Upcoming WTR Sessions

There will be several war tax resistance sessions online during February. Here are the ones we know about so far:

- War Tax Resistance Social Hour on Zoom at 6p Eastern (Sun February 16, 2025). This event is offered by NWTRCC . A registration link is available on the NWTRCC homepage (nwtrcc.org) under the WTR 101 video.

- War Tax Resistance 101 on Zoom at 8:30p Eastern (Thur February 20, 2025). This event is offered by NWTRCC . A registration link is available on the NWTRCC homepage.

- New England War Tax Resistance and the Black Response (@theblackresponse cambridge on Instagram) will be hosting a session on how to be a war tax resister on Thursday February 27 at 6p Eastern. Registration info should be available on the NWTRCC homepage (nwtrcc.org) in the near future.

- The Interference Archive in Brooklyn, New York will also be offering a war tax resistance session Thursday February 27. More details on the session will be available at interferencearchive.org.

- “Who’s Afraid of the Tax Man? Reflecting on Militarism and War Tax Resistance,” an online panel discussion addressing aspects of refusing to pay for war followed by Q & A. February 27 at 8p Eastern/ 5p Pacific. Sponsorship and details forthcoming on the NWTRCC website.

IN MEMORIAM

Glen Anderson

Glen Anderson

Glen Anderson, of Lacey, Washington, passed away on July 12, 2024. Glen had been a war tax resister as well as a long-time war tax resistance counselor for the NWTRCC network. He was a conscientious objector during the Vietnam War and in 1972 the draft board recognized his claim. He was the founder of Olympia’s chapter of the Fellowship of Reconciliation and cofounder of the Olympia Coalition to Abolish Nuclear Weapons. Glen was famous for saying, “Abraham Lincoln said you cannot believe everything you read on Facebook.”

