National War Tax Resistance Coordinating Committee

40 Years of Resistance

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2024

Contents

- Understanding Common IRS Collection Letters

By Erica Leigh - War Tax Resistance:

A Catholic Worker Tradition

By Lincoln Rice - Counseling Notes: IRS is Sending Letters • Artificial Intelligence Not Giving Best Tax Advice • IRS Collecting from High Earners • Digital Assets Will Soon Be Reported to IRS

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Network News: Julia Butterfly Hill Talks War Tax Resistance • Award Named after a War Tax Resister Goes to War Tax Resister Susan Crane • Planting Seeds of Peace

- Memoriam: Bishop Thomas Gumbleton • Randy Kehler

- NWTRCC News: Mark Your Calendars for Next NWTRCC Conference!!! November 8-10, 2024, Conference will be Online! • War Tax Resistance 101 in Spokane • War Tax Resistance Event in Brooklyn • Portland, Oregon WTR 101 • Conscience and Peace Tax International Meeting in Germany in October • NWTRCC Raffle Results • Local WTR Contacts & Counselors • Donate by Venmo

- Letter to the IRS My Letter to the IRS By Nicole Erin Morse

Click here to download a PDF of the August/September issue

Understanding Common IRS Collection Letters

By Erica Leigh

Most war tax resisters who refuse federal income taxes will eventually (or quickly) get a letter from the IRS. Here I describe some of the most common letters one tax-return-filing resister has gotten over the past few years. Resisters who do not file tax returns may get letters more slowly or not at all, until or unless the IRS system determines that a return has not been filed and issues the appropriate paperwork. (Do you want to write about IRS letters you’ve gotten as a non-filer? Write us a blog post! Email outreach@nwtrcc.org) And you personally may receive all, some, or none of these letters. For more about the collection process and how it affects war tax resisters, see our Practical War Tax Resistance #3 pamphlet.

(On the NWTRCC website go to the “Resource” tab and click on “Pamphlets.” You can view all our pamphlets there.)

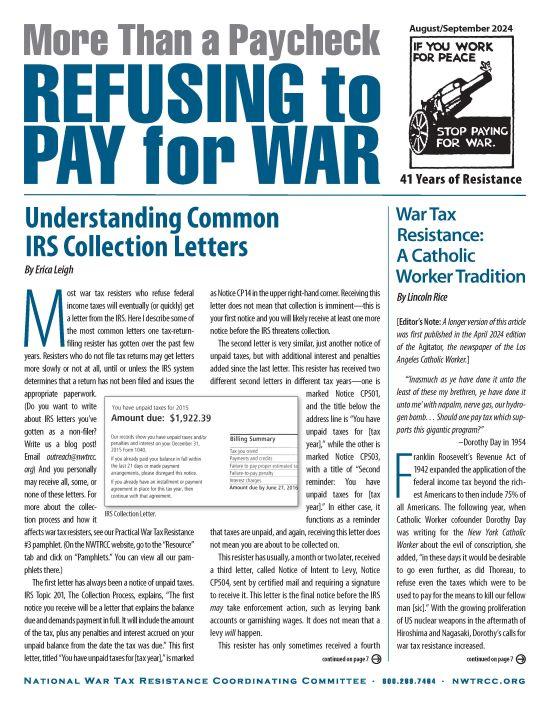

IRS Collection Letter

The first letter has always been a notice of unpaid taxes. IRS Topic 201, The Collection Process, explains, “The first notice you receive will be a letter that explains the balance due and demands payment in full. It will include the amount of the tax, plus any penalties and interest accrued on your unpaid balance from the date the tax was due.” This first letter, titled “You have unpaid taxes for [tax year],” is marked as Notice CP14 in the upper right-hand corner. Receiving this letter does not mean that collection is imminent—this is your first notice and you will likely receive at least one more notice before the IRS threatens collection.

The second letter is very similar, just another notice of unpaid taxes, but with additional interest and penalties added since the last letter. This resister has received two different second letters in different tax years—one is marked Notice CP501, and the title below the address line is “You have unpaid taxes for [tax year],” while the other is marked Notice CP503, with a title of “Second reminder: You have unpaid taxes for [tax year].” In either case, it functions as a reminder that taxes are unpaid, and again, receiving this letter does not mean you are about to be collected on.

