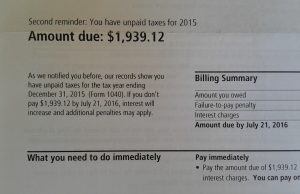

An example of a letter from the IRS, reminding a resister about unpaid taxes.

One of the top questions we get at NWTRCC is, “If I don’t pay the IRS, won’t I go to jail?” Our response:

“People who are first considering war tax resistance often have the mistaken impression that people who refuse to pay their taxes from motives of conscience are at great risk of going to jail or having their homes taken away from them. In fact these risks are so rare that the list of war tax resistance cases since World War II is a short one. Here, for example is a list of war tax resisters taken to court or jailed for their resistance, and a list of property seizures and attempted property seizures against war tax resisters. The lists taken together represent fewer than a hundred people, or a fraction of one percent of the people who have practiced war tax resistance over those years.”

It is much more common for resisters to get letters from the IRS, or have the IRS levy their bank accounts, garnish their wages or self-employment income. In rare cases, the IRS seizes property, such as houses or cars, for back taxes, but since the 1990s the IRS appears to have moved away from this tactic. Jail has affected even fewer resisters over the years. (See our detailed page that covers most of the potential consequences of war tax resistance for more.)

But you can structure your resistance in such a way as to further reduce your risk to a manageable level. For example:

- If you choose to file a tax return, be honest about your income and deductions.

- If you choose not to file a tax return, do your taxes accurately and honestly anyway. Keep the full return indefinitely for your records and in case the IRS files a return for you that is inaccurate and tries to collect a larger amount than you actually owe.

However, different people may find themselves targeted differently by the IRS – sometimes we can pinpoint a specific reason for this, and sometimes we can’t. For example, outspoken public activists or those who resist large amounts of taxes may catch the IRS’ attention more readily. But some first-time, small-amount resisters have been targeted with harsh enforcement action, while some people who have resisted thousands of dollars over the years never hear from the tax collector. Those who include a letter with their tax returns have sometimes gotten “frivolous filing” penalties. And yes, a tiny fraction of war tax resisters have ended up in jail for refusal to cooperate with the tax system or for filing what the IRS considers fraudulent returns.

Resistance is a risk, but we hope you will agree that it is worth it. The National War Tax Resistance Coordinating Committee provides community, stories, experience, and support for war tax resisters. Contact a war tax resistance counselor near you if you have concerns about jail and war tax resistance. Please note that a counselor does not give tax advice, but can tell you our current knowledge about how the IRS deals with war tax resistance and about levels of risk associated with the different types of resistance. And if you are already a war tax resister, please let us know if you are facing a tax court case with potential jail time associated. The NWTRCC office may be able to connect you with various kinds of support.

And remember:

“Of course there are also terrible risks involved with not doing war tax resistance. If you continue to pay war taxes, you contribute to global insecurity, nuclear terrorism, and imperialism, you put innocent people in harm’s way, and you risk the moral injury of knowing that you are complicit in such things.”

Post by Erica

My name is not on the list of people who have gone to jail for war tax resistance. But the US Justice Department did take me to federal court in the 1980s when I was working for NWTRCC. They took action presumably because I was fairly visible as a national organizer and I refused to tell them the location of my assets so they could seize resisted taxes. Ultimately the judge ruled that I did not have to cooperate with the IRS. I am looking forward this year to having another significant interaction with the IRS. As a result of the death of my father last year I will have taxable income approaching a half million dollars. I am redirecting a lot of money to local, national and international charities. Today I sent $5000 to Resist for NWTRCC and $5000 to the AJ Muste Foundation for WRL. I also sent $5000 to Give Directly a charity that gives money to the extremely poor in Africa. And just to top it off I sent $20,000 to other local and national do gooders! Right now I am just resting on my laurels. I am also directly helping a young man in Haiti get some job training and a young woman in Kenya get some trainIng so she can work on AIDS there.

Bravo Larry! You are a hero and an inspiration to me brother!

Thanks, Erica, for keeping me in the loop!.

It is obviously good information for everyone to know. I have the impression that most of this is included in either the Handbooks or in the 8 booklets (practicals) which have been published.

WHOLLY, HOLEY, HOLY by Melvin D. Schmidt is a newly published booklet which contains some gems on war tax resistance, including a World War I veteran’s testimony in Halstead, Kansas (see pages 145-146).

His name was Andrew Pjesky. Also note the reference to Harry Diener’s witness against WWI on the farm.

The author writes candidly. Book is published by the Mennonite Press(2016) in Newton, KS. 67114. It retails for $22.95 but can be secured from the author for $15 plus shipping($19.68). Call: 301-277-1362.

Schmidt’s father wanted him to save the struggling family farm, but instead became a pastor. He lives in Hyaatsville, Md. His writing highlights the humor as well as the hardship, including the controversies.

Schmidt is a tax resister; we worked together for 3 years in Indonesia. — ddk Jan. 5, 2017

Thanks to this group for this very useful information. I wanted to know if the group had heard about tax protests against the incoming administration to fight against its proposed policies targeting vulnerable populations, like the undocumented, people of color, Muslims, or even just based on the fact that the incoming president has not released his own tax returns and has apparently avoided taxes for many years. I’m assuming the same principles and tactics apply but coordinated resistance against domestic oppression could be very powerful. Thanks again for this info and for your work.

Hi Emma –

The principles of tax resistance that we use can certainly be used for other causes! We also have been defining war and militarism more broadly in the last several years, with reference to the current struggles of people in the United States around indigenous sovereignty, immigration, border militarization, and police militarization and violence. I’ve heard some interest around organizing to stop payment for the border wall Trump is now saying taxpayers will fund (and Mexico will pay back, he says – ha!), but no additional campaign or effort.

Here’s another post you might be interested in:

http://nwtrcc.org/2016/12/14/tax-resistance-age-trump/

And if you do come across tax resistance related to the incoming administration, please comment here, on our Facebook page at http://www.facebook.com/nwtrcc, or e-mail me at wartaxresister at nwtrcc dot org. We are always looking to build connections.

Best,

Erica