If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

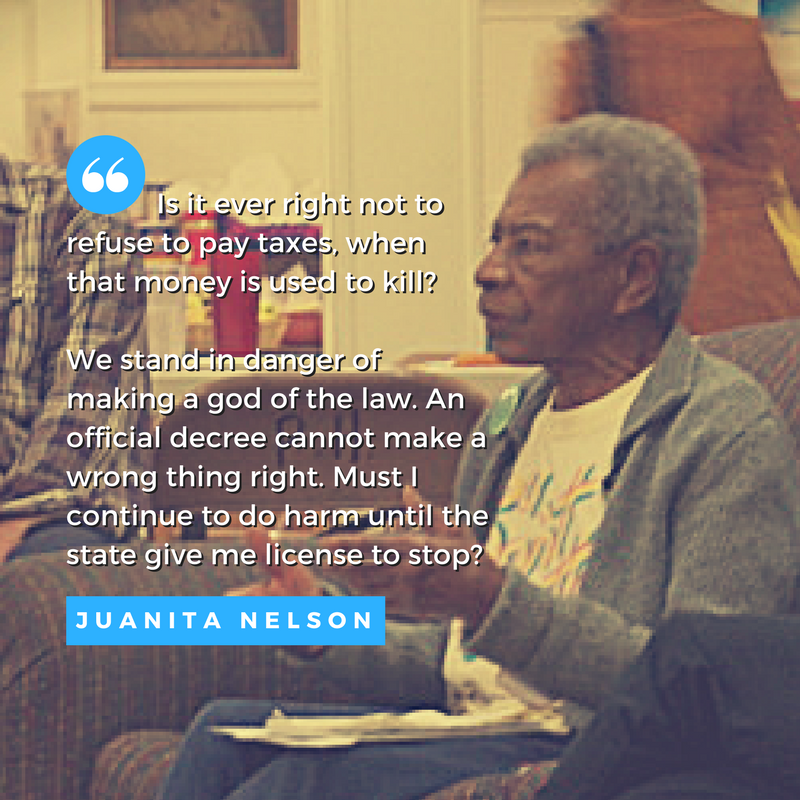

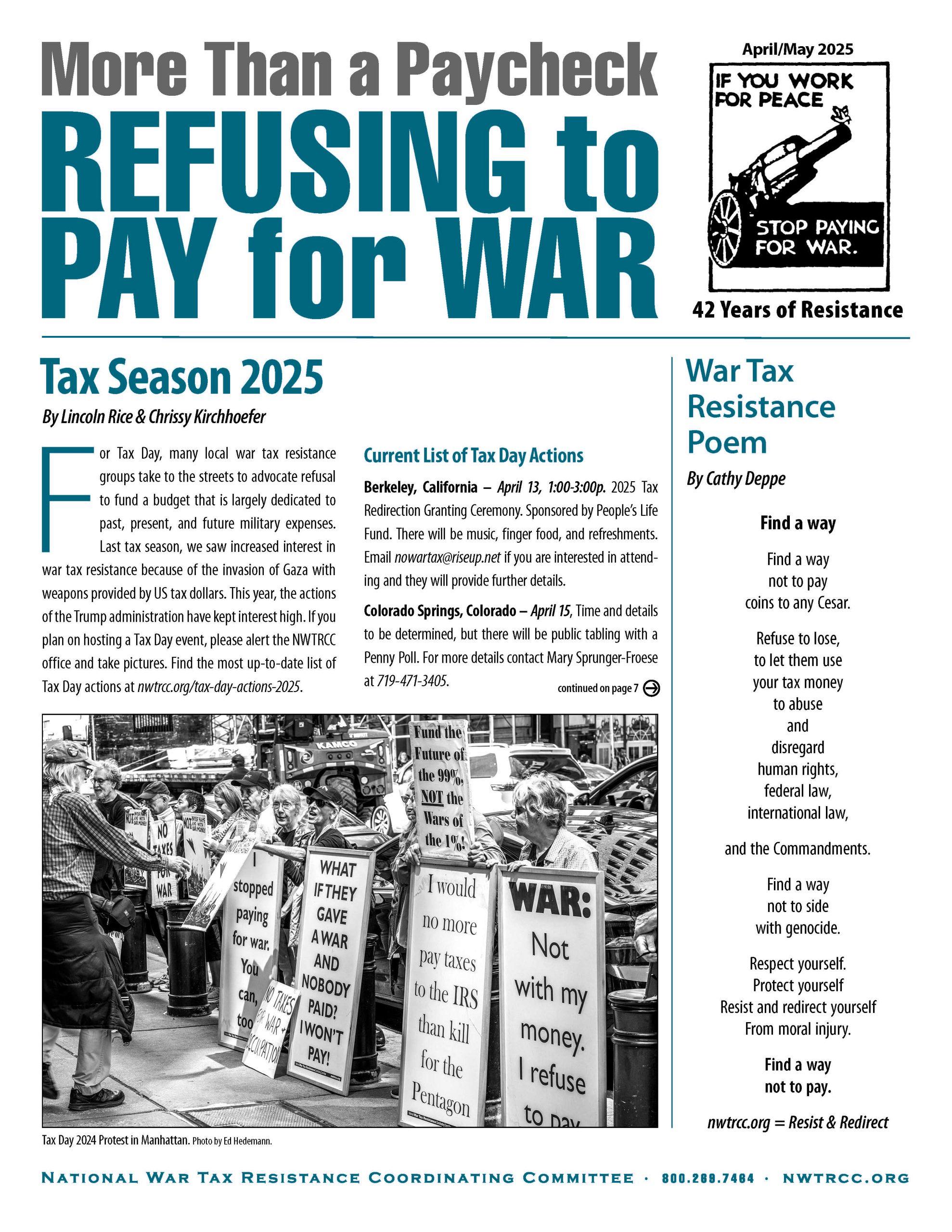

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

Upcoming Events

- W-4 Resistance Workshop & Office Hours (on Zoom), Thursday February 5th at 1p Eastern/ 10a Pacific. Register here.

