More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

August – September 2021

Contents

- Biden’s IRS Funding Proposal

By Lincoln Rice - Left in the Dark: $2 Trillion and Counting By Chrissy Kirchhoefer

- Counseling Notes: IRS Clarifies Bank Levies • IRS Resumed Normal Collection Procedures on June 15, 2021 • Passports and the IRS • Private Debt Collection Update • Property Seizures, Levies, and Liens

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Podcast on African American Female Athlete and War Tax Resister Eroseanna Robinson • Peace Week: Introduction to WTR Webinar (21 September 2021) • War Tax Resistance Discussion at World Beyond War Virtual Conference (4 June 2021) • Vermont & Western Massachusetts Outreach

- NWTRCC News: NWTRCC Charity Art Auction is Online • Bequest Campaign Update • Mark Your Calendars for Next NWTRCC Conference!!! • In Memoriam: Ernest Stanley (Stan) Bohn

- Profile: Funding a Livable Future

By Sue Barnhart

Click here to download a PDF of the August/September issue

Biden’s IRS Funding Proposal

John Ed Croft at Manhattan IRS office in 1987.

Photo by Ed Hedemann

By Lincoln Rice

In April, President Joe Biden began his push to provide an additional $80 billion to the IRS over the next decade to close the tax gap. The tax gap is the difference between what people owe the IRS and what it actually manages to collect in a given year. The estimated tax gap has been around $550 million each year.

With its current resources and authority, the IRS manages to collect about 10% of the tax gap. The Biden administration estimates that the proposal would increase collection by $700 billion over a decade. Though analysts at the University of Pennsylvania believe the number would be closer to $480 billion. Either way, the additional funding for the IRS would pay for itself.

Biden’s proposal would grant the IRS greater authority, double its personnel, and update its flagging computer system. As noted in the Counselors Notes of the June newsletter, this proposal also includes making repeated willful failure to file a tax return a felony. I have already received several phone calls about this particular aspect of Biden’s plan. Some war tax resisters are wondering if they should begin filing next year.

My advice: “Hold your horses!” Nothing has happened, yet. Biden and the IRS are trying to drum up support for this plan. Nothing is known about what portions of this plan will become law… or if any of it will become law. (NWTRCC’s newsletter will keep you abreast of any developments.) The plan needs Republican support. Though some Republicans were showing support for increasing funding to the IRS, the bill still has a long way to go.

As this goes to press, the passage of the bill looks less likely. Biden has touted his IRS proposal as a way to pay for his infrastructural plan. But Republicans in Congress just claimed a “victory” by forcing Biden to remove the IRS funding plan from this infrastructure proposal. Capitalizing on everyone’s fear of the IRS, Republicans have prided themselves in starving the IRS.

To counterbalance the Republican stance against the IRS, the Biden administration wants Americans to know that the rich are not paying their fair share of taxes. Earlier this summer, a large amount of tax information and tax returns filed by the richest Americans was leaked to the press. I have a hard time believing this leak was not intentional by someone in the IRS or with the Biden administration.

The central messaging of Biden’s tax legislation is that the rich will pay their fair share. What the leaked files made clear is that the richest Americans are not avoiding taxes by illegal means, but by well-known loopholes. The current Biden proposal would not do much to increase tax collection on the Jeff Bezoses of the world. Nevertheless, the legislation would affect higher income earners as well as low and middle income earners—including war tax resisters.

If this proposal becomes law, many war tax resisters may have to reassess their strategies. We might see war tax resisters submitting appeals to the war tax resistance penalty fund. And many folks who have practiced their war tax resistance on an island may discover that they would now prefer to be connected to a local group or to NWTRCC. A lot of things might change, but let’s wait to see what happens. And no matter what happens, NWTRCC will be here to support and encourage war tax resistance.

Left in the Dark: $2 Trillion and Counting

By Chrissy Kirchhoefer

In the early hours of July 2, U.S. troops departed Bagram Air Force base in Afghanistan. It appears as though the Afghan government was left in the dark about the departure of U.S. troops. Biden had been previously clear about a formal departure and with the definitive closure of Bagram, the U.S. has completed 90% of the troop withdrawal.

The New York Times article, “The Salvaged Relics of a Very Long War: Shops near Vacated Afghanistan Base Sell Vestiges of U.S. Presence,” describes how Bagram, surrounded by grape vineyards, has an economy based on the refuse of two superpowers over the past 40 years.

