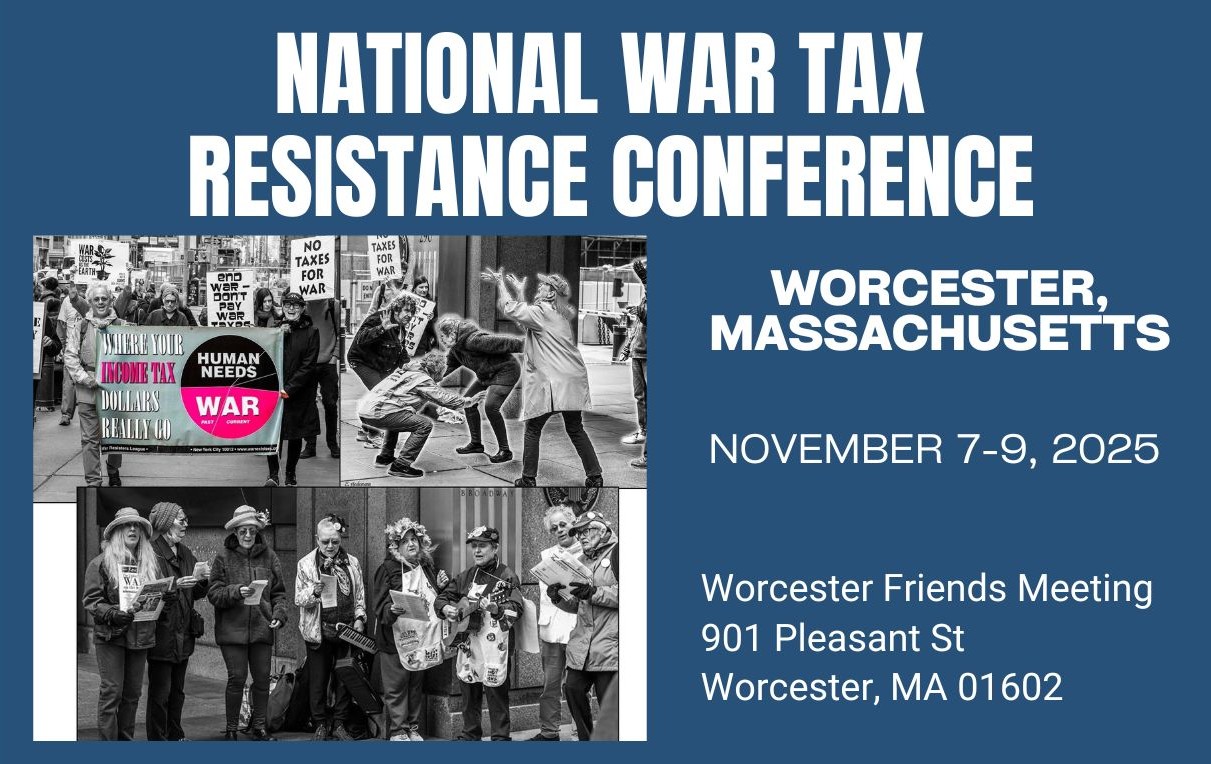

War Tax Resistance Gathering and Coordinating Committee Meeting

Worcester Friends Meeting, 901 Pleasant St, Worcester, MA 01602

November 7-9, 2025

If you cannot attend in person, there will be a virtual connection for most sessions and the Sunday a.m. business meeting (registration required). All sessions will be held at the Worcester Friends Meeting, except for the Sunday business meeting. There will be plenty of floor space for sleeping bags at the meeting house. There are also local people offering beds. (Registration Page)

Weekend Schedule (subject to some adjustments)

Resisting Together

Friday, November 7

5:00 pm: Arrival / Registration / Supper

6:00 – 7:00 pm: US Representative Jim McGovern

Rep. McGovern has been a member of the United States House of Representatives since 1997, representing Massachusetts’s 2nd congressional district since 2013. Since the death of Representative John Lewis, McGovern has been the main sponsor of the National Campaign for a Peace Tax Fund. He will discuss the issue of taxes and military policy from an insider government perspective/as a strong anti-war voice in Congress.

7:00 – 8:30 pm: National Priorities Project

Lindsay Koshgarian, the Program Director for the National Priorities Project will offer critical information about the national budget and the budget-making process. National Priorities Project is the only nonprofit, non-partisan federal budget research organization in the nation with the mission to make the federal budget accessible to the American public. In 2014, NPP was nominated for the Nobel Peace Prize in recognition of their pioneering work to track federal spending on the military and promote a US federal budget that represents Americans’ priorities, including funding for people’s issues such as inequality, unemployment, education, health and the need to build a green economy.

Saturday, November 8

8:00 – 9:00 am: Breakfast

9:00 – 10:00: Introductions, Schedule Review, Orientation

10:00 – 11:30a: Planning for Tax Resistance in Tax Season 2026

Interest in tax resistance has greatly increased because of the genocide in Gaza and Trump’s second term. This session will focus on ways to increase awareness of war tax resistance as a response this coming tax season.

11:30 – 12:30a: Lunch

12:30 – 2:00 pm: Resistance Panel

This session will feature a panel with people involved in various areas of social justice, including racial justice, climate justice, and the genocide in Palestine. Virginia Cuello will share about the work of The Black Response Cambridge. Claire Schaeffer-Duffy, the Program Director for the Center for Nonviolent Solutions and a member of the Ss. Francis and Therese Catholic Worker, will discuss the current situation in Palestine. Paul Popinchalk, a 350.org member and retired engineer with experience in facilities management and energy conservation, will speak to increasing concerns of the federal budget’s impact to the environment during the Trump administration.

2:30 – 3:45 pm: Changing Trends in War Tax Resistance

This session features Ruth Benn, one of the authors of the recently updated book

4:00 – 5:15 pm: War Tax Resistance 101 & 201

- War Tax Resistance 101 An introduction to the why and how of this form of resistance, with discussion of potential consequences and resource referral. For people new to WTR or just getting started. Facilitated by Chrissy Kirchhoefer, NWTRCC Outreach Consultant

- WTR 201 Updates, trends, and Q&A for current war tax resisters. With NWTRCC Coordinator Lincoln Rice and the expert resisters in attendance!

5:30 – 6:30 pm : Supper

7:00 – 8:30 pm: Music with Charlie King

Folk musician Charlie King perform to close out Saturday on a celebratory note. Charlie is a previous winner of War Resisters League’s Peacemaker Award and Pete Seeger nominated Charlie for the Sacco-Vanzetti Social Justice Award, which he received in November 1999.

Sunday, November 9

8:00 – 9:00 am: Breakfast

9:00 – Noon: NWTRCC Business meeting (open to all.) Find the agenda and materials for the business meeting here.