More Than a Paycheck,

REFUSING to PAY for WAR

April/May 2017

Contents

- Throwing Down the Gauntlet and Other Tax Season News

- Counseling Notes 2017 Credit Rating Changes • W-4 Resistance Not Really Legal • Academic Papers of Interest • Alternative Currency • Tax-Free and Low Usury Investing

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- War Tax Resistance Ideas and Actions Building Community from War Taxes • A Rare Acquittal • Tax Day Actions

- Resources Advertise Your Resistance • Free Lit Kit • WTR Online

- NWTRCC News Raising the Stakes: War Tax Resistance and Community Survival in Troubled Times • Copwatch

- PERSPECTIVE What Others are Saying

Click here to download a PDF of the April/May issue

Throwing Down the Gauntlet and Other Tax Season News

“What an exciting time to be promoting war tax resistance,” says Ginny Schneider of the Maine War Tax Resistance Resource Center in her organizing report (below – News from Maine). Her words capture this tax season well. The January 2017 inauguration of the most unpopular president in U.S. history coincided with the beginning of tax season. Since then inquiries from individuals, groups, and journalists have outpaced anything we’ve seen in years.

“What an exciting time to be promoting war tax resistance,” says Ginny Schneider of the Maine War Tax Resistance Resource Center in her organizing report (below – News from Maine). Her words capture this tax season well. The January 2017 inauguration of the most unpopular president in U.S. history coincided with the beginning of tax season. Since then inquiries from individuals, groups, and journalists have outpaced anything we’ve seen in years.

The period just before the 2003 invasion of Iraq was busy, with interest focused on war. In the last couple months the NWTRCC office and consultants have been fielding requests for information and support for tax resistance to protest the border wall, the travel ban, any cut-off of sanctuary cities by the federal government, and from those wanting to refuse to pay until Trump releases his taxes or is impeached or forced to resign. One anti-Trump effort is at taxstrike100.com, which calls on people to refuse to pay $100 for 100 days to protest the Trump administration and Republican-controlled Congress.

NWTRCC hit the worldwide spotlight when The Guardian U.S. and UK ran a feature, “We will not pay: the Americans withholding their taxes to fight Trump,” by Joanna Walters on February 15. After that, articles appeared in The Village Voice, MarketWatch, The New Republic, and Time.com/money. A Portuguese journalist, Ana França, wrote a long and thorough piece about war tax resistance in the March 6 Observador from Lisbon.

The Independent Journal Review patched together quotes from various articles about tax resistance and announced, “In an opening salvo on its website, NWTRCC throws down the gauntlet against Trump.” They referenced a blog piece on our website that started off, “There has been renewed interest in war tax resistance following Trump’s inauguration. Something has clicked in the minds of thousands of people across the country… we don’t want to pay for Trump’s agenda!” Most of the journalists admitted they had never heard of this form of protest, and some were better than others at acknowledging that we predate the Trump era.

Perhaps the more exciting part for many of us is just the increased interest in workshops, in-person meetings, and presentations. People want to know “what happens if I refuse to pay,” and by offering our standard workshops we have new opportunities to talk about war and the military budget. For the first time NWTRCC also offered WTR 101 as an online workshop, or “webinar.” Erica Weiland and David Gross both gave live “101” webinars in February and March, and Sam Koplinka-Loehr offered one on “Redirecting Taxes to Black, Brown, and Indigenous Resistance!” Erica’s and Sam’s can both be found on NWTRCC’s YouTube channel. Dave’s will be repeated and recorded in April.

Below you will find reports from various parts of the country, and on pages 4-5 the initial list of tax day actions by groups in the NWTRCC network. There is an online call for April 15 Tax Marches, taxmarch.org, to demand Trump release his tax returns to clarify any conflicts of interest and whether he pays any taxes. In some cities war tax resisters have joined up with these marches, while other NWTRCC groups are organizing for tax day itself, April 18, 2017 (or both).

See you in the streets, in the classrooms, and on the airwaves!

Ruth Benn has been NWTRCC’s Coordinator since May 2003 and a war tax resister through three Democrat and three Republican presidents.