“As they left, the Americans demolished things like armored cars and more than 15,000 other pieces of equipment deemed excess property, a catchall that allows U.S. forces to destroy items so that they are not sold by the Afghans for profit.” Still, some who have been left behind in the ravages of war were able to gather some of the spoils (or rather scraps) of war to sell to try and make a living or to preserve life.

An F-16 Fighting Falcon taking off for a combat mission at Bagram Air Force Base. Photo Courtesy of Wikimedia Commons.

During a press conference later that day, President Biden cut off a question on the issue saying, “I want to talk about happy things,” which for him meant the U.S. jobs report. When asked about concerns about the U.S. pulling out troops, Biden said “Look, we were in that war for 20 years. Twenty years. The Afghans are going to have to be able to do it themselves.” The U.S. has offered to support the Afghan troops with teleconferences and drones from afar.

The U.S. government has relied on the U.S. people to be unaware or apathetic about the fighting. Former Air Force analyst Daniel Hale was concerned that the U.S. public was not getting important information about the nature and extent of U.S. drone warfare. He had worked for the National Security Agency at Bagram Air Force Base and could not distinguish who was being targeted in drone attacks.

Hale released information to the public and is facing sentencing on July 27 on whistle-blowing charges. With the growing number of civilian casualties from drone airstrikes, he was appealing to the conscience of the people of the U.S.

Fortunately, throughout all of the history of wars, there have been people raising awareness and resisting wars; cutting through rhetoric about “good wars” and other ways of distancing from the impacts of war. In the U.S. with the largest portion of our taxes going to war, we are in a unique position to resist these taxes in ways that are not as easily done in other parts of the world.

Barbara Lee, who was the sole vote against the authorization of use of force following the September 11 attacks, has recently introduced legislation that would reduce funding to the Pentagon. While she has acknowledged that it may not be passed this year, she states, “We cannot continue to prioritize funding for a department known for its waste, fraud, abuse, and failure to pass an audit—especially when the money to ‘protect national security’ is failing to protect our most vulnerable citizens.” l

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2021. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

IRS Clarifies Bank Levies

The Chief Counsel Advice (CCA), who are legal advisors for the IRS, recently clarified that a bank levy from the IRS only pertains to funds in a person’s bank account when the levy is received in the mail by the bank.

Funds put in the bank account by a depositor after the levy is received are not subject to the levy, even if funds are deposited later on the same day that the levy is received. The CCA wished to clarify this because if the funds in a bank account before the levy is received are turned over the taxpayer after the levy is received instead of the IRS, the bank becomes liable for up to 50% of the funds given to the taxpayer.

Likewise, if the bank turned over funds to the IRS that were deposited after a levy was received, the bank would legally owe those funds to the depositor.

IRS Resumed Normal Collection Procedures on June 15, 2021

Due to pandemic, the IRS has kept its systemic and automated lien and levy programs idle since April 2020, except in situations where a person’s tax debt may be about to expire. But the IRS now plans to return to its normal collection casework processes.

Generally, balance due notices are automatically sent to taxpayers after the tax filing deadline. Beginning June 15, 2021, the IRS began sending follow-up letters to taxpayers who have failed to respond to prior notices. These taxpayers will be notified that they have 30 days to respond or pay their tax bills. Taxpayers who fail to respond to these additional letters could be subject to levies or Notice of Federal Tax Lien filings beginning August 15, 2021. For taxpayers who receive money through federal or state programs (e.g., Social Security), levies on these funds could begin as early as July 15, 2021.

Passports & the IRS

Due to pandemic, the IRS had temporarily stopped its practice of certifying seriously delinquent tax debts—meaning someone with a debt over $54,000. They resumed this practice in mid-March 2021. Once the IRS certifies that someone has a seriously delinquent tax debt, they will notify the State Department, and the State Department will no longer issue a U.S. passport to those individuals.

Even before the pandemic, the IRS was not moving very fast in its certifying. Only three people in our network have received such a notice since this law went into effect in 2018. If you do receive such a notice, please let the NWTRCC office know.

Private Debt Collection Update

Since 2018 when the IRS started using private debt collection agencies again, several folks in our network have had their tax debt assigned to one of these agencies. In July, two war tax resisters in California with different collection agencies assigned to each of their cases both received notice that the collection of their tax debt was being handed back to the IRS.