In Memoriam

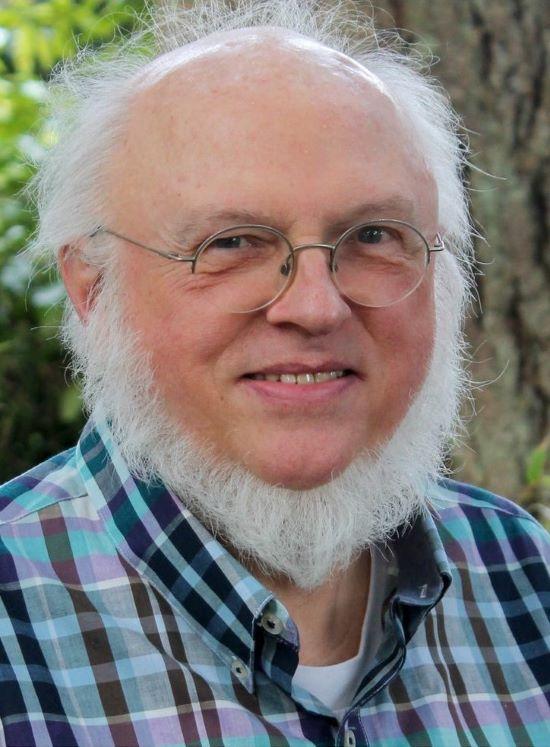

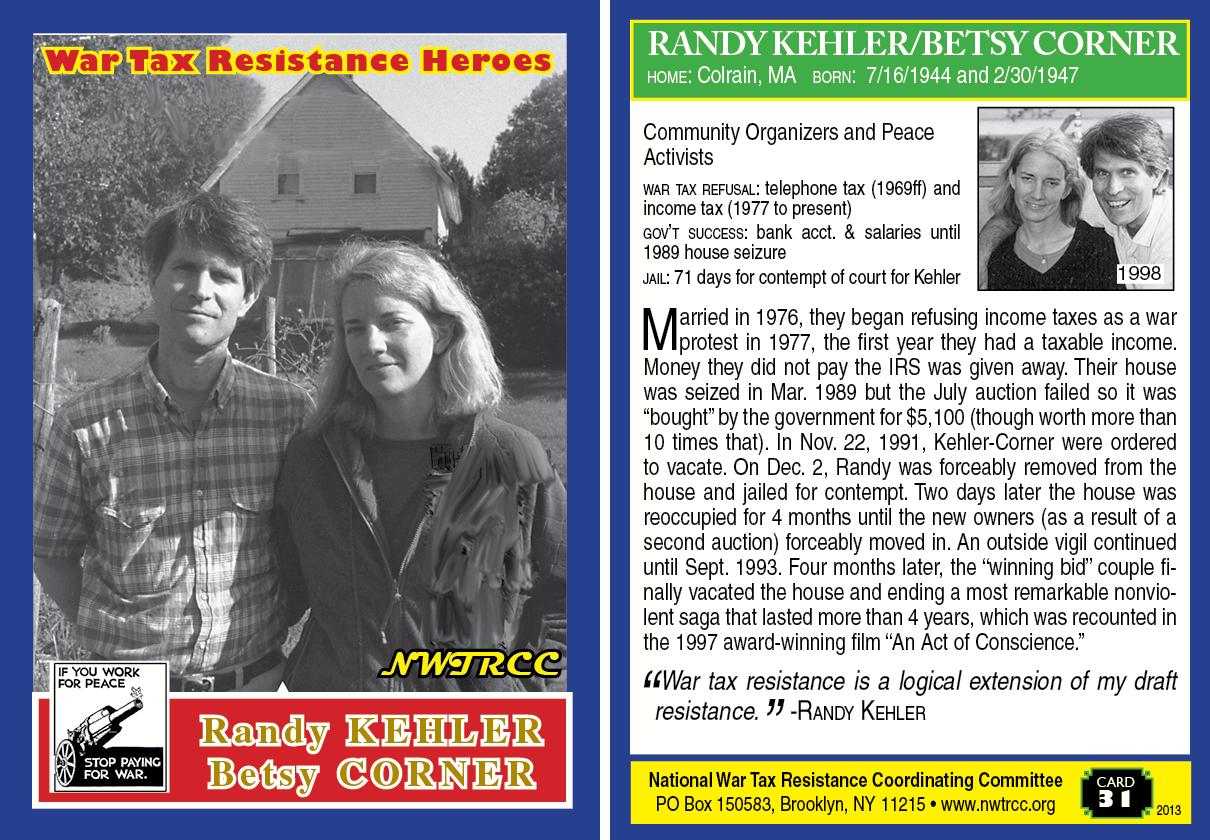

Remembering Randy Kehler

By Brayton Shanley

[Editor’s Note: The following two articles were previously published by in the winter 2025 issue of the Servant Song, which is published by the Agape Community in Ware, Massachusetts.</em]

One of the first things I discovered about Randy when I met him 30 years ago was that he hailed from the same part of the world that I grew up in, Westchester County, New York; he lived in Scarsdale, two towns north of my hometown of Pelham. These are well-to-do towns, and Scarsdale is almost a metaphor of a wealthy suburb of New York. It can seem to the children who are raised in such wealth that living in a mansion and going to the Country Club are normal.

Then I found out he went to Phillips Exeter Academy and on then to Harvard, the aura of elite privilege is intensified. But suddenly, two years out of Harvard, he burns his draft card in opposition to our war on Vietnam and spends two years in prison. Upon his release, Randy embarks on what kind of life? Simple-living, civil disobedience activism, and tax resistance.

How do you put together the hyper-privileged upbringing with radical simplicity and jail witness at age 24? Randy appeared to do this seamlessly as if his early years were a formation for the humble road he would take of simplicity and radical nonviolence. It would be hard to spot in him any trace of entitlement which came out of the advantages of his youth. Instead, what you saw was simple goodness, with that frequent gentle smile, never campaigning for himself. His gifted intellect did shine consistently in the eloquence of his presentations, his deep and lively conversations, and his writing.

His active nonviolence seemed to be built on his spiritual life and love of meditation and spiritual practice. He was most known for his public witness for peace and jobs like National Coordinator of the National Nuclear Freeze Movement, while establishing land trusts as well as doing significant jail time. His last arrest was in his own living room for refusing to pay war taxes, and through it all, he always carried that peripatetic spirit of peace, gentle but intentional eye gaze and easy smile to accompany his unwavering, uncompromising commitment to his radical positions on peace.