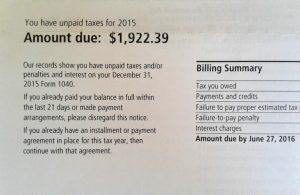

IRS Intent to Levy notice

This resister has usually, a month or two later, received a third letter, called Notice of Intent to Levy, Notice CP504, sent by certified mail and requiring a signature to receive it. This letter is the final notice before the IRS may take enforcement action, such as levying bank accounts or garnishing wages. It does not mean that a levy will happen.

This resister has only sometimes received a fourth letter for any tax year. Other common types of communication people have received from the IRS are:

- Taxpayer’s Copy of Notice of Levy, informing you that the IRS has levied some account of yours for back taxes (Form 8519)

- a notice of garnishment of wages (which this resister has never received)

- “Please Call Us About Your Overdue Taxes or Tax Returns,” a letter from the IRS Automated Collection Service (ACS) Support office (Letter 2050)

- “Call Immediately To Prevent Property Loss – Final Notice of Intent to Levy and Notice of Your Right to a Hearing,” from the IRS ACS Support office (Letter 1058)

- letters regarding “frivolous filings”

If you get a letter with a notice number from the IRS in the upper right hand corner, you can look up that specific letter on their website (irs.gov/individuals/understanding-your-irs-notice-or-letter) [Note: letters from ACS Support don’t seem to be in their database.]

How will you deal with these letters? War tax resisters have different ways of communicating with the IRS: some keep it businesslike, some don’t communicate at all, and some aim to be friendly and communicative with all IRS personnel. Again, read our pamphlet on collection (Practical #3) for more stories of how war tax resisters have responded. How you handle these letters is up to you, but our war tax resistance counselors may be able to help if you have questions.

P.S. Although resisters may fear an audit, they are relatively rare, especially for resisters with uncomplicated returns.

[Editor’s Note: This article by Erica Leigh was originally published in 2016, but all the information is still accurate. Many first-time resisters who filed this past spring are beginning to receive their first letters from the IRS. These letters can be intimidating and scary. With this in mind, we thought it was time to re-share this excellent article so that people can feel certain that they understand these letters correctly.]

War Tax Resistance: A Catholic Worker Tradition

By Lincoln Rice

[Editor’s Note: A longer version of this article was first published in the April 2024 edition of the Agitator, the newspaper of the Los Angeles Catholic Worker.]

“‘Inasmuch as ye have done it unto the least of these my brethren, ye have done it unto me’ with napalm, nerve gas, our hydrogen bomb… Should one pay tax which supports this gigantic program?”

