W-4 in the Digital Age and Private Collection Letters

Adjusting a W-4 form through an online portal was a new WTR counseling question for me. Many of us longtime WTR counselors still rely on printed materials, so thanks to the counselee who introduced me to the online ADP system, the payroll service their company uses. ADP and random accountant websites do have some tips about navigating the system (this video is pretty good). An HR office could probably help with the basics too, but often workers have no in-person contact with that office.

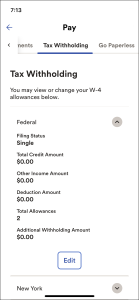

At first the counselee emailed me a print out of the form that you get to on a phone (see image) after answering some other standard questions. Right off I was mystified by “allowances” near the bottom since the federal government changed the W-4 from the allowances system to “deductions” a few years ago. A tip from someone at the last NWTRCC gathering clued me in to the fact that “allowances” might be for state taxes (New York), and they were correct.

At first the counselee emailed me a print out of the form that you get to on a phone (see image) after answering some other standard questions. Right off I was mystified by “allowances” near the bottom since the federal government changed the W-4 from the allowances system to “deductions” a few years ago. A tip from someone at the last NWTRCC gathering clued me in to the fact that “allowances” might be for state taxes (New York), and they were correct.

I was also confused by all the zeros, especially on deductions, since the standard deduction should be taken into account on this person’s W-4. When I eventually saw the form live it became clear that the standard deduction (single = $15,750 in 2025) is factored in as soon as you enter your status.

As far as adjusting federal withholding, you can get an idea of what you want to do by using the formula under “Calculating Deductions” on this page. Or, use the IRS withholding calculator to help clarify allowed credits and pre-tax contributions you make. At the end it shows if your withholding is too low or too high (per IRS standards, of course).

For the individual in question who had been getting a refund and wanted to be able to resist at least a small amount of taxes, the key was to add some amount to the “Deduction Amount” line. (The last line, “Additional Withholding Amount” has to do with having multiple jobs or filing jointly with a working spouse.) In this case, they made a rough guess and entered a few thousand dollars on the “deduction” line, but for some reason it would not save in the cell phone app. Opening the account in a desktop computer turned out to be much easier, and the adjustment was easily made and saved (who knows why….just a tip in case this happens to you). A message came up that the change might be temporary covering only a couple paychecks. Could that be because we are near the end of the year? Perhaps the process needs to be repeated in the new year?

With the digital account it’s easy to look at the pay stub once the new deduction level kicks in and see if the federal tax withholding number has gone down. You can roughly calculate where you’ll be at the end of the year: will you owe taxes and resist; is it about even so that you won’t owe but won’t get a refund either; or, do you need to increase the deductions because you want to be sure you have taxes to resist? Once again, the IRS withholding calculator is a useful tool, and you are allowed to change your W-4 anytime. Be sure to read about potential consequences in NWTRCC’s Practical #1, Controlling Income Tax Withholding, in case the IRS decides your withholding is too low.

Private Debt Collection

Many resisters are contacting counselors about letters they’ve received from the IRS, which seems to be busy blasting them out. The staff may be decimated but the computers are still working. One letter that seems to be arriving more frequently is CP40, “We assigned your overdue tax account to a private collection agency.” I think this letter used to arrive in the mailboxes of longtime resisters who had older tax debt (5+ years?), but perhaps with the