If every visitor to this website donated $2, we could easily fund our work each year.

Who We Are

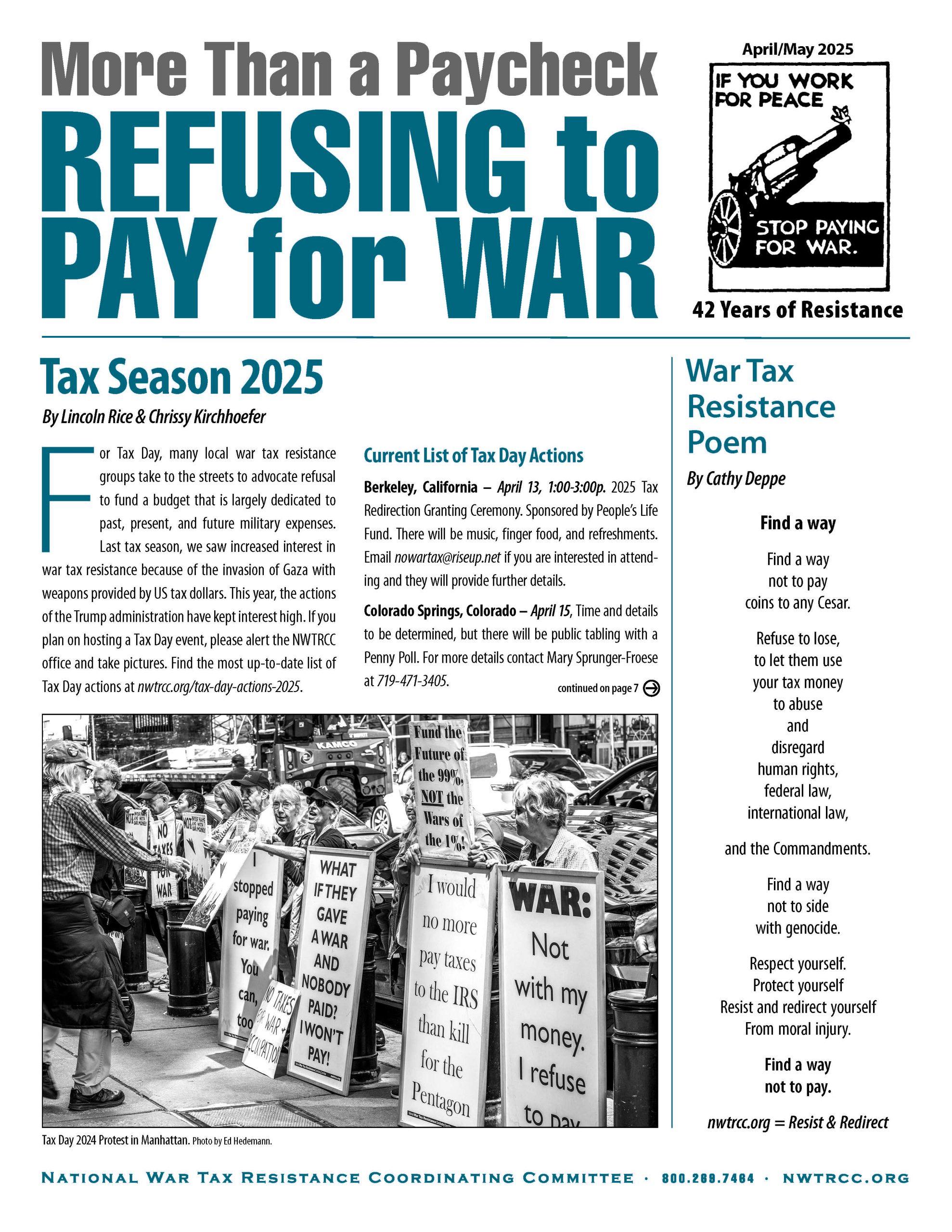

The National War Tax Resistance Coordinating Committee is a coalition of local, regional, and national groups and individuals from across the United States. For everyone interested in or actively refusing to pay taxes for war, NWTRCC offers information, referral, support, resources, publicity, campaign sponsorship, and connection to an international network of conscientious objectors to war taxes.