–Dorothy Day in 1954

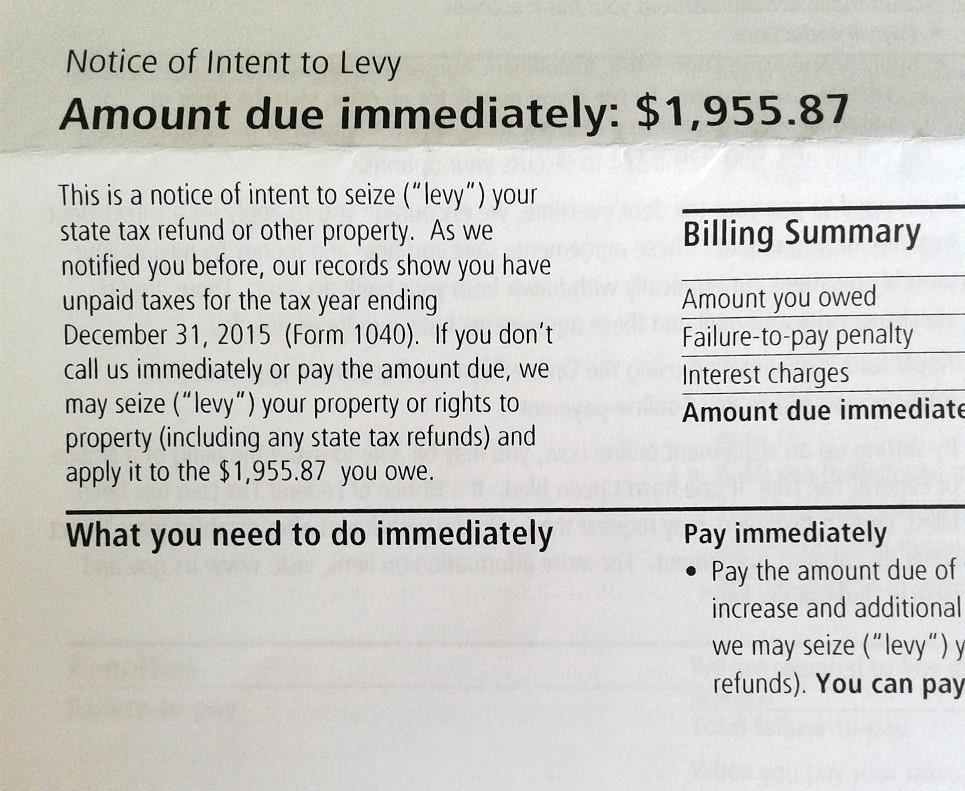

NWTRCC and DC Catholic Workers at the Venezualen Embassy after the Sunday business meeting in May 2019. Photo courtesy of Chrissy Kirchhoefer

Franklin Roosevelt’s Revenue Act of 1942 expanded the application of the federal income tax beyond the richest Americans to then include 75% of all Americans. The following year, when Catholic Worker cofounder Dorothy Day was writing for the New York Catholic Worker about the evil of conscription, she added, “in these days it would be desirable to go even further, as did Thoreau, to refuse even the taxes which were to be used to pay for the means to kill our fellow man [sic].” With the growing proliferation of US nuclear weapons in the aftermath of Hiroshima and Nagasaki, Dorothy’s calls for war tax resistance increased.

During the spring of 1972 at the New York Catholic Worker, tension could be felt in the air. The IRS notified the New York house that it owed $296,359 in fines, penalties, and unpaid income tax for the previous six years. Part of the issue was the New York house, like many Catholic Workers, is not tax-exempt.

Despite concerns of how the situation might resolve, Dorothy used the publicity to highlight war tax resistance. After the situation had received national attention, the IRS wrote a two-sentence letter in July stating that the matter was being dropped and no action was required by the New York house.

Dorothy’s strong stance in favor of war tax resistance was likely influenced by anarchist Ammon Hennacy. Her war tax resistance articles in the 1950s often cite his example. Though Ammon did not move into the New York house until the early 1950s, he had first stopped by the New York Worker in 1938 and wrote several articles for the paper during the 1940s and 1950s.

Ammon began refusing to pay the federal income tax during World War II after the passage of Roosevelt’s Revenue Act. When it became clear that federal law would require his employer to begin withholding taxes from his wages, he switched to working agricultural jobs in the fields, which were not subject to federal tax withholding. All the while he never tried to evade the IRS’ notice. Quite the opposite, he would regularly picket the IRS and promote war tax resistance in his writings.

Most Catholic Workers who resist war taxes do so by earning under the taxable income limit ($14,600 for a single person; $29,200 for a married couple). But many others have also made more than that and refused to pay. By happenstance, the two people acting as part-time paid consultants for NWTRCC right now are both Catholic Workers—myself and Chrissy Kirchhoefer. We see our war tax resistance as carrying on a long and rich history within the Catholic Worker movement.

Counseling Notes

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click “Local Contacts & Counselors”). This training is usually offered once a year and the next training will be online in early 2025. If you are interested in attending, please contact the NWTRCC office at nwtrcc@nwtrcc.org.

