This past Tax Day, Tom Joyce in Ithaca, NY joined others to raise awareness about how much of US taxpayer money goes towards military spending that can result in moral injury. May this ongoing and consistent action inspire!

This past Tax Day, Tom Joyce in Ithaca, NY joined others to raise awareness about how much of US taxpayer money goes towards military spending that can result in moral injury. May this ongoing and consistent action inspire!

Statement of War Tax Resistance – Tom Joyce April 15, 2024

Since coming to this commitment as a young man, I have never willingly and/or voluntarily paid the military portion of my income tax. In the last 14 years, I have withheld $16,287 in military taxes and by the most recent communication that I’ve had from the IRS, I owe over $23,000.

Thus, it includes over $7,000 in interest and penalties. The IRS currently has a lien on my house. When I first started collecting Social Security, the IRS began garnishing a portion of my monthly checks. For some mysterious reason, this ended after the first calendar year of SS benefits.

On the bright side of this, the ten-year statue of limitations has come into effect for the 2010, 2011, and 2012 military taxes owed; and on June 9 th of this year, the 2013 military taxes will, theoretically, be uncollectable. It’s possible that the Social Security garnishments were done to avoid the passing of the 2010 statute of limitations. But, absent taking the issue to a federal court, I’ll probably never know how all of the accounting is actually proceeding. And, luckily, because the IRS is so underfunded by Republican forces in the federal government, the IRS may not have the accounting either.

Much of the monies that I’ve withheld are being held in escrow in a Quaker controlled fund; although portions have been donated to those who are being held hostage to the military economy. Thus, my main risk of collection are the interest and penalties that have accrued over these 13 years. And, of course, the monetary consequences if our house were ever to be put up for sale.

Anyway, small worries, compared to the thought that I would be participating in our bloated military.

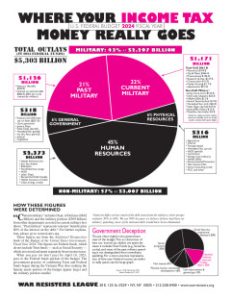

For the first time in many years, in 2023, my income was such that I didn’t owe any federal income tax. I had planned to donate the military portion – 45% according to the War Resisters League federal budget analysis – to the Combatants for Peace. This is an organization of former members of the Israeli Defense Forces. former members of armed Palestinian militias, and their supports in Israel-Palestine and here in the U.S.

Of the other side is my letter to the IRS, refusing to pay the military portion of the military budget last year.

Internal Revenue Service April 15, 2023

Dear Sir/Madam,

I am a conscientious objector to war and military preparations for war. I am a member of the Religious Society of Friends (Quakers). I have a statement of conscience on file with the New York Yearly Meeting (of Friends).

By the analysis of the War Resisters League, 43% of the federal outlays collected from income tax for the 2024 fiscal year go to pay for current military, the wars in the Middle East and Northern Africa, the so-called war on terrorism and past wars, the nuclear weapons part of the DOE budget and including $806 billion of the interest on the national debt (80% of which is estimated to be created by military spending). I cannot, in good conscience, participate in this funding mechanism and I encourage you, too, to examine your conscience in this regard.

Currently, I am concerned that we are making little effort to seek a negotiated settlement in the war between Russia and Ukraine. Instead, we are fueling the war by massive military provisions. These costs are included in the above mentioned military part of the federal budget.

I continue to be concerned about the new generation of nuclear weapons that we are developing. They will undermine the minimal treaty obligations that we’ve made. Under the terms of the Non-Proliferation Treaty, we have agreed to negotiate the reduction and elimination of all nuclear weapons with the other nuclear nations, including Russia. In addition, we should join the countries of the United Nations who have signed and ratified the Treaty on the Prohibition of Nuclear Weapons and which went into effect January 22, 2021.

I continue to be concerned about the new generation of nuclear weapons that we are developing. They will undermine the minimal treaty obligations that we’ve made. Under the terms of the Non-Proliferation Treaty, we have agreed to negotiate the reduction and elimination of all nuclear weapons with the other nuclear nations, including Russia. In addition, we should join the countries of the United Nations who have signed and ratified the Treaty on the Prohibition of Nuclear Weapons and which went into effect January 22, 2021.

My payment with this tax return will pay the 57% non-military part of my income tax. 43% of the income tax due – the military portion – will be deposited in an escrow account to be held until such time as the United States government recognizes the right of conscientious objectors to pay only for the non-military aspects of government spending (see Peace Tax Fund legislation). Thus, I believe that I have paid my taxes in full.

Sincerely,

Thomas E. Joyce