![What if ...you want a WORLD WITHOUT BORDERS, while your taxes are building walls? [with illustration of barbed wire turning into birds in flight]](https://nwtrcc.org/wp-content/uploads/2017/02/whatif_borders_banner.png)

The Trump administration’s focus on border “security,” including growing the Border Patrol, building a complete border wall between the US and Mexico, and imprisoning/deporting immigrants, is galvanizing many people to action. All of these projects will be paid for out of the federal budget, and all of these projects increase the militarization of the US itself. The National War Tax Resistance Coordinating Committee (NWTRCC) is here to support people who are considering refusing or choose to refuse to pay taxes for border militarization.

Contents

Border Militarization under Trump

Trump called for completely walling off the US/Mexico border throughout his campaign, and he reiterated that call after the election. As of August 2019, there are 5,700 troops at the Southern Border and it is estimated the cost of these troops will exceed $430 million by the end of 2019. Earlier this year, Trump declared a national emergency in order to access $6.7 billion toward building the wall without Congressional approval. Trump continues to claim that Mexico will ultimately pay for the wall, even if taxpayers were fronting the money.

In addition, Immigration and Customs Enforcement (ICE) raids on immigrant communities have increased throughout 2019. On September 5, 2017, the administration announced the revocation of Deferred Action for Childhood Arrivals (DACA). DACA permits over 800,000 young people, brought to the US as children, to work, study, and live in the US. As of August 2019, DACA is still in place as it is being litigated in the courts. Trump has also continued to threaten ICE raids against immigrants. In early August 2019, the Trump administration launched one of the largest immigration raids in a decade, arresting 680 individuals.

A Recent History of Border Militarization

After 9/11, the Bush administration created the Department of Homeland Security, growing the United States’ power to regulate immigration and travel. Immigrants from many majority-Muslim countries were forced to register their locations with the government, starting in 2002. President Obama ended this practice in 2011 and formally ended the program at the end of 2016. Within a week of assuming the role of the Presidency, Donald Trump signed an executive order that banned foreign nationals for 7 predominately Muslim countries. The ACLU reports that on June 26, the Supreme Court upheld the Trump administration’s third Muslim ban and shared stories of people affected by the ban.

The Secure Fence Act of 2006 was to fund 700+ miles of a double-fence border barrier, ostensibly to help prevent undocumented immigration. What was constructed, however, was about 670 miles long, cost over $2.4 billion, and in many places, consisted of a single fence. Its primary function was to divert undocumented immigrants into the more dangerous open desert, ostensibly to discourage immigration, but with the impact of causing more deaths to migrants.

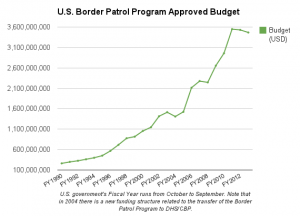

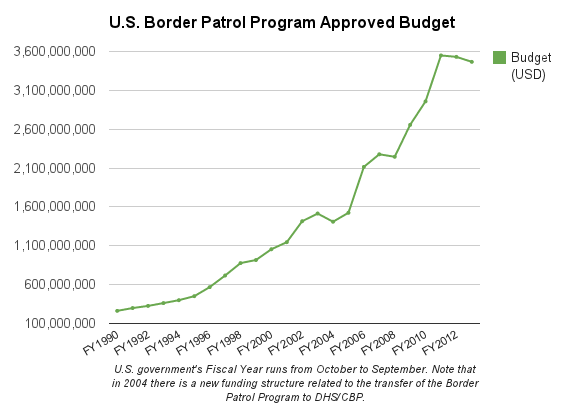

In addition, the government began to ramp up immigration enforcement within a 100-mile border zone sometimes called the “Constitution-free zone.” The Border Patrol budget increased sharply as a result (see the graph to the left). Militarization was also increased through the Secure Communities program (active 2008-2014, and now revived by a Trump executive order). But thousands of people have died in the southern border area trying to make it to better lives in the US anyway.

Border security doesn’t just affect immigrants and travelers. The Tohono O’odham people have not been able to freely visit members of their own indigenous nation in Mexico for several years. The Tohono O’odham reservation in the US is occupied by Border Patrol checkpoints, surveillance towers, and armed Border Patrol agents who search for traveling undocumented immigrants and harass locals. Likewise, residents of Arivaca cannot leave their town without passing through a checkpoint.

Many of the programs and trends begun during the Bush administration continued during Obama’s. Some immigrant rights activists have called President Obama the “deporter-in-chief.” The Obama administration had the largest number of formal removals of undocumented immigrants of any presidential administration, even as the number of people crossing the border was decreasing.

With the growth in concern about border security, the fiscal year (FY) budgets of US Customs and Border Protection (CBP, includes the Border Patrol) and Immigration and Customs Enforcement (ICE) have also grown:

| FY 2010 (enacted) | FY 2015 (enacted) | FY 2017 (requested) | |

| CBP | $11.5 billion | $11.8 billion | $13.9 billion |

| ICE | $5.7 billion | $5.8 billion | $6.2 billion |

In fact, in FY 2012, the budgets for CBP and ICE combined exceeded the collective budgets of all other federal law enforcement agencies (Source: Border Militarization Policy).

The Department of Homeland Security’s requested 2o17 budget for CBP included expenditures that illustrate border enforcement’s militarism:

- two King Air KA-350CER multi-role enforcement aircraft to patrol the Pacific coast

- funding for Integrated Fixed Towers to surveil the border zone (including Tohono O’odham land), made by Elbit Systems, which supplies the Israeli government’s surveillance towers along the wall separating Israel from the West Bank

- Black Hawk helicopters,

- M-4 rifles, and

- night sights for CBP P2000 pistols.