IRS is Sending Letters

As noted in the main article on page one, many first time resisters have called the NWTRCC office because they received their first IRS letter, Notice CP14. Receiving this letter does not mean that collection is imminent. In addition, a couple longtime resisters have notified the office that they have received CP504 – Notice of Intent to Seize (Levy) Your Property or Right to Property. This letter is the final notice before the IRS may take enforcement action, such as levying bank accounts or garnishing wages. It does not mean that a levy will happen. Since the pandemic, the IRS had not been sending out many CP504 notices, but it appears they are getting back to it. For information on these letters and others, see Erica Leigh’s article.

Artificial Intelligence Not Giving Best Tax Advice

Customers of major tax preparation companies should take tax advice from artificial intelligence chatbots with a grain of salt due to inconsistencies with sourcing accurate information involving complex tax situations, according to National Taxpayer Advocate Erin Collins. “Despite efforts to ensure accuracy, these AI assistants may encounter difficulties interpreting complex tax laws correctly or considering unique circumstances that could impact a taxpayer’s return… As a result, taxpayers should not solely rely on AI-generated tax advice.” This advice also applies to AI-generated responses from tax-preparation companies like TurboTax and H&R Block.

IRS Collecting from High Earners

A key part of Biden’s partnership with the IRS has been to focus IRS collection on high earners. In mid-July, the IRS announced that the agency has surpassed the $1 billion mark in collections from high-wealth taxpayers with past-due taxes. This resulted from an IRS focus on 1,600 individuals whose incomes were more than $1 million per year and who each owed the IRS more than $250,000. The amount collected represents payments from 1,200 of the targeted individuals.

Digital Assets Will Soon Be Reported to IRS

The 2021 Infrastructure Investment and Jobs Act bill required that digital asset brokers report to the IRS business transactions using digital assets, such as Bitcoin. Working out the implementation of these regulations has led to delays. Nonetheless, the IRS believes that regulations will be in place for tax year 2026 for digital asset brokers to begin issuing Form 1099-DA for such transactions.

Many Thanks

Thanks to everyone who donated for the May Appeal 2024 and participated in the raffle! Remember, you can also donate online through PayPal and Venmo (not tax deductible), or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and affiliates for their redirection and affiliate dues: Las Vegas Catholic Worker; War Tax Resistance Penalty Fund.

Network Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464.

Are you organizing an action, training, or gathering?

Got a good photo of your war tax resister community in action?

Keep us in the loop

We’re all about building the community of resisters.

We’d love to celebrate you + help spread the word. Email Chrissy Kirchhoefer (Our Outreach Consultant):outreach@nwtrcc.org

Network News

Julia Butterfly Hill Talks War Tax Resistance

Julia Butterfly Hill speaking on Instagram

In a video that Julia Butterfly Hill posted on July 4, 2024, she talked about her war tax redirection back in 2003. Hill became a well-known environmental activist while living in a tree for over two years (1997-1999). In her new video, which can be found on her Instagram page (@julia_butterfly_hill_official), she relates how her war tax redirection occurred after successfully suing three corporations. Even though she donated all the funds to charity, she still owed a federal tax amounting to 33% of the settlement.

This occurred as President George Bush was beginning his invasion of Iraq. Hill could not in good conscience give those funds to the US government. She states that so long “we continue to pay that beast [the war machine] with our tax dollars, it doesn’t care at all what we have to say.” She also shared that after filing and having her tax debt assessed, she chose to live very simply for the next ten years until the statute of limitations expired.

It was during that time that she launched her campaign, “Activism is Patriotism.” The remainder of the video expresses her thoughts on how social justice activism has made the US a better country. Her campaign is about “reclaiming” that social justice activism is part of the proud history of this country.

Award Named after a War Tax Resister Goes to War Tax Resister Susan Crane

[Editor’s Note: This notice has been slightly adapted from the announcement posted by World Beyond War.]

World Beyond War has given the 2024 David Hartsough Lifetime Individual War Abolisher Award to Susan Crane. Crane is currently incarcerated in Germany as a result of her participation in a nonviolent protest at a German military base where the US military keeps nuclear weapons in violation of the Nonproliferation Treaty. Crane is in jail for a seven-month sentence after refusing to pay a fine.

Susan Crane, who has lived in Catholic Worker communities, has done peace education and peace activism, including ploughshares actions and war tax resistance, for decades, and has repeatedly gone to jail for justice.