Escalating Political Resistance: A workshop On Tactics for Racial Justice

On January 28, eighty people came to a Philadelphia workshop co-hosted by Philly REAL Justice Coalition, the Black and Brown Worker’s Collective, and Philly War Tax Resistance. Erica Mines (REAL Justice), Shani Akilah and Abdul-Aliy Muhammad (Workers’ Collective), and Ari Rosenberg and myself on war tax resistance presented on our work with a focus on tactics for racial justice and liberation. The focus was on point, and breakout groups followed for attendees to learn more from whichever groups they wanted to. This model of co-hosting worked beautifully. The space was packed (if we do it again and more folks come, we will need a bigger space for full group presentations). The war tax resistance group attracted 10 young people/young adults who were ready for tax resistance. They took materials, and there’s been a bunch of buzz already. Folks are especially excited about tax resistance as a component of redirection to black-led organizing. I think our next step is to setup a support group to meet with folks who are ready to resist and go through the “how-tos” again as well as how others can help spread the word about collective redirection here in Philly. All told — a very solid success.

— Sam Koplinka-Loehr

Taxes for Peace!

Taxes for Peace held an introductory workshop at the Community Alliance of Lane County (CALC) offices. CALC director Michael Carrigan hosted, and a panel including Sandi Mann, Bill Glassmire, and Sue Barnhart talked about their resistance and responded to the great questions asked by the 15 attendees. They bought literature, plus many wanted to meet again and others could not make it, so another meeting is in the works.

— Sue Barnhart

Los Angeles Peace Summit on Militarism and War Tax Resistance

Fourteen church members gathered at Holy Faith Episcopal Church in Inglewood, California, February 9, to hear about the history of war tax resistance, check out the War Resisters League pie chart with its excellent description of our federal war budget, watch the video Death and Taxes, and discuss methods, consequences, how to resist collection, and redirection. Engaging the audience with personal stories, resisters Joe Maizlish and Cathy Deppe from Southern California War Tax Resistance gave public witness to the empowering effects of committed refusal to pay for war. By keeping the resource table close at hand during the Q & A, speakers easily passed out relevant brochures as they answered questions. For most attendees the program was a first exposure to war tax resistance as a viable option for conscientious objection to today’s permanent war economy.

— Cathy Deppe

Redirect Your War Taxes to Peace

San Diego War Tax Resisters co-sponsored a war tax resistance workshop with UHURU Solidarity Movement, and the local chapter of 9/11 Truth on February 12. Representatives of each sponsoring group had a block of time to explain what they do. War tax resistance counselor Anne Barron started her presentation by handing out the WRL pie chart, offered her individual counseling services for follow up, and gave an overview of the history of war tax resistance. She covered the various methods and how-tos, talked about consequences and her personal motivations that help her face the risks, and gave some steps that people can take even if they aren’t ready to resist. You can watch the whole thing on the Uhuru Solidarity Movement — San Diego Facebook page, facebook.com/USMSanDiego. When you go there you will see the reviews for the evening’s program, including, “I love seeing white people who are awake and who have a conscience,” “This video is amazing,” and, “Wow full house!”

WTR Goes to School

I presented on war tax resistance to an American Government class of about 25 students at the Nova Project, an alternative high school in Seattle, Washington. I engaged the students throughout the 75-minute class with a lot of questions about war and taxes and resistance: Why do people support war? Why do they oppose war? What are alternatives to war? What kinds of taxes are there? To what causes do they go? What examples of civil disobedience do you know about? Students were eager to participate and at least half the class responded to these questions or posed questions of their own. Between these discussion questions, I weaved in information about the scope of US wars, how the federal budget is laid out, and how people resist war taxes. At the end, I also got a lot of thoughtful questions back from the students about the risks and merits of resistance. If you are presenting to secondary school classes about war tax resistance and would like to see my slide presentation, go to http://bit.ly/2mmeSNi.

— Erica Weiland

New York City

Two workshops in New York City brought out new faces and better attendance than over the last dozen years. Ruth Benn and Ed Hedemann gave a basic WTR 101 workshop at Judson Memorial Church in Manhattan on Saturday afternoon, February 25, where everyone seemed anxious to resist because of endless war. Jerry Goralnick described the NYC People’s Life Fund and how it works. Even after Q&A a number of people stayed on to talk more and ask one-on-one questions.