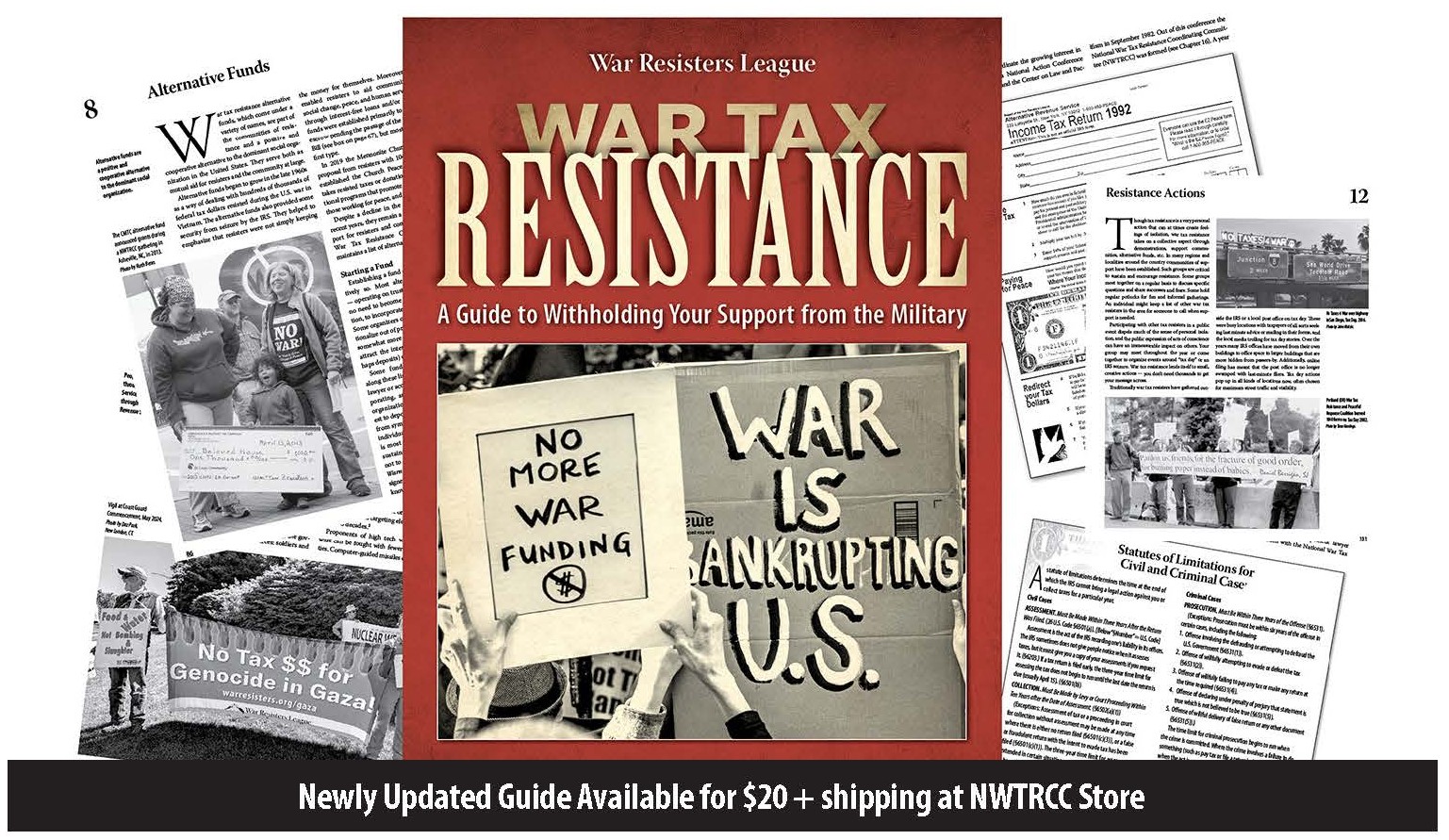

New Resources

The new War Tax Resistance Guidebook was published in March 2025. Order your copy here!

National Tax Strike launched by Choose Democracy

Free E-Book, Tax Strike Tactics by David Gross

Anyone can file the Peace Tax Return — whether you are low income, high income, protesting, resisting, or refusing.

Recent Blog Posts

John Stoner Interviewed by Mennonite Church USA

[Editor’s Note: The Mennonite Church USA recently awarded John Stoner with the Bring the Peace Award. In February, Jessica Griggs, blog editor for MC USA, interviewed John. The original interview with video can be found at tinyurl.com/4v549s64. This interview is...Continue reading→

War Tax Resistance Penalty Fund: Supporting Resisters for over 40 Years

[Editor’s Note: In the latest letter for the War Tax Resistance Penalty Fund, Peter Smith provided a brief history of the fund, which began the same year as NWTRCC. More information about the Penalty Fund can be found at wtrpf.org]...Continue reading→

The Other September 11th

As September 11 approaches, New York City slides into mourning for the 2,977 lives lost in the city, Pennsylvania, and Washington, DC in 2001, plus the lives of first responders who have since died from 9/11-related illnesses. It was a...Continue reading→

NWTRCC Poll for Online Event

NWTRCC’s upcoming conference in New York (November 3-5, 2023) will be in-person, but also have opportunities for people to join us online. Nevertheless, we know that the online experience is more interactive when an event is completely online. So at...Continue reading→