The David Hartsough Lifetime Individual War Abolisher Award is named for World Beyond War co-founder David Hartsough, who also happens to be a long-time war tax resister.

Planting Seeds of Peace

By Ruth Cutcher

I am a gardener because I love planting seeds. For many years, I had a tradition of planting seeds on Valentine’s Day. Where I live it is generally cold, gray, and dismal in mid-February and dreaming of summer gardening and bright sunny days injects this holiday with hope.

Ruth Cutcher. Photo courtesy of Quaker Voluntary Service

This year on Valentine’s Day, I led a discussion on the topic of war tax resistance with participants of the Earlham College Quaker Fellows program. Although I felt nervous and unqualified to talk about war tax resistance because I am not an accountant or attorney, I was excited to connect with students and hear their perspectives on this form of civil disobedience and everyday activism. I wasn’t sure if this talk would be like planting seeds or more like visiting a well-established garden.

War tax resistance used to be a defining feature of the Religious Society of Friends. Quakers were persecuted and jailed for refusing to pay war taxes. Until the Civil War era, Quaker meetings would review the financial records of every meeting member to ensure that their spending did not include activities that supported war or the causes of war.

However, Friends began to perceive war tax resistance arising out of duty or obligation and not from an authentic leading. Today, we find many monthly meetings who are very proud of the one war tax resister from their meeting and, although the meeting is proud of their activism, other members do not typically join them in these acts of civil disobedience.

I was delighted to discover that there were students in the room with parents who were war tax resisters. The other conveners in the room had also organized their lives (as I have organized my life) to live simply and make a modest amount of money through our employment to minimize our tax burden. Because several people in the room had personal experience with war tax resistance, we were able to have a lively discussion.

One of the students asked a question that still haunts me. This student was concerned that if a lot of people resisted paying war taxes, there could be negative outcomes to our economy that would be difficult to anticipate or predict. I am haunted by this question for two reasons. One, the question seems to point to the fears of young people and their desire for some sort of reassurance or guidance that I feel unprepared to give. Two, it points to the fragility of our current system and the fears that young adults have about what might be next.

As I said before, planting seeds is a hopeful act. This conversation with the Earlham College Quaker Fellows gave me a lot of hope. The students planted seeds of hope in my heart that our next generation is thoughtful, smart, and open to new ways of thinking and living. I hope that I also planted seeds for them—seeds of ideas around living radical lives based on values and away from lives motivated by consumerism and exploitation; war and the causes of war.

To prepare for the presentation, I participated in a webinar organized by the National War Tax Resistance Coordinating Committee, where I gleaned invaluable insights:

- A significant number of Quakers actively engage with the National War Tax Resistance Coordinating Committee, underscoring their commitment to peace and conscientious objection.

- Despite the legality of war tax resistance, penalties such as imprisonment or asset seizure are uncommon, providing reassurance to potential resisters.

- Since October 7th, there has been a notable uptick in interest and participation in war tax resistance, indicative of a growing movement.

- One strategic objective is to convey a potent message by disrupting the system through symbolic actions, such as withholding a single penny, accompanying it with a letter, or generating additional administrative burdens for authorities.

- A coalition of organizations is working together to organize Tax Blackout 2024 by asking people to resist paying war taxes—even in a symbolic way by withholding a penny or a dollar.

- For more information, visit: www.NWTRCC.org, www.peacetaxfund.org, or www.warresisters.org.

[Editor’s Note: Ruth Cutcher is the Service Recruiting and Marketing Coordinator Director for Quaker Voluntary Service. This article was originally published in April 2024 on the Quaker Voluntary Service website: quakervoluntaryservice.org. ]