“Tax Resistance 101: using our $ to protest war, violence, and the Trump agenda” was the title of a workshop sponsored by Educate & Act, an educational series that was cohosted by Hunter Artist Action Group (HAAG) of Hunter “abbr title=”Master of Fine Arts”>MFA, The Creative Resistance, and 2 Hours a Week (2hoursaweek.org). Organizer Daniela Ciocca introduced the program and told how she had found NWTRCC’s info after “reading everything I could find” on tax resistance, including David Gross’s book 99 Tactics of Successful Tax Resistance Campaigns. Ruth Benn used NWTRCC’s new webinar slides to give an overview of war tax resistance, and LDS followed with some exercises to help attendees think out their motives and next steps. Daniela continues to strategize with her group about steps toward tax season 2018.

The Time is Ripe – News from Maine

What an exciting time to be promoting war tax resistance. We restarted Maine’s annual war tax resistance gatherings with a program called “Keep on Walking Forward: Movement and Music for War Tax Resistance” at the Holocaust Center on the campus of UMaine/Augusta. The March 15 event started with a sharing circle focused on our personal resistance stories and was followed by a concert featuring Maine’s singer/songwriter of the year Ruth Hill. Other entertainers were Katherine Rhoda, Jason Rawn and Gray Cox. They are all fabulous musicians; check them out on the internet.

Maine WTR Resource Center also tabled at the statewide Resistance Conference at the Augusta Civic Center on March 5 sponsored by the Maine People’s Alliance. Over 900 people came together to strategize about the future, learn basic organizing skills, and cohere around a vision for Maine and our country.

Counseling Notes:

Credit Rating Changes

The Wall Street Journal reported recently that the big three credit rating companies — Equifax, Experian and TransUnion — will begin to remove tax-lien and civil-judgment data from credit reports starting around July 1. This is designed in part to address the problem of inaccuracies in the reports used by rating companies. The data will be removed if it does not include a complete list of at least three data points: a person’s name, address and either a social security number or date of birth. This will improve scores for many consumers, or “expand debt access” as the jargon goes. Many war tax resisters may be among those who see their scores improve. Some readers may question whether “widening the credit box” is a good thing or not, but others may find welcome benefits.

W-4 Resistance: Not Really Legal

After some workshops recently, it seemed that people were going home with the understanding they could change the allowances on their W-4 to stop all withholding and that doing so is legal. This is probably a confusion when workshop leaders say a little too casually that this is low risk and the IRS hasn’t applied fines in years. An increase in this form of resistance may spark an IRS crackdown, so it is important to refer people to our literature or website information on W-4 resistance. The IRS can assess a $500 civil penalty for a false W-4, and there is also the potential of criminal penalties of up to one year in jail and/or a fine of up to $1,000 for “willfully supplying false or fraudulent information” on a W-4 form to decrease the amount of withholding. In recent years the one repercussion we have seen is that the IRS sends a “lock-in letter” to employers that changes the allowances to 1 unless the individual proves to the IRS’s satisfaction that more than 1 allowance fits their circumstances.

Academic Papers of Interest

Allen D. Madison, Assistant Law Professor at the University of South Dakota Law School, has written up a good summary of “The Legal Consequences of Noncompliance with Federal Tax Laws.” While there’s an important difference between what the IRS can do and what it will do, this paper is an authoritative source on the power of the IRS: http://bit.ly/2nZ8toh. In addition, Professor Madison wrote a paper in the Thomas Jefferson Law Review (Vol. 36, No. 2, Spring 2014) that might be of interest to some, titled “The Futility of Tax Protester Arguments.” In it he distinguishes between tax resisters “who disagree with governmental policies and, as a result, refuse to pay taxes to fund such policies,” and protesters who refuse based on arguments that they do not owe tax. See http://bit.ly/2nZ8toh.

Alternative Currency

The IRS considers bitcoin a kind of investment. If you buy or earn some, and later spend it, the difference between the value of the bitcoin at those times counts as a capital gain or capital loss. You’re supposed to file a Form 8949 to report it. But to bitcoin users, the stuff is a currency, and it would be folly to keep track of how much it’s worth every time you earn and spend it. So it’s little surprise that only about 800 people report bitcoin transactions on Form 8949, according to the IRS.

And, in a nod to Kellyanne Conway, a twitter user posted a picture of Monopoly money with his protest: “I’m going to pay for my taxes this year with alternative cash.”

Tax-Free and Low-Usury Investing

For readers with some money to invest but concerns about how that money is used, one Maine couple recommends tax-free muni bonds:

Several years ago we chose to finance construction of an elementary school in Lewiston (approved by the voters) which was needed because of the in-coming of many Somalian refugees. Recently we have invested in two school districts because we feel education is very important. Our broker knows we are not interested in any muni-bonds from Bath or Brunswick because Bath Iron Works makes war ships.