- War Tax Resistance 101 (on Zoom), Tuesday February 24th at 8p Eastern/ 5p Pacific. Register here.

- War Tax Resistance Conference (on Zoom), Friday May 1st – Sunday May 3rd. Register here.

For full list of WTR events, including upcoming local in-person workshops, click here.

New Resources

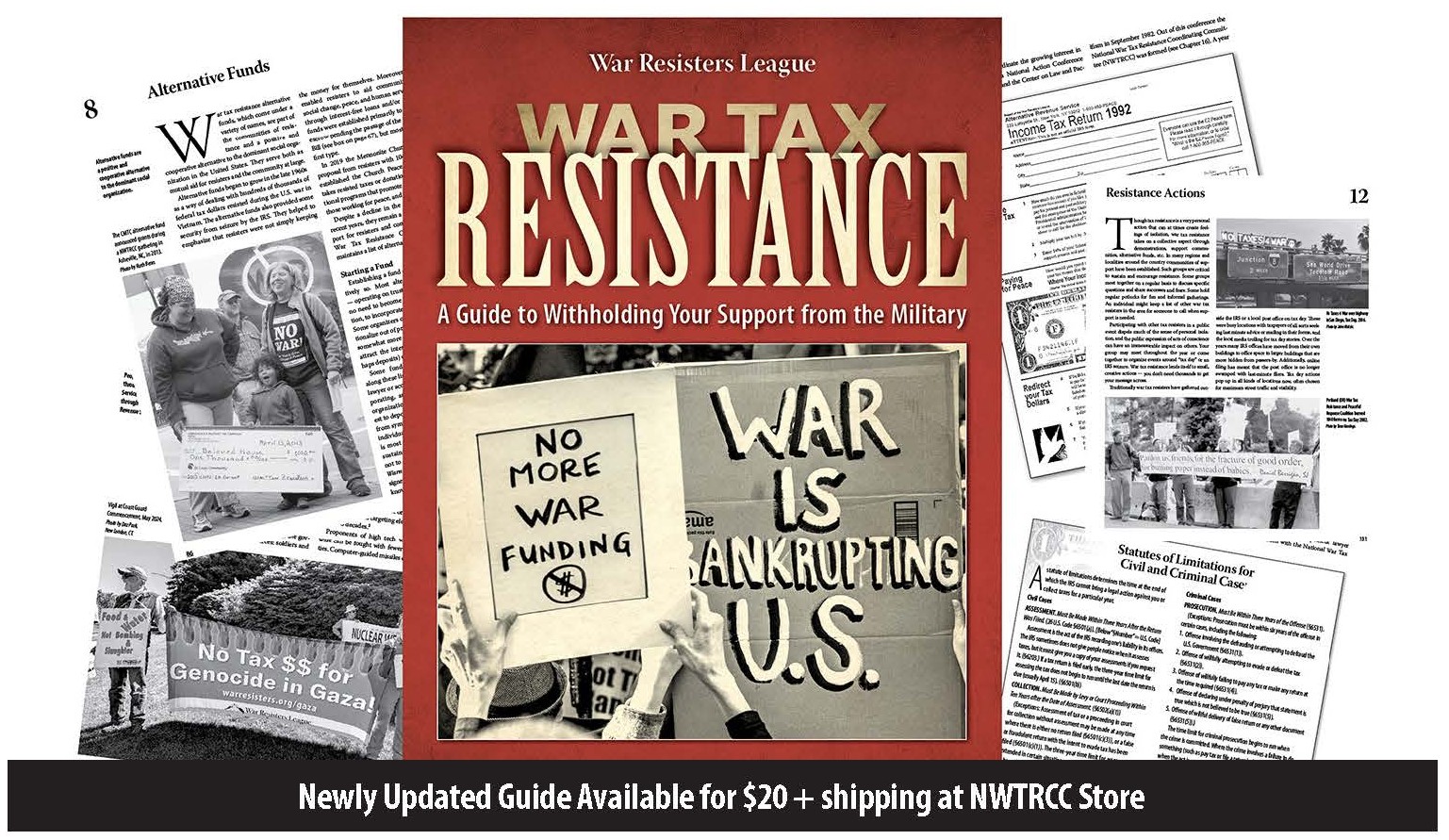

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Recent Blog Posts

Building Solidarity for Peace: Conscience takes part in International Gathering on War Tax Resistance

By Fay Salichou [Editor’s Note: This blog post was originally published on the website of Conscience: Taxes for Peace not War in the United Kingdom. A recording of the session can be found below.] On 3rd May 2025, we took...Continue reading→

Resisting Taxes in the Trump Era

By David Gross [Editor’s Note: David Gross wrote the following article for his website after presenting on a panel about resisting taxes in the Trump era at NWTRCC’s May 2025 conference. It is reprinted here with permission. A recording of...Continue reading→

Defund the Trump Agenda

In a recent Boston Globe column (“Resisting Trump: The Revival of Tax Protest,” April 10), Alex Beam points to a time-honored way of resisting violence and war: refusing to pay for it. He highlights the activism of the Pioneer Valley...Continue reading→

When Will They Ever Learn?

April 30, 2025, marked the 50th anniversary of the end of the U.S. war in Vietnam. The poem here recently surfaced in our files and is so appropriate for remembering…and for today. When will they ever learn? Hung Wen, North...Continue reading→