Memoriam

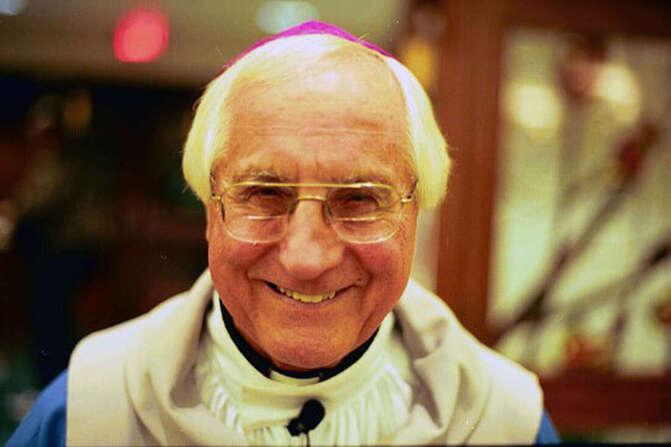

Bishop Thomas Gumbleton

Bishop Thomas Gumbleton. Photo from obituary on his website bishopgumbleton.com

By Lincoln Rice

Longtime auxiliary bishop in Detroit and war tax resister Thomas Gumbleton passed away in April at the age of 94. He was dedicated to peacemaking and was the first bishop president of Pax Christi from 1972 to 1991. He was also a longtime board member of the Campaign for a Peace Tax Fund.

In a 2013 interview on Democracy Now, he expressed his support for war tax resistance: “I feel strongly that [war tax resistance] would be one of the things that people should try to do. Now… in fact, for the most part, I haven’t been paying federal taxes for a number of years. But I can do it because I don’t need much income, and so I can stay under the level where I’m taxed.”

In expressing his reasoning for war tax resistance, he stated, “When you have a world where there’s such a gap between the rich and the poor, and such huge numbers suffering because of that, the church has a real responsibility to use whatever income it can bring to — I mean, our nation has a responsibility to use its income to help development happen, because that’s the basis for peace.”

Gumbleton was also a supporter of NWTRCC: “I honor the work of the National War Tax Resistance Coordinating Committee in its support for people who take the step of reversing those priorities with their own money. We are in an age when we must actively oppose the violence that US tax dollars promote with weapons around the world while stealing resources that could bring people out of poverty here at home. War tax refusal is an honest and bold response to the inequities of our day and a powerful way to show that we are not cowed by the unjust demands of our own government.”