Please contact a professional for advice on investing in muni bonds. I am only an amateur who has invested in muni bonds for 30 years in order to pay for life-enhancing projects instead of financing war and preparations for war (including nuclear weapons) via federal taxes. We file a federal tax return but do not owe any money. All this is perfectly legal, and frees up funds for one’s own foreign and domestic giving programs while hopefully preserving some capital to be inherited by children and grandchildren.

— Marilyn Roper

— Thanks for some submissions from David Gross, The Picket Line, sniggle.net/TPL

Many Thanks

Once again we are most grateful to

…craigslist Charitable Fund for their generous grant to NWTRCC. These grants have helped NWTRCC expand outreach and in-person contact with activists in our network just in time for the new interest!…for the annual support from the Community Foundation’s Kathy Yoselson Fierce Determination Fund (Tompkins County, NY)

…and a big shout out to Larry Bassett for his generous donations this year.

Special thanks for Affiliate dues payments from:

- New England War Tax Resistance

- Conscience and Military Tax Campaign Escrow Account

- War Tax Resisters Penalty Fund

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464) if you would like a printed list by mail.

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

War Tax Resistance Ideas and Actions

Building Community from War Taxes

David Gross posted a note on Facebook about a “Village Building Convergence” hosted by his community in California that’s all about grassroots local solutions. He was hoping to present about how tax resistance/redirection can play a part in village building, but got cut from the speakers’ list. In response David created a flyer to hand out at the event. On one side it gives examples of war tax resistance redirection from communities around the U.S. and on the other information about Spanish war tax resisters and “Occupy”-style activists who joined forces to organize a sharing economy network and nourish it with redirected taxes. If you would like copies of David’s flyer for a similar event in your area click here.

A Rare Acquittal

Climate Changed: Movin’ and Shakin’

Esther Kisamore personed the literature corner during the Pikes Peak Justice & Peace Commission annual meeting on January 28. The evening started off with a little and levity from Colorado Springs’ own First Strike Theatre performing a new post- , “Climate Changed: Movin’ and Shakin’.” The show highlighted “some of the dark turns being taken re inclusion, environmental integrity, racial justice, militarism, women’s rights…and encouraged folks to ‘vote with our feet, vote every day, frequent movin and shakin will get us on our way’,” says Mary Sprunger-Froese of the First Strike Theatre. Photo by Mary Lynn Sheetz.Four drone resisters who had been arrested in 2015 at the upstate New York Hancock drone base — James Ricks, Daniel Burns, Brian Hynes and Ed Kinane — were found innocent of all charges on March 3 at the Dewitt Town Court. After deliberating for only about a half hour, the jury returned with a verdict of not guilty on all charges. The four were part of an action that shut the base gate with a giant copy of the U.N. Charter, posters of three relevant book covers, and a banner quoting Article 6 of the U.S. Constitution. Following the rendering of the verdict, a juror approached Brian Hynes and said, “I really support what you are doing. Keep doing it.”

— nukeresister.org

Tax Day Actions

–or you can just link to the page online – https://nwtrcc.org/programs-events/tax-day/tax-day-actions/

Tucson, Arizona — April 18, 7 am-8 am. Tax Day vigil at Raytheon Missile Systems, Hermans Road entrance to the plant (3rd traffic light south of Valencia on Nogales Highway, the extension of South 6th Avenue). Join the Raytheon Peacemakers as we demonstrate against war and those who profit from it. More info: (520) 323-8697

Berkeley, California — April 15, 5 pm-8 pm. People’s Life Fund Granting Ceremony with music at 5 pm, potluck dinner, followed by Bay Area war tax resisters redirecting $32,000 to twenty-six amazing peace and justice organizations! BFUU Fellowship Hall, 1924 Cedar St., Berkeley. More info: No. Calif. War Tax Resistance/People’s Life Fund, More info: (510) 842-6124.San Diego, California — April 15, 10 am-Noon. Tax March to demand Trump release his taxes, with a strong war tax redirection component. County Administration Center, 1600 Pacific Highway, marching to Civic Center Plaza, 1200 3rd Ave. For more information about the war tax component email anne@prcsd.org.

Boulder, Colorado — Sunny days in April, midday. Look for Gary Erb out tabling and leafleting on the downtown mall with war tax resistance materials. More info: Rocky Mountain Peace & Justice Center, 303-499-9456.

