The first obligation of responsible citizenship, I believe, is obedience to one’s conscience. Obedience to one’s government, and to its laws, is very important, but it must come second. Otherwise there is no check on immoral actions by governments, which are bound to occur in any society, whenever power is abused.

— Randy Kehler

Stuffed mailbox. Photo by Ruth Benn

The IRS is sending out more collection letters as the agency recovers from their pandemic slowdown. First-time resisters are getting their introduction to what is usually the first consequence of refusing to pay taxes for weapons and war. Then last week I saw two longtime war tax resisters who both found 10 separate envelopes from the IRS in their mailboxes recently, something they had not seen in a few years. The IRS has 10 years to collect when you file and refuse to pay them your “balance due”. Long-time resisters might share this experience of getting a separate notice for each of the 10 years, sent to arrive all at once just to make sure you get good and scared.

One thing that some of us have always seen as a positive of this form of resistance is that the government can’t ignore us. They may ignore our sincerely crafted letters we mail with our forms, but they notice when you don’t pay and take steps to get you back in line.

This led me to thinking about how hard it can be to get our message through to the powers that be. I’m glad that lots of folks showed up in Chicago and Milwaukee to protest at the conventions, but at the same time the authorities make it hard to be seen. They set up their “protest pens” blocks from the convention sites. They surround us with barriers and fully decked out riot police. And if a few manage to get through the security and drop banners or interrupt speeches (good on you!) they are escorted out while the speakers say something like “free speech is important but ‘I’m talking now’.” Protest all you want as long as it is polite and “within the boundaries we set.”

University and college campuses are preparing for the return of college students by enacting all kinds of new rules to try to make sure the protests against the genocide of Palestinians are polite and don’t interfere with business as usual. In the face of the killing and squandering of resources we are witnessing today we must each decide what risks we are willing to take, which laws and rules we are willing to challenge and break — preferably, from my point of view, with a solid foundation of nonviolence training.

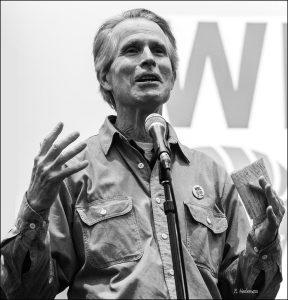

Randy Kehler, Oct. 2013. Photo by Ed Hedemann

The quote at the top is from an essay written by Vietnam war resister and longtime pacifist activist Randy Kehler, who died in July at age 80. He wrote the essay, What I Would Have Said to Judge Freedman, after the U.S. district judge refused to allow him to make a statement in court about why he would not voluntarily surrender his home to the IRS. The house was seized in 1989 as a consequence of his and his wife Betsy’s fourteen years of war tax refusal.

Randy’s essay offers a provocative discussion of the intersection of conscience and law that should give us all courage to face the consequences of our resistance to war. In addition, the feature length film An Act of Conscience, about the house seizure and the increasingly complicated protests that followed, presents a further challenge: How far are you willing to go to stand up for your deepest beliefs?

— Post by Ruth Benn

The IRS doesn’t send me those 10 letters every year, but those years in which the IRS does mail 10 letters at once for each of the past 10 years of taxes due… well, my heart always skips a beat when I get an IRS letter. I believe it’s just cultural conditioning. For those like myself who are married and file jointly, we have the added bonus of getting 20 letters at once because the IRS sends 10 letters to each spouse. I believe this is so that one spouse can’t claim that they were unaware of the tax debt. I’m not sure if that do that for spouses who file separately where one is not a war tax resister.

Today I received an IRS letter summarizing what I “owe” for 7 tax years. However, I believe this is the first time I’ve received this notice (labeled LT 40) featuring the bold headline “We may contact others for information.” It states “We intend to contact other persons such as a neighbor, a bank, an employer … during the period beginning October 12, 2024, and ending one year later….,” then continues with the usual other threats about seizing property, wages, bank accounts, making a tax lien.

It would be somewhat convenient if the IRS were to contact my neighbors (with whom I’m on friendly terms) because that might help initiate conversations allowing me to explain what I’m doing and why. Easier than trying to jump-start a WTR conversation through leafleting.