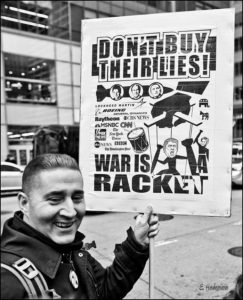

Since the invasion of Gaza in October 2023, NWTRCC has seen an exponential increase of interest in war tax resistance. Much of this new interest is among younger people who participate in the gig economy. There has been a lot of confusion about the gig economy and third-party reporting, so this post is meant to address these issues.

Photo by Markus Winkler on Pexels.

What is a Gig Worker?

A gig worker is someone who is self-employed and solicits paid gigs through online platforms. Selling items on Ebay or driving for Uber would be typical examples. Someone who drives for Uber is not an Uber employee. They sign up to receive driving referrals from Uber. After completing a driving request, the person will receive a payment via Uber, which collected the original payment from the person given a ride. In this instance, Uber simply handles the transaction as a third party.

There could be situations where Uber provides the driver a bonus for meeting some sort of threshold. In this case, the person would still be self-employed, but Uber would no longer be a third-party intermediary since they would be directly paying the person for contracted work. These are two different types of payments that are treated differently for reporting purposes.

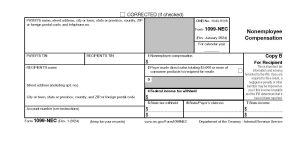

1099-K Payments

This difference in work payments may be more easily understood if we examine the two types of tax forms that Uber may send you at year’s end. First, you will probably receive a 1099-K. This form is used when a company acts as a third-party agent for handling money. For Uber, this form would report all the payments from those given rides. Up until tax year 2023, Uber only had to report these payments to you [and the IRS] if the payments you received for goods or services totaled over $20,000 from over 200 transactions. For tax year 2024, this reporting threshold will drop to $5,000. And in 2025, the threshold will drop to $600.

1099-NEC Payments

You may also receive a 1099-NEC tax form from Uber for any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees. This tax form is what traditional self-employed people receive when they are working directly for another company. The reporting threshold for this tax form is $600.

Additional Reasons for Receiving a 1099-K

You may also receive a 1099-K as a traditional self-employed person if you receive credit card payments or payments from third-party processors like PayPal, Venmo, Cash App, etc. For example, if you clean homes and some of the people pay you using a credit card or third party processor, this is 1099-K income. The sole purpose of the 1099-K form is to report third-party financial transactions. The reporting thresholds are the same as listed above for 1099-K income.

There are two notable exceptions to what is reported as 1099-K income. First, if when making a payment to you, the person pays you as “family or friend” and no fee is removed by the third-party processor, these types of payments are not supposed to be reported. The 1099-K is for reporting third-party business transactions, not those between family and friends. Second, Zelle is not subject to 1099-K reporting. The reason Zelle is exempt is because Zelle acts as a mechanism for transferring money from one account to another. Zelle never holds the money. In this sense, Zelle is similar to writing a check or a wire transfer. It simply transfers money between accounts without it ever being held in a third-party account.

Tax Day March. Photo by Ed Hedemann.

Gross Income v. Net Income

Lastly, whether someone is a traditional self-employed individual or a gig worker, you are able to deduct expenses from your gross income. Your gross income represents the total amount of money you earned during the year. The earnings reported on all 1099 forms represents gross earnings. As a self-employed person or gig worker, you are responsible for keeping track of allowable expenses. For example, in reporting 1099-K income, Uber and Lyft do not reduce the reported income by the amount they charged you in fees. When filling out your tax forms, you will mark these fees down as a business expense. After you have taken all allowable business expenses, you will arrive at your net income. What you will owe in Social Security and Medicare payments, as well as your federal income tax amount are based on your net income.

For more information on war tax resistance as a self-employed person, check out our booklet on the topic, Practical #4: Self-Employment: An Effective Path for War Tax Refusal.

~Post by Lincoln Rice