South Bend, Indiana — April 17, 4:30 pm. Vigil with signs demanding “Divest from War, Invest in People” outside the Federal Building. More info: (574) 289-2126.

Maine — Statewide tabling and leafleting. March 31 – April 18, Resist War: Global Days of Action in Maine. Leafleting at many locations and times around the state including: March 31 – Bar Harbor College of the Atlantic Cafeteria (breakfast & lunch); April 4 – UMaine/Machias (10 am – 2 pm); April 8 – UMaine/Orono, Hope Fest

(11 am – 3 pm), and, Waterville Castonguay Square (Noon – 5 pm); April 15 – Belfast Food Coop (11 am – 5 pm), and Blue Hill Food Coop (Noon – 2 pm) and Brunswick Post Office (11 am – 1 pm); April 15-16 – Rome Youth Activism Gathering (all weekend); April 17 – UMaine/Farmington, Student Center (10 am – 2 pm); April 17-18 – Damariscotta Post Office (11 am – 4 pm); April 18 – UMaine/Orono, Memorial Union (11 am – 2 pm) and Portland – Monument Square ( 8 am – 5:30 pm), with rally at noon co-sponsored by Veterans for Peace, PeaceWorks, Peace Action Maine and Global Network against Weapons and Nuclear Power in Space. More info: Maine WTR Resource Center, (207) 221-2818.St. Louis, Missouri — April 7, 11:30 am–1 pm. Leafleting with WRL pie charts at the corner of Forsyth and Central in Clayton. More info: Women’s International League for Peace and Freedom – St. Louis Branch, joanbran@mac.com.

New York City — April 18, Noon–1 p.m. Vigil and leafleting outside the IRS office, 290 Broadway at Duane Street, across from the Federal Building. War tax redirection by the NYC People’s Life Fund at 12:30. Cosponsored by Brooklyn For Peace, World Can’t Wait, NYC Metro Raging Grannies, Pax Christi Metro New York, NYC Catholic Worker. More info: NYC War Resisters League, (718) 768-7306.

Eugene, Oregon — April 15, 1-4 pm, Alton Baker Park. Resist Taxe$ Supporting War on our Planet! Rally/March/Speakers/Activist Booths. This event is co-sponsored by Taxes for Peace, CALC, ESSN, WAND, Indivisable, Women’s March, and others. More info: Taxes for Peace! (541) 342-1953.

Portland, Oregon — April 15, 3-5 pm. Tax Day Redirection Program at the 18th Ave. Peace House, 2116 NE 18th Ave. Join us as we divest from war and invest in people and the earth. More info: WRL of Portland/Oregon Community of War Tax Resisters, (503) 249-6343.

Philadelphia, Pennsylvania — April 18, Noon. Tax Day Line of Resistance in front of Philadelphia Federal Building Courthouse, 601 Market Street, illustrating sacrificing human needs and the environment for the sake of war, militarism, and nuclear weapons, with a 25-foot graph of the breakdown of the federal budget and an equally long banner reading: YOU PAY; LOCKHEED MARTIN PROFITS. More info: Brandywine Peace Community, (484) 574-1148.

Brattleboro, Vermont — April 15, 2017, 10am-3pm. War tax Resistance literature and friendly explanation of WTR, plus music appropriate for these times, directly outside of the Brattleboro Food Coop, 2 Main Street. More info: Pioneer Valley War Tax Resistance, (802) 387-2798.

Spokane, Washington — April 15, Noon-2pm. Location TBA. Invest in People, Not the Pentagon! A budget is a moral document. Does Trump’s budget reflect your values? Continuing our tradition of tax day actions that link out of control military spending with cuts to safety net programs for struggling families, we will be holding a Rally & Teach In to connect the dots between Trump’s proposed $54 billion increase in military spending and cuts to many vital social and environmental programs. More info: Peace and Justice Action League of Spokane, (509) 838-7870.

The Global Days of Action on Military Spending extend from April 18 – 28, with a list of actions around the world and resources for local organizers. See demilitarize.org/gdams-2017.

Resources

Advertise Your Resistance

“Don’t Buy War by NWTRCC” is our new store on the website CafePress where you will find shirts, mugs, stickers, magnets, buttons, cloth shopping bags, and more with the bomb in a shopping cart logo and “I’m not buying it,” the “Divest from War, Invest in People” slogan, NWTRCC’s longtime cannon logo “If you work for peace stop paying for war,” and a dove image with that same slogan. Check it out at cafepress.com/nwtrcc.