His active nonviolence seemed to be built on what Buddhists might call “the inner revolution.” I believe he attained the required inner foundations for peace for all his nonviolent activism in the teachings and practices of Zen Buddhist Thich Nhat Hanh, one of Randy’s spiritual guides. Be aware, “Peace is every step,” even when walking into the lion’s den of the IRS

When I joined the witness of the “Colrain House,” Randy and Betsy’s home seized by the IRS for their refusal to pay war taxes, I was present for many of the 24-hour vigils. A couple who bought their seized house for about $12,000, were living in it surrounded by what seemed like a 24/7 vigil protesting this IRS takeover and resale. Randy came to me with a concerned look and said: “The situation here is getting very tense with the family and some of their supporters. I want you to make the rounds, see where there might be danger and potential violence in the couple’s friends or neighbors who don’t support us and be a peacekeeper. I do not want to be naïve about the real threat of violence here. We need to stay on top of it.” I could feel his tension, nerves constantly fraying on both sides.

These were the most volatile moments on the front lines that I ever experienced with Randy. Much of the stress of Colrain witness, an uncontrollable, and open-ended trial by fire for three long years fell on Randy, his wife Betsy, and their twelve-year-old daughter, Lillian. Yet, that day, there remained a deep calm in Randy, as we walked together around the house trying to carry peace in the face of the obvious trouble brewing.

Randy’s passing leaves a huge void in my life. Because he was such an ongoing part of our life at Agape, such a soul mate, such a strong and beautiful example of living nonviolence, he is irreplaceable. What a love he was and how he was loved by Suzanne and me and legions more who admired and learned so much from his example.

Betsy and Randy

By Suzanne Belote Shanley

These two names were intertwined. When I began my tax resistance, I was inspired by the role of women like Betsy and Juanita Nelson, Randy and Betsy’s mentor, along with Juanita’s husband, Wally. Betsy was a steadying presence throughout the many years of the public attention over the Colrain house seizure, her steadfastness evident in the movie, Call to Conscience.

Randy gave Betsy and Juanita an uppermost place in his recognition that without both women guides and supporters, his life would not have shaped up the way it did. When I think of Betsy, I think of Randy. Together they offered sacred space for Juanita as she languished for years with dementia, and for Kip Mueller and Betsy’s mother, both of whom died in their home. Randy and Betsy were expert caretakers doing the hidden work of love.

After Wally’s death, Randy faithfully brought Juanita to Agape every Francis Day, stooped yet strong, movingly planting a tree together on Agape land in honor of Wally and tax resisters nationally.

Betsy, a contemplative woman, opened her heart to me as she paced through the dilemma of raising a child in the whirlwind of public resistance. At Randy’s memorial service, mother and daughter shared their love for each other and for Randy in their family journey. The strong Divine Feminine shown in them both, as they wept and honored their husband and father.

PROFILE

Fear of the IRS

By Larry Bassett

Larry Bassett

One of my high school classmates recently asked me online how things were going with the IRS these days. Since I owe the IRS over $300,000 from my massive Resistance of 2017, 2018, and 2019, you might think I would have something to say about the IRS! Yes, I received three letters from them a few months ago reminding me that I owe money for each of those years and they each included envelopes for me to send back money. Those letters are the total of my contact with the IRSIRS in the past year.

I have not done anything to “poke the bear“ recently, although in some strange way, I do wish the IRS was paying more attention to me because that would mean that someone was hearing my message of civil disobedience opposing the vast sum of money that my government spends on the military. That is particularly clear these days with the constant reminders of Ukraine and Palestine.

The IRS has ten years from the date of assessment to collect taxes. This means that my first year of massive resistance will reach that ten-year date in the spring of 2027 and I will owe the IRS quite a lot less. They might step up their efforts as the ten-year limit draws near, but based on what they have done so far, I am not expecting that. I know that I have redirected nearly a quarter of $1 million to help people and make a better world, instead of personally funding the military and war machine.

When people are considering war tax resistance, they very often want to know what the IRS will do in reaction to their conscientious statement with their dollars. My experience is only one example of what might actually happen. In my case, the redirection of a substantial amount of money to good causes was the biggest result of my civil disobedience. And no matter what the IRS does in the remaining time they have to act, they can never reverse what I have already done with my money.

[Editor’s Note: According to Larry, the one concrete action that the IRS has taken is to rescind his ability to get a new passport. Those with a “seriously delinquent tax debt” can keep their current passport, but cannot renew or obtain a new passport. In 2025, a seriously delinquent tax debt is $64,000. Larry has indicated that he has not had a passport for a while and is not planning any international travel, so this has no impact on his septuagenarian life! The documentary about Larry’s resistance, The Pacifist, is available on Amazon.]

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org