A story from Finland jumped out of the paper at me recently: “In Finland, Every Citizen’s Taxable Income Is Revealed” (NY Times, 11/2/2018). The article describes a surprising tradition in that country. Many in Finland feel that this transparency helps to control the gap between high and low incomes and to control disparities in pay for the same work. Executives seem to think twice before raising their own salaries. One interviewee said Finns tend to be humble; “If you show it around, no one likes you,” he said.

Such an idea must make that guy in the White House cringe. The rest of us can certainly see advantages to having such a release be automatic as far as trying to keep politicians on the honest side. The article notes that some economists in the U.S. are interested in salary disclosure as a way to reduce gender and racial differences in pay levels for the same work.

While the Times article referred to this as Finland’s “Jealousy Day,” other pieces I read online indicated that that nickname comes from the outside and that a lot of Finns actually “don’t give a toss” about the whole thing. Others mine the data more closely to see how much tax the wealthy are paying. Publicity about business owners scheming to avoid taxes has led to public shaming and new laws to close loopholes in the tax system.

Each November 1 since the 19th century the Finnish tax administration releases the taxable income data for every citizen, a requirement of the country’s transparency laws. People (mostly journalists apparently) can go to the tax office and access the tax information for celebrities, politicians, executives, laborers — or family members for that matter.

The potential for public shaming could be a new challenge for war tax resisters. Perhaps it would make conscientious resistance more public — a good thing from the point of view of many of us — but presumably it would inhibit a lot of people from resisting. I do not have information on war tax resistance in Finland (please add comments below if you do!), but I see on the War Resisters’ International website that Finland has required military service for men, and conscientious objectors and resisters have faced jail terms until recently.

Openness about money reminded me of a discussion we had at one of our gatherings way back in 2006, which took off from an article written in 1989 by former NWTRCC Coordinator Karen Marysdaughter that still resonates today.

“The influence of money on our attitudes and behavior is far-reaching and deeply-rooted. Consumerism has become a way of life in our society; people are “addicted” to acquiring things and spending money. More means better. Many people have no conception of any other lifestyle or economic system, and money’s influence on them is largely unconscious.” Read online

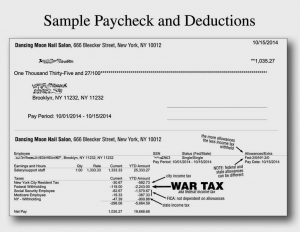

The transcript from our discussion in 2006 is still online, along with other readings on money. I remember that discussion as being enlightening in this culture where talking about one’s income is such a taboo. Even in our WTR circles, more openness can lead to a much more frank discussion about techniques, fears, and choices that influence our activism and resistance.

— Post by Ruth Benn

I just received a request from 350.org (Bill McKibben) to all contributors, to consider ‘upping the ante’ if we could. He’s cool, he hates asking for money. It is not only obvious, he has said so before…who does like to ? It’s just necessary though, to remind us of the importance of giving to just causes. I was going to increase my nominal amount, and may still, but I can’t forget NWTRCC…especially after the dissolution of the fund I was contributing to that helps war tax resisters. Thanks Ruth, I’ll have to cut out ice cream for my New Years resolution ! Lol…Merry Christmas and/or Happy Holidays to all. There, no PC police can get me now 🙂

P.S. I have received several letters from our friends at the IRS, and the last one was certified. I will ignore “until the cows come home”.

I agree that openness is an important component to war tax resistance but, if enforced (as is done in Finland), may well discourage some from resisting. And, in this world, resistance is imperative.

However, from that perspective, I think some peace activists do not make enough money, at least not enough to owe federal taxes. If I were “in danger” of falling below the taxable level and couldn’t figure out a way to earn more, I’d be willing to declare sufficient extra income (even if bogus) on my 1040 form to show a tax due, which I would openly refuse to pay.