No reason for this change was given. For one person, the collection agency was handling some tax debt that had reached the statute of limitations and some that will expire shortly. For the other person, they were handling a tax debt that will expire in the next couple years. Perhaps the IRS wanted to handle the cases again since the IRS has the power to levy, while private debt collectors only have the power to make phone calls and write letters.

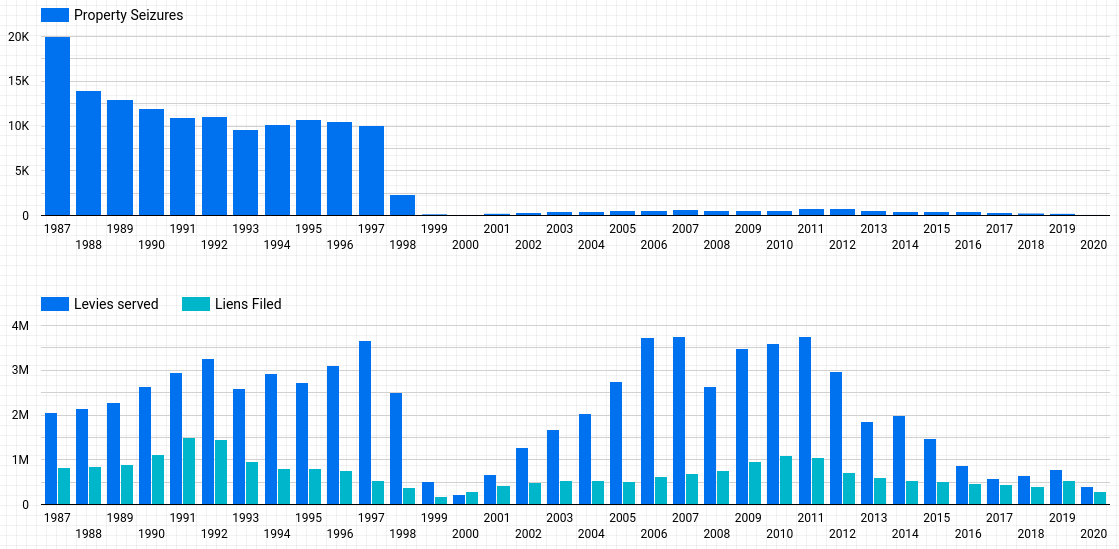

Property Seizures, Levies, and Liens

Using data recently released by the IRS, David Gross (of The Picket Line blog) has created graphs showing IRS property seizures, levies, and liens from 1987 to 2020. Property seizures collapsed in the 1990s have remained a seldom utilized tool compared to past practice. With the pandemic, it is no surprise that property seizure, levies (which included wage garnishments), and liens filed with local courthouses are all at 20-year lows.

Many Thanks

Thanks to everyone who donated for the May Appeal 2021! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and alternative funds for their redirections

and Affiliate dues: Michiana War Tax Refusers; War Tax Resistance Penalty Fund; Las Vegas Catholic Worker

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

ADVERTISEMENT

On The Road Again

Karl Meyer, continuing 61 years of refusing any payment of Federal income taxes, to visit old friends, war tax refusal support groups, and other justice communities, and do a day or two of volunteer carpentry, plumbing, and electrical repairs.

Traveling in my new PEACE HOUSE 2.0, van-home and well-equipped tool shop.

WHEN:

Autumn and winter 2021—PRIMARY EDUCATIONAL MESSAGE—in van displays and personal dialogue:(1) End the new “Cold Wars” with Russia and China; work with all countries to reverse climate change, promote proper use of Earth’s resources, and mediate peaceful resolution of civil and regional wars; (2) War Tax Refusal–History and Methods.

BACKGROUND:

<strong1966 – initiator of first telephone excise tax refusal campaign;

1968 – architect of the W-4 Form method of preventing income tax withholding;

1985 – ’94 original draft author of pamphlets #1-4 in NWTRCC’s Practical War Tax Resistance series.

POTENTIAL ITINERARY (subject to timing and host invitations):

September: Indiana, Illinois, southern Wisconsin

October – November: Iowa, Nebraska, Colorado, Utah, Oregon, California, Nevada, Arizona, New Mexico, Kansas, Missouri, Kentucky, Tennessee.