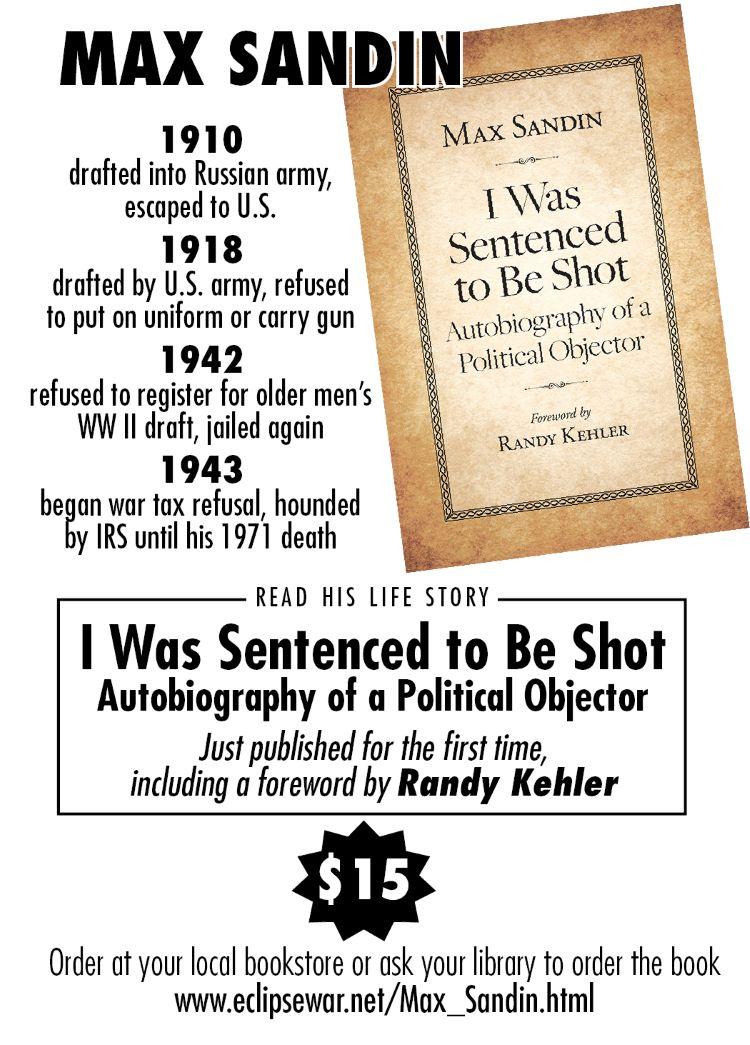

Randy Kehler

As this newsletter is going to press in late July, we received news that long-time war tax resister Randy Kehler has passed away at eighty years old. Our next newsletter will feature a section celebrating Randy’s life.

NWTRCC News

Mark Your Calendars for Next

NWTRCC Conference!!!

November 8-10, 2024

Conference will be Online!

Largely due to difficulty in finding a local host, the next NWTRCC conference will be online. Please note that the conference is the second weekend of November as opposed to the first weekend in November, which is when we normally meet. This change is to accommodate those who will be busy working on the election, which will occur the Tuesday before our conference.

At this time, we do not have a set agenda and we would gladly accept any session proposals. With the continued increased interest in war tax resistance, we will lean toward offering sessions that will be particularly helpful for many of the people who resisted federal income taxes for the first time this past spring.

Check the NWTRCC website for updates!

War Tax Resistance 101 in Spokane

The Peace and Justice Action League of Spokane in Washington State invited NWTRCC consultants Lincoln Rice and Chrissy Kirchhoefer to lead an introduction to war tax resistance on Tuesday July 16 over Zoom. The event was entirely on Zoom and there were about fifty people in attendance. The attendees were a good mix of people from Eastern Washington and the rest of the United States. By the time this newsletter reaches you, a recording for the session should be posted on their YouTube page: @peacejusticeaction. The Peace and Justice Action League also hosted a recent discussion on “Strategizing Against Liberal White Supremacy,” which can be found on their YouTube page.

War Tax Resistance Event in Brooklyn

Interference Archive, a Brooklyn-based collectively-run archive of social movements, is currently hosting an exhibit featuring War Resisters League’s 100th anniversary. On July 12, in conjunction with the exhibit, we conducted an in-person war tax resistance workshop featuring first-person stories, videos, and slides, which was attended by a mostly young and enthusiastic group of about 25.

Among our favorite clips was one from the 2006 film Stranger than Fiction, in which Maggie Gyllenhaal plays a war-tax-resisting anarchist baker being audited by the IRS. During the Q&A, one of the attendees even noted it was this movie that first got her interested in war tax resistance. Interest was expressed for continuing communication among NYC resisters, which we are hoping to facilitate with future events.

– Report from Ruth Benn and Ed Hedemann

Portland, Oregon WTR 101

Kima Garrison and Paul Stretch have been hosting several War Tax Resistance 101 sessions this year. Most recently, they hosted a session on Sunday June 16th at Portland Mennonite Church. As this newsletter goes to press, they will also be hosting a session at the same venue on Sunday July 21st. The latter session advertises that attendees will have “lots of free literature to take home!”

Conscience and Peace Tax International Meeting in Germany in October

Netzwerk Friedenssteuer, the German branch of the worldwide Peace Tax Movement, is hosting the 17th biennial Conscience and Peace Tax International meeting from October 4th to 6th near Lübeck, Germany. Unfortunately, even before the pandemic this was a meeting with sparse attendance. As of now, it’s being planned as an in-person event, but we have asked them to offer a Zoom component. For the most up-to-date info, see their website: .