Free Lit Kit

Tax Day is just around the corner but there’s still time for NWTRCC affiliates and activists to ask for our free Lit Kit. This year the packet will include 100 pie charts, 100 Divest/Invest 3” x 5” cards, 50 “We Only have one planet” 4” x 6” cards, and one of our Divest from War/Invest In People organizing packets, and maybe a bonus item or two. Please promise to distribute the contents! If you would like a packet mailed to you, please call the NWTRCC office at 800-269-7464 or email nwtrcc@nwtrcc.org.

WTR Online

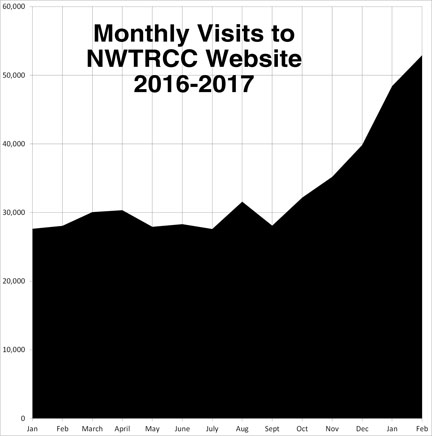

Webinars: As you can see by the front page graph, NWTRCC is very active online, and the latest additions are the webinars that we offered in February and March: War Tax Resistance 101 with Erica Weiland, at youtu.be/m3J9eixB-14, and Redirecting Taxes to Black, Brown, and Indigenous Resistance with Sam Koplinka-Loehr, at youtu.be/RWudRDvuzIk. Or, you can just jump to NWTRCC’s YouTube channel (youtube.com/user/nwtrcc) from the link on our home page at nwtrcc.org and watch the webinars and other offerings.

WTR Interviews: Go to the Media menu at nwtrcc.org and click on the TV and Radio interviews. You will find these links: Last Fridays Maine Talk Show with Ginny Schneider; Cindy Sheehan’s Soapbox with Sam Koplinka-Loehr; Rob Lorei’s Radioactivity (Tampa, FL) with Robert Randall; McIntyre in the Morning on KABC/Los Angeles with Ed Hedemann; and Peace & Social Justice Radio on KZFR/Chico with Ruth Benn and more.

NWTRCC was given some “Tax Strike Now” tee shirts that happen to have the War Resisters League website on them. Nevertheless, we are selling them for $12 postpaid. They are black with white writing and come in a variety of sizes. Order by calling the NWTRCC office (number below) to check on size and availability, then send a check for $12 to NWTRCC, PO Box 150553, Brooklyn, NY 11215.

Visit nwtrcc.org/store for war tax resistance literature including brochures, the Practical War Tax Resistance series of 8 booklets, bumperstickers, books, and more, or ask for a literature list from the office, 800-269-7464.

NWTRCC News

Raising the Stakes: War Tax Resistance and Community Survival in Troubled Times

National War Tax Resistance Gathering and Coordinating Committee Meeting

May 5-7, 2017 · Friends Meetinghouse, 1001 Park Avenue, St. Louis, Missouri, 63104

Please plan to meet war tax resisters May 5-7 in St. Louis for a weekend of workshops, reports, brainstorming and strategizing for the times ahead. It’s been a busy tax season, so there will be lots to report and discuss. With new interest and campaigns sprouting up around the country, this weekend will be important for setting out plans for the coming year. Plus, we’ll have a special program featuring the 2017 Collective Redirection to Black, Brown, and Indigenous Resistance.

Among the skills-sharing sessions during the weekend, we will take time for a special training with the St. Louis group CopWatch (see box). Our time is limited, so the training will be a shorted version to introduce us to the active work of CopWatch and link NWTRCC attendees up with similar projects in their home communities.

If you are traveling to St. Louis, there is public transportation from the airport and Amtrak or bus stations to the meeting site. Floor space for sleeping is available at the Friends Meetinghouse where there are also showers, and there will be some home hospitality too. NWTRCC’s business meeting is Sunday morning, and we will offer a war tax resistance counselor’s training on Sunday afternoon for those who wish to stay on (please RSVP to the NWTRCC office in advance for the counselor’s training).

The program schedule and registration form are on the NWTRCC website under the “Programs” button, “Gatherings and Events” or call NWTRCC at 800-269-7464, for a brochure and registration form. The registration fee is $20.The weekend is hosted by NWTRCC and the new Dick Gregory Catholic Worker House, and co-sponsored by Veterans for Peace. We are grateful to Chrissy Kirchhoefer in St. Louis for her willingness to host our weekend.

WeCopwatch

The primary goal of WeCopwatch is to watch the police, to educate and empower the public by informing people about WeCopwatch as a community defense tool, and to teach people about their rights in the event they are stopped by the police. A training with WeCopwatch is against all forms of hate and bigotry; acts under principles of non oppression; and stands against white supremacy, racism, sexism, violence against women, homophobia, transphobia, xenophobia, and any form of collectivized hatred or bigotry.

WeCopwatch trainings cover a variety of areas, including: the nonviolent observation of the police; using our presence as a de-escalating or mediating factor in interactions that are aggressive and hostile; educating about rights during police interactions, and tactics and strategies for asserting rights when approached, stopped, or questioned by law enforcement; how to effectively document police stops and encounters; the importance of being a good witness; and dealing with the aftermath of incidents ranging from evidence collection, to locating witnesses.

For more information about WeCopwatch see wecopwatch.org.

PERSPECTIVE

What Others Are Saying

One result of more media attention has been a plethora of responses from publications who take issue with us. Here’s a sample of a few article titles and comments posted to those articles online (as they appeared with typos and abbreviated sentences).

Independent Journal Review: “Mia Farrow Urges ‘Resistance’ Democrats to Protest Trump Administration — By Refusing to Pay Taxes

- Yes please don’t pay taxes you stupid liberals and the Government will come and take them along with penalty and interest plus some of you might even go to jail.

- When are you going to realize you do not matter and do not have the backing of the TRUE AMERICANS. You lost, get over it, move out of the USA, and shut up.

- This will be a good use of the 10,000 IRS agents Obama hired to marshall his health care plan. Go after them.

- Audit and Arrest as needed… Let some of these Ultra-Libs find out that their “status” does Not Place Them ABOVE The LAW!!!

- All these years paying taxes and I didn’t know I could send little personal notes designating where to spend MY money. Or to deduct some tax money and tell them where I spent it! Must be an interesting job for the accountants that have to figure all this out. (Sarcasm)

- not paying your taxes is a felony, if you get convicted of a felony in federal court you lose your right to vote, The federal government will seize your assets. you will have no say in government, I agree please stop paying your taxes and help make america great again by getting rid of the liberal vote

- This is the best idea I’ve heard coming from the leftist idiots. Let them not pay their income taxes and get charged with tax evasion. Then maybe they won’t have the time or money to protest and riot.

- Yes, don’t pay the taxes that go toward the military. That way all those deserving under paid soldiers, marines, sailors, coast guard will not get paid to protect the country that allows you to try to do the stupid things you try to do.

- Why didn’t these hypocrites get outraged after 8 years of war in the Middle East under Obama. Obamacare wasn’t exactly a great success. The

- Love the idea, get a web page going telling us how to do this and we the people will back this, if trump don’t have to pay taxes why should we

Mad World News: “Trump Haters Refuse to Pay Taxes But A Nasty Surprise Waits for Them”

[excerpt from the article] It should be noted that you didn’t see any conservatives refusing to pay taxes in protest of Barack Obama’s presidency, even though it lasted for an excruciating eight years and our hard-earned money went to fund causes which we passionately disagree with. … Still, we paid, because it’s illegal not to.Zero Hedge: “New Protest Idiocy Lows: ‘Resisting’ By Not Paying Federal Taxes”

- Do George Soros’ checks to protestors get taxed? I’m all for the underground economy, but…

- I would love to be a fly on the wall when one of these SJW’s is sitting in a 8×8 room with two IRS agents, asking just why they haven’t paid their taxes…

- I was wondering when the anti-war left would come off their eight year vacation.

- Maybe someone in the IRS reads ZH and will have Ruth Penn make a scheduled visit to her nearest IRS office along with her checkbook. I hope it is full.

- Have these asshats ever even read Thoreau’s essay? And maybe they don’t know about the free nights he got as a guest of the government…

- The Tea Party was THE anti-tax movement, and even they advocated no such thing.

- “tax resistance” has been a mainstay of the alt-right forever. just saying