CONTACT:

Karl Meyer, Nashville Greenlands, 2407 Heiman Street, Nashville, TN 37208

615-322-9523 · karlmeyerng@hotmail.com · endwarlistentoearth.com

Tax Resistance Ideas and Actions

Podcast on African American Female Athlete and War Tax Resister Eroseanna Robinson

Podcast on African American Female Athlete and War Tax Resister Eroseanna Robinson

In 1959, Eroseanna Robinson refused to stand for the national anthem at the Pan American Games in Chicago. In 1960, she went to prison for her war tax resistance.

Longtime war tax resister Karl Meyer of Nashville Greenlands was interviewed about Robinson for the podcast. Karl was deeply influenced by Eroseanna’s example and organized protests outside the court house to support her when she was jailed for her war tax resistance.

Listen to this fantastic podcast at http://shutupandplaypodcast.com. The episode is called, “Taking a Knee” and the segment on Robinson begins at the 24.50 minute mark. The podcast can also be found wherever you normally listen to podcasts.

Peace Week: Introduction to WTR Webinar (21 September 2021)

As part of Pace e Bene’s Peace Week (September 18-26, 2021), NWTRCC will host an online webinar on WTR on September 21, 2021 at 8:30p Eastern/ 5:30p Pacific. This session will be an introduction to the whys and hows of war tax resistance, with a discussion of potential consequences and resource referral. This session is for people new to war tax resistance or just getting started. Facilitated by Lincoln Rice (NWTRCC Coordinator) & Chrissy Kirchhoefer (NWTRCC Outreach Consultant). Please invite anyone who you think might be interested to participate. A link to the registration page can be found under the “Action & News” section of the NWTRCC homepage.

War Tax Resistance Discussion at World Beyond War Virtual Conference (4 June 2021)

A discussion on WTR at this year’s World Beyond War conference was facilitated by NWTRCC Coordinator Lincoln Rice, Conscience Canada president Doug Hewitt-White, and Conscience–Taxes for Peace Not War (England) director Robin Brookes. About 15 people from all three countries joined the conversation. Some were long-time war tax resisters and others were interested in how to divest from war in their respective countries. Along with the practice of war tax resistance being more difficult in Canada and England, both groups are struggling to grow membership and participation. Discussion during the session ranged from how to practice WTR to the connections between government spending with climate change and police funding.

Vermont & Western Massachusetts Outreach

Lindsey Britt, who is a member of the Administrative Committee for NWTRCC, is organizing a group of Vermont & Western Mass. war tax resisters and allies. If you are interested in war tax resistance and live in Vermont or Western Massachusetts, please fill out this quick interest form: tinyurl.com/yzufcv2b.

As Lindsey states, “Tax resistance can be a useful tool for individuals and groups looking to live lives more aligned with their values while creating a more peaceful and just world for all. War tax resistance takes many forms: sending letters to congressional delegates, contributing to war tax resister penalty funds, living simply to lower tax liability, and/or refusing to pay a portion of or all of a person’s tax liability. War tax resisters are concerned with the militarization of police forces, the military’s contribution to the climate crisis, the use of tax dollars to kill people all over the world, and any other issue that touches on the use of taxpayer dollars to fund violence in the United States and abroad.”

NWTRCC News

NWTRCC Charity Art Auction is Online

Art Print by artist Sandy Griffin in St. Louis.

(This print was sold at last year’s auction.)

This summer, NWTRCC is holding its second online charity art auction. The auction is being coordinated by NWTRCC’s fundraising committee, along with the generous time and effort of Carlos Steward, director the Flood Gallery Fine Art Center in Black Mountain, North Carolina.

The auction is taking place online and at the Flood Gallery Fine Art Center, giving folks in the local area a chance to see the items up close and place bids. The auction ends on October 2, 2021.

A link to the auction website can be found on the NWTRCC homepage. Go back often to see the new items that are posted. If you have art to donate to the auction, please send to Carlos Steward, 3 Windrow Dr, Asheville, NC 28805. Please share links to the auction on your social media accounts (if you use social media).