Although comprehensive immigration reform was an issue of much discussion during the terms of Presidents Bush and Obama, Congress was not able to pass a bill. Proposed comprehensive immigration reform bills combined a route to citizenship for some undocumented immigrants with increased border militarization.

The Impacts

A segment of the existing border fence, seen from Nogales, Sonora, Mexico.

While Trump estimated the cost of a border wall at $8-12 billion, the MIT Technology Review estimated $27-40 billion. A leaked report from the Department of Homeland Security estimated $21.6 billion for a combination of solid walls and fences, without factoring in geological and geographical challenges that could raise the cost even higher. Maintenance of the wall alone could cost over $750 million per year.

US Customs and Border Protection (CBP)’s budget was over $13 billion for fiscal year 2017. This figure is likely to increase in future years, as Trump’s executive order also instructed the Border Patrol to hire 5,000 more agents. Heightened enforcement also means more money spent on immigration detention centers funded by ICE. It has been estimated to cost US tax payers $750 dollars per day to house a child migrant.

We know that the current barriers and the presence of the Border Patrol (the border police, part of CBP) force migrants into long journeys in the less-heavily-patrolled open desert. We know that many migrants are exploited by “coyotes” who collect a fee in exchange for a promise of safe passage to the US. Thousands have died in the desert from hunger, thirst, heatstroke, or other causes. As described above, the Border Patrol also negatively affects the lives of people living near the border. Focusing on securing the border costs lives, tears apart families, and causes millions of people to live in fear of la migra (Border Patrol/ICE).

Trump portrays undocumented immigrants as criminals, and insinuates that immigrants take jobs from documented citizens and residents. Neither is true.

And finally, many people crossing the US/Mexico border are fleeing instability and poverty caused at least in part by the US, through trade policies (Mexico and Central America generally), tacit support of government violence or coups (Honduras), or past/current military intervention (Guatemala, Nicaragua, El Salvador, to name just a few).

Take Action

You might decide that it’s a violation of your conscience to pay taxes to a government that spends money on border militarization. You might want to pressure the government through tax resistance on this issue. Or perhaps other motivations apply.

In any case, you probably have questions about how to carry out your convictions! Fortunately, the National War Tax Resistance Coordinating Committee (NWTRCC) has been supporting people who resist taxes for war and militarism since 1982. Among the affiliates and individuals in our network, we have thousands of years of experience resisting taxes, with experience in all the risks, consequences, and rewards of this act of civil disobedience.

How do I resist?

The main methods for resisting border militarization taxes are:

- Refusing to pay some or all of the income taxes you owe (an act of civil disobedience with certain potential consequences)

- Living below a taxable income level (a legal option to refuse to pay taxes)

We recommend reading more about your options to decide what method and amount of resistance will work best for you.

If you are owed a refund at tax time in 2018, the government already has your tax dollars for this year – you won’t be able to resist paying. Consider changing your W-4 withholding so that you give less or no money to the government out of each paycheck. When you owe money at tax time next year, it’s your choice to refuse or not. But if the government owes you money, you don’t have a choice.

If you owe money in 2018, the choice to refuse to pay some or all of it is yours. Keep in mind that resistance is an act of civil disobedience – it has its risks and benefits, and not all of those are 100% predictable!

And you can redirect your resisted taxes to people who are directly affected by and working to end border militarization. Redirection is a powerful way to show what is possible when taxes are used for justice and peace. In the 2017 tax season, many war tax resisters collectively redirected taxes to immigrant communities and organizing efforts led by people of color.

How much of my taxes should I refuse to pay?

Many resisters resist an percentage of their taxes equal to the percentage of federal income tax dollars that fund war (including border militarization – War Resisters League estimated the total percentage at 48% for the 2020 fiscal year). They might want to pay for other government expenditures, like housing and education, but want to refuse the percentage that goes to war.

Others resist all income taxes. Those who resist everything often do so because they can’t pick and choose what programs are funded by the taxes they pay. They feel any payment to the government could be used for war.

And still others choose to resist a small or symbolic amount of their taxes. For example, you could resist $19.84 (in reference to George Orwell’s novel 1984 portraying a surveillance state), or a token amount like $10.40 or $50. The choice is yours.

If you earn below a taxable income, or want to work toward low-income tax resistance, see our pamphlet on this subject.

Whether or not you owe taxes, you can take action.

If you are unwilling to support the use of tax dollars to fund a border wall, border checkpoints within the US, Border Patrol occupation of indigenous land, and/or the war on immigrants and refugees, NWTRCC can provide knowledge and support.

- If you file a return this year, consider enclosing a letter explaining your objection to paying for border militarism.

- Share that letter with your local newspapers, blogs, friends, family, faith community, and other networks.

- Speak out in support of people refusing to pay taxes for war and border militarism.

- Get connected to a local war tax resistance group, or consult a war tax resistance counselor, for support.

- If you start a new border militarization tax resistance movement in your community, please consider endorsing NWTRCC or becoming an area contact or affiliate!

- Read our informative materials in the Resist! and Resources sections.

- Consume some Media: newsletter, blog, podcasts, interviews, and articles – and then share them on Facebook or Twitter!

- Learn about our programs, including Tax Day activities, gatherings, and more.

- Contact the NWTRCC office.

- Buy war tax resistance literature and merchandise.

Border militarization is likely to continue whether or not the wall is built, so let’s organize for the long haul.

Updated 8/29/19