NWTRCC Fundraising

This spring, NWTRCC held a raffle concurrently with its spring appeal. Thank you to all who donated during our spring appeal and all who donated items for the raffle!!! Here is a list of our raffle winners:

Top Prizes

- 2 Nights near Nelson Homestead (Deerfield, Massachusetts): Mary M. (Vermont)

- 2 Nights at Celo Inn (Burnsville, North Carolina): Sarah W. (Kansas)

Additional Prizes

- Swag from the NWTRCC Café Press Store (up to $50): Barbara W. (New Jersey)

- Nuclear Resister T-Shirt & Button. Donated by the Nuclear Resister: Bob & Rachel G. (Indiana)

- Body Work Session (In Person or Online). Donated by sarasunstein.com: Mary M. (Vermont)

- Twin Oaks Rope Hammock. Donated by Rick Bickhart: Gail P. (Michigan)

- Bread & Puppet Theater Poster & Booklet. Donated by Ruth Benn: Rick B. (Virginia)

- 3 – WTR Guide Book (2003 with 2023 update insert): Marie O. (Maryland); Jan F. (Ohio); Heidi G. (Illinois)

- 2 – WTR Guide Book (2024, not published yet): Dolores H. (California); Bob & Rachel G. (Indiana)

- Book – A Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation: Brianna S.-P. (Wisconsin)

Local WTR Contacts & Counselors

NWTRCC keeps an updated list of NWTRCC affiliates, local contacts, and war tax resistance counselors by state on its website. Just go to the “About Us” tab and click on “Local Contacts & Counselors.” This list is regularly updated, such as when an area contact is added or when a counselor moves to a different city or state. We have contacts for most states, but not all. Especially if you are in one of the following states and willing to be an area contact, please contact Lincoln at the NWTRCC office: Alaska, Arkansas, Idaho, Mississippi, Louisiana, Nebraska, New Hampshire, North Dakota, Rhode Island, Utah, and West Virginia.

Donate by Venmo

NWTRCC now accepts donations by Venmo! We still accept donations by check, PayPal, and credit/debit card using PayPal. Also, tax deductible donations can be made by check or credit/debit card using one of our fiscal sponsors. For more information on all the ways you can donate to NWTRCC, go to nwtrcc.org/donate.

Paid Advertisement

Letters to the IRS

My Letter to IRS

By Nicole Erin Morse

Nicole Morse

To Whom It May Concern:

Enclosed is my completed Form 1040 tax return for the year 2023 including the necessary schedules. I have underpaid for the year. This letter explains why, as a matter of conscience, I am not paying a symbolic portion of my taxes this year. Approximately 53% of US tax dollars go toward war or the preparation for war. As someone who is responsible for paying $XXXX in Federal Income Taxes, that means that if I pay my taxes in full, I am being compelled to contribute $XXXX to war efforts that I oppose as a matter of conscience. Therefore, for the year 2023, I am redirecting $100 of my unpaid tax liability to support humanitarian aid for the people of Gaza in protest of the fact that my government is using my tax dollars to fund a genocide in Gaza.

As I write this letter, over 32,000 civilians in Gaza have been killed by US weapons and with US support. Tens of thousands of the dead are children. The International Court of Justice has judged that what Israel is doing in Gaza is plausibly a genocide, which means that the US government and all people of conscience are obligated to do our part to try to prevent genocide. Instead, the US government has just authorized even more funding for the horrors that everyone is seeing daily on social media and the news.

Under these circumstances, and as a religious Jew who takes my obligation to pikuach nefesh—the saving of life—very seriously, I must do something to clearly indicate that this slaughter is something I oppose. I recognize that my choice to redirect a mere $100 of my tax liability does nothing to stop a war effort that is costing our country billions of dollars. Nonetheless, knowing how this money will be used, I cannot simply pay my taxes quietly this year.

I believe that as members of a society, taxation is necessary, and I understand that as a taxpaying citizen I will always have to contribute toward efforts with which I might disagree. However, war crimes are a category outside of the ordinary functions of government, and I will continue to seek out ways to express and enact my opposition to the US participation in war crimes in Palestine and elsewhere in the world. Every morning when I daven, I pray: oseh shalom bimromav hu ya’aseh shalom aleinu (May the one who makes peace in the heavens make peace for us and all the world). This act is one small way of working toward the world of peace for which I pray daily. I hope that others will join me, and that one day we can have peace for all who dwell on earth.

Sincerely, Nicole Erin Morse

West Palm Beach, Florida

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org