Bequest Campaign Update

NWTRCC’s Fundraising Committee began a bequest campaign late last year. We have reached out to many of you to ask if you would consider putting NWTRCC in your will. Four folks have committed to doing just that while several others committed to making more regular donations to NWTRCC. Thanks to all of you! To learn more about making a bequest to NWTRCC, go to nwtrcc.org/bequests/ or contact the office.

Mark Your Calendars for Next NWTRCC Conference!!!

November 5-7, 2021 · Conference will be Online!

In light of the continuing pandemic, the Administrative Committee made the decision to have another online-only conference.

One of our Saturday sessions will feature a panel with Extinction Rebellion UK (which launched Money Rebellion, which includes a tax resistance component) and Grup Antimilitarista Tortuga (a very active war tax resistance group in Spain).

We are diligently working to put together a great conference and hope everyone will join us.

For the most recent information on the gathering, including registration information, go to nwtrcc.org/programs-events/gatherings-and-events/ or call the NWTRCC office.

In Memoriam: Ernest Stanley (Stan) Bohn

Stan Bohn (right) with members of Cherith Brook Catholic Worker during a protest at a nuclear parts plant, which was under construction at the time. Gathering, Nov. 2011. Photo by Ruth Benn

By Susan Miller (Friend of Stan Bohn)

Stan passed way at 90 years old on 19 May 2021 in North Newton, Kansas.

Stan was a peacemaker. He befriended people on the margins of society because of his Christian faith and perhaps because he remembered his ancestor’s humble beginnings in Pennsylvania as an indentured servant.

Stan was a leader of Heartland Peace Tax Group, which affiliated with and supported the Religious Freedom Peace Tax Fund Act and NWTRCC. He attended NWTRCC meetings in St. Louis and Kansas City, and helped Heartland host two meetings in Kansas. Our group did a penny poll at Bethel College and some of us participated in a war toys “recall” at Walmart.

On Tax Day, we handed out pieces of pizza in Newton and fruit pie at the Hesston post office, along with pie charts. We tabled war tax resistance information—including the large charts of historical tax resistance—at numerous church conferences and wrote letters to church and local newspapers.

On several Good Fridays, the Heartland group led Stations of the Cross walks, stopping to pray at the courthouse, jail, peace center, and other places in downtown Newton. Stan was considered a radical pastor in Newton, but few people could argue with him since he grounded his resistance on being a “Jesus follower.”

Stan and Anita—his wife of 68 years—practiced war tax resistance the past 35 years. They donated their resisted money to life-giving causes and allowed the IRS to raid their bank account and Social Security income.

Stan accepted the consequences of his nonviolent peace activism and did not judge those who disagreed with him. Before moving away from Kansas City, Stan notified his all-white neighbors that he was selling his home to an African American. The Bohns received several anonymous threatening phone calls at night and a white hood was put on their doorstep. Stan had to wonder if he had taken too great a risk for his children’s safety.

Stan testified to Kansas legislators for abolition of the death penalty, citing his family’s willingness to forgive the person who murdered his sister if he was ever found. Stan said that was the only way he could move ahead without the burden of hatred and retribution added to his grief. During his retirement years, he volunteered in prison ministries.

An arrest at an Iraq War protest in New York City put him in jail overnight. He noted that the good part of that experience came when his cell mate, Ben Cohen, gave him coupons for free Ben & Jerry’s ice cream.

Stan conveyed a kind, pastoral presence in his peace and justice advocacy and ministry. He was the first pastor of Rainbow Boulevard Mennonite Church in Kansas City, Kansas and of Shalom Mennonite Church in Newton. He also served as pastor or interim pastor of churches in Ohio, Kansas, and New York City.

Anita and Stan also volunteered with Mennonite Central Committee in Kingston, Jamaica, where he taught conflict resolution and philosophy at Jamaica Theological Seminary.

Stan grew up in Mennonite farming communities in Indiana, Pennsylvania, and Ohio. He earned degrees from Bluffton University, Ohio State University, and Anabaptist Mennonite Biblical Seminary. He also studied at San Francisco, Iliff, Concordia, Garrett, and Auburn Theological seminaries. Near the end of his life, he smiled and said he would soon be admitted to medical school. (Upon his death, Stan’s body was donated to a medical school.)

A celebration of life service was held at Shalom Mennonite Church in Newton. The memorial service can be viewed at bit.ly/36sByAa</em.

Also online is an interview with Stan by his son-in-law, Dan Coyne, on 13 March 2021: bit.ly/3yGFIAh.

PROFILE

Funding a Livable Future

Image by MasterTux from Pixabay

By Sue Barnhart

We woke up to black smoky air the day after Labor Day 2020. It was challenging to breathe outside, even with a N95 mask. We could not see the sun. The air quality index was over 500— the extremely hazardous range. Our beautiful Oregon was burning up. The trails we love hiking and the places we love camping and many families’ homes were burning. All over the state fires were burning out of control, including along a major highway following the McKenzie River, only 10 miles from Eugene, Oregon, where I live. In some cases, folks had less than a 15-minute warning to abandon their homes.

Until the wildfires—though we were in the COVID shutdown—we could enjoy hanging out in our yard and taking walks. Suddenly, we were confined to our homes. We had to keep all the windows and doors shut and were sharing air filters with friends to keep the air quality livable inside our homes. People without homes were not as lucky. Due to the pandemic, they weren’t allowed inside public buildings to breathe fresh air, and though a few shelters were open, there was not enough room for everyone who needed shelter from the bad air. We were all scared and glued to the news. We learned the fires might keep burning until the fall rains and winter snow started, and due to global warming the rains might not start for months.

We all packed go bags and had them near our doors or in our cars. We took pictures of family pictures, because there isn’t much room in a car for all the things you might want to save if the fires continued to spread. And we wondered, if we had to evacuate, where would we go? There were traffic jams everywhere as people fled the poor air quality.

Sue Barnhart at Tax Day 2021 Action

One friend who lives in the forest woke up to his house surrounded by flames. Knowing he was on an evacuation alert, he had put things near the door that he planned to take if the fire came close to his house. Sure enough, as he slept the winds whipped up the fires. All he was able to do was rush out the door past his collected belongings, jump in his car and drive through raging bright orange and yellow flames and large darting embers from both sides of the road. He made it out. One of the lucky ones, eleven others did not.

Low humidity and unusually high winds from the east fanned fires already started by lightning, campfires, and electrical wires blown down by the winds. But the major culprit in this historic wildfire season on the West Coast was climate change.

The summer of 2020, an extremely hot, dry one, was precipitated by decades of drought caused by rising world temperatures. The result was massive, sobering destruction in rural Oregon. And what might be the world’s largest emitter of CO2 and therefore the largest driver of climate change? The U.S. military.

Though firefighters worked bravely to put out fires, a bloated military budget funneled off tax money that could have been better spent to hire more firefighters. Many small-town fire departments are run by volunteers. Firefighters stationed in every town who are paid a living wage would be a much better use of our taxes. Unfortunately, Biden is asking for an increase to the military budget, including an increase for more nuclear weapons!

Now those fires are out and eventually the forests will recover, but many magical hiking trails and camping areas have been destroyed. 4,000 homes were lost and Oregon’s homeless population, which is already very large, grew by thousands.

Now it is summer 2021. Usually our autumns, winters, and springs have lots of rain, and I wear my rain gear most days, I hardly wore my rain gear last winter and it barely rained all spring. My neighbors and I are worried about some of our trees and have begun to water them regularly in a hope to save them, something we have never done before.

We already have fires to the North, East, and South of us and occasionally I smell smoke in the air here in Eugene. People closer to the fires have already had to evacuate. We have all begun obsessively checking the air quality and so far it has crept into the moderate range somedays, depending on how the air is blowing. Though I love the cool breeze we get in the evenings, I worry it will whip up one of the fires and increase the spreading.

A few weeks ago, we had temperatures over 110, higher than has ever been recorded in this area. Many elderly people and people with disabilities died. We were lucky to have the resources to escape to the coast, but not everyone is so lucky and we did feel guilty about increasing our carbon footprint. We returned home late at night, and it was still over 100 degrees. And still people deny that there is a climate catastrophe.

I have been a war tax resister since the 1970’s, since I do not want my money supporting murder. Now I am also a war tax resister because I don’t want my money supporting the biggest contributor to the burning of our planet—the U.S. military.

I want my tax dollars to provide for food and homes for all; comprehensive health care that includes dental, hearing, vision, and mental health care for all who need it. Free, excellent childcare and education should be provided for all who need it, children and adults. Finally, I want my tax dollars going toward ensuring a sustainable future for our planet, toward real solutions to the climate crisis.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org