Federal Tax “Fast” – Don’t Wait Until April 15

It’s hard to concentrate on day-to-day tasks of late. What with the weather, projects piling up around the house, worrying about the present and future, worrying I’m not doing enough, worrying that whatever I do is so minor in the face of it all… I’ve been to the U.S. Mission to the UN a few… Continue reading

Rooted in Pacifism: Facing the Future from a Deep Tradition

By Tim Godshall When I first learned of WTR in my teenage years, I was smitten. Growing up in the Mennonite church, in which pacifism is a key part of church doctrine, I learned about our history of conscientious objectors who refused to fight in previous wars. Since the U.S. military draft ended a few… Continue reading

War Tax Resistance: Two Complementary Visions

By Karl Meyer I see two alternative visions that I call War Tax Protest and Resistance and War Tax Refusal. I distinguish these two basic approaches by an analogy with the behavior of electrical energy. Copper is a material that allows, but resists, the passage of electric currents. The process of resistance generates heat and… Continue reading

Building Solidarity for Peace: Conscience takes part in International Gathering on War Tax Resistance

By Fay Salichou [Editor’s Note: This blog post was originally published on the website of Conscience: Taxes for Peace not War in the United Kingdom. A recording of the session can be found below.] On 3rd May 2025, we took part in a powerful global conversation hosted by the National War Tax Resistance Coordinating Committee… Continue reading

Resisting Taxes in the Trump Era

By David Gross [Editor’s Note: David Gross wrote the following article for his website after presenting on a panel about resisting taxes in the Trump era at NWTRCC’s May 2025 conference. It is reprinted here with permission. A recording of the entire session can be found below.] Yesterday I was on a panel concerning “Resisting… Continue reading

Defund the Trump Agenda

In a recent Boston Globe column (“Resisting Trump: The Revival of Tax Protest,” April 10), Alex Beam points to a time-honored way of resisting violence and war: refusing to pay for it. He highlights the activism of the Pioneer Valley in western Massachusetts, and central to that activism were Juanita and Wally Nelson, two peace… Continue reading

When Will They Ever Learn?

April 30, 2025, marked the 50th anniversary of the end of the U.S. war in Vietnam. The poem here recently surfaced in our files and is so appropriate for remembering…and for today. When will they ever learn? Hung Wen, North Vietnam: 1972* By Karen Lillis During an air raid an old man drops to his… Continue reading

Tangled Up in Red

I got all tangled up trying to write a blog about producing the WRL pie chart in light of the federal budget process chaos currently discombobulating Washington. As so often happens with new administrations, there was no Trump budget proposal to analyze in time for our tax day flyer, just lots of bluster from the… Continue reading

Tax Day Events, Action Ideas, and Press Release

Tax Day is right around the corner! Here are few resources you may find helpful: A link to the most up-to-date list of Tax Day actions: https://nwtrcc.org/tax-day-action-2025/ If you are hosting an event that is not on this list, there is a form to add your event at the bottom of the list. Tips for… Continue reading

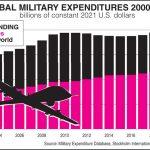

Mixed Signals

Recent news of the disclosure of war plans on the Signal app has unleashed a flurry of commentary on U.S. war planning. The text chat disclosed specific operational details of the U.S. plans against the Houthi militia two hours before airstrikes were conducted. Over 2 dozen of the major planners of war were involved in… Continue reading

MAGA Tax Plans and War Tax Resisters

We war tax resisters have a new challenge in front of us: the potential demise of the IRS. Just when they were ramping up the collection system after a decade of Congressional budget cuts and the pandemic lockdown, a new regime has swept into Washington hell-bent on shrinking the government. Or at least the parts… Continue reading

Moral Compromise

Post by Joshua Wrolstad [Editor’s Note: NWTRCC is a big tent organization that is composed of people with various political beliefs. We welcome blog post submissions on war tax resistance from many points of view. The publication of personal opinions expressed in these posts should not be construed as an endorsement by NWTRCC, which makes… Continue reading