Earlier this year, Professor Leslie Book of the Villanova University Law School stated, “The IRS has yet to fully acknowledge its role as one of the most important federal agencies in terms of delivering benefits.” According to the Government Accountability Office (GAO), from April 2020 through the end of 2021, the IRS distributed $837.5 billion in total Economic Impact Payments and $93.5 billion in advance child tax credit payments.

Although the IRS is a social benefit provider, it maintains a policy of race neutrality in its data collection. In addition, since the IRS does not collect racial data, it is difficult to ascertain if the IRS treats people of color fairly in its interpersonal interactions and structural policies. Essentially, the IRS has a “color-blind” approach that it believes protects it from being racist. In reality, this approach simply makes it difficult to know how its actions affect communities of color.

Interpersonal interactions for which it would be very important for the IRS to track race data include referrals to the Department of Justice for criminal investigation, civil penalty assessments, settlement amounts, and denial of innocent spouse relief. Although NWTRCC has not witnessed racial disparity in how war tax resisters are treated by the IRS, our sample size is too small. It would be helpful to have the big picture data to determine if being a war tax resister carries a greater risk for people of color.

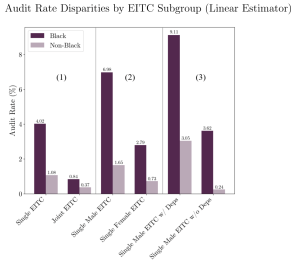

From a recent Standford study, we do know that Black people are 2.9 to 4.7 times more likely to be audited than other race groups. The largest disparity occurs with those claiming the Earned Income Tax Credit. Black filers accounted for 21% of EITC claims, but were the focus of 43% of EITC audits. The researchers believe that the IRS algorithm is to blame.

In drafting structural policies, Book stated that the IRS needs to consider the following: (1) will a policy promote racial equity; (2) how will a policy affect historically unfairly treated communities; and (3) will a policy perpetuate or exacerbate racial inequity.

One thing that we do know is that extremely wealthy white men have a significant voice in forming the tax code. Pro Publica has reported how billionaires influenced the Trump-era tax cuts. (This was reported in an August 2021 article entitled, “Secret IRS Files Reveal How Much the Ultrawealthy Gained by Shaping Trump’s ‘Big, Beautiful Tax Cut.’” The most vulnerable do not have a direct phone line they can use to influence tax policy.

~Post by Lincoln Rice

[The main source for this article was Tim Shaw, “Law Professor: IRS Should Embrace Race Data to Promote Equity,” at tax.thomsonreuters.com.]

I work with the IRS VITA (Volunteer Income Tax Assistance) program and we do collect race data and submit it through the Taxslayer program. I don’t know what happens to it after it is submitted.

Excellent article on a topic about which I do not recall NWTRCC speaking out about in the past 40 years!

Peter, That is interesting. The IRS must be interested in keeping track of that specific initiative, but they are not interested in keeping track of race data for tax forms, audits, as well as civil or criminal enforcement of the tax code.