“I call money ‘green energy,’ because where we plant it, it will grow! If we plant it in systems of oppression and violence, then that is what we will grow. However, if we plant our green energy in organizations, businesses, and people who are at work helping heal our world and planet, then we grow more beauty, connections, equity, and health.”

—Julia Butterfly Hill, activist and war tax resister

Your tax dollars subsidize the Pentagon’s contribution to global climate change.

Image by MasterTux from Pixabay.

The U.S. federal budget prioritizes militarism far above environmental preservation and restoration:

- The Pentagon is the largest user of oil in the world, burning 240,000 barrels of oil per day in 2014.

- At top speed, a F-35A jet ignites more fuel in a single hour than the average car owner consumes in two years.

- The U.S. now spends over $1 trillion a year on the military compared to about $13.2 billion (in 2017) to address the climate emergency. We should be spending $55 billion per year to seriously implement a clean energy transition. Less than 4.5% of the military budget—which could be easily found just by eliminating waste—would fill that spending gap.

U.S. military official s have stated on numerous occasions that they support renewable energy initiatives and that climate emergency threatens U.S. security. So they’re working hard to convince us that with the right “green” technology and policy choices, the military can become environmentally friendly. There is nothing environmentally friendly about massive resource consumption and worldwide deployments. We must demand an end to this grotesque contribution to climate change that comes with the global unrest, death, and oppression. Let’s make that demand with our money, our “green energy,” as Julia Butterfly Hill calls it.

s have stated on numerous occasions that they support renewable energy initiatives and that climate emergency threatens U.S. security. So they’re working hard to convince us that with the right “green” technology and policy choices, the military can become environmentally friendly. There is nothing environmentally friendly about massive resource consumption and worldwide deployments. We must demand an end to this grotesque contribution to climate change that comes with the global unrest, death, and oppression. Let’s make that demand with our money, our “green energy,” as Julia Butterfly Hill calls it.

The current military budget, now over $900 billion, could be used instead to slow and stop climate change. The government could develop sustainable energy sources for residences and businesses, retrofit houses for energy efficiency, regulate industry, clean up SuperFund and other polluted areas, and more. Individuals and organizations could put that money to work developing local agriculture, creating sustainable economies, installing decentralized renewable energy generators, and cleaning up polluted sites.

“Wars are fought over resources and oil (energy) is currently the hot commodity. The organization that needs

the most oil and gas is the same one charged to wage war.” — Coleman Smith, activist and war tax resister

Photo Courtesy of Extinction WikimediaCommons.

The government subsidizes and promotes climate change through the military with money from U.S. taxpayers. About half of each income tax dollar goes to military expenses.

Let’s use our money to save the earth, not destroy it, by refusing to pay for war. You can legally refuse the federal income tax by lowering your taxable income, or you can commit an act of civil disobedience by refusing to pay some or all of your federal income tax or federal excise tax on local telephone service.

Thousands of people around the United States have taken a step to boycott the Pentagon by refusing to pay war taxes. They double the impact of the protest by giving resisted taxes to organizations that use it for human and environmental needs, rather than keeping the money for themselves.

How to Resist! — Consequences — Frequently Asked Questions

Other War Tax Resistance Climate Crisis Resources

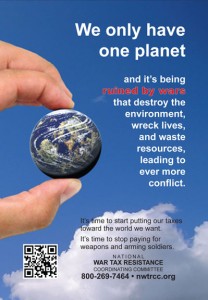

Left: “We only have one planet” card to hand out. 4″×6″, more text on back. Contact the NWTRCC office if you would like some (free) for an upcoming event or to make available in your peace center, office, or at your next meeting. Normal cost is 10¢ / card.

Left: “We only have one planet” card to hand out. 4″×6″, more text on back. Contact the NWTRCC office if you would like some (free) for an upcoming event or to make available in your peace center, office, or at your next meeting. Normal cost is 10¢ / card.

Half-sheet flyer with this text to download and hand out.

Download and copy this ¼-page flyer to hand out at rallies and demonstrations.

See also our Divest from war, invest in people materials which make the connection between fossil fuel divestment and other types of divestment, and how war taxes are spent.

See also:

- Peace Resource Center of San Diego “military and the environment” flyer (PDF)

- There is No Future in War: Youth Rise Up, A Manifesto

- On the Streets with Extinction Rebellion by Ruth Benn

- World Beyond War: War Threatens Our Environment

- Veterans for Peace: Take Action for Earth Day

- Veterans for Peace & Climate Change

- We Can’t Confront Climate Change While Lavishly Funding the Pentagon by J. P. Sottile, Truthout (8/18/19)

- Combat vs. Climate: The Military and Climate Security Budgets Compared. Report from the Institute for Policy Studies by Miriam Pemberton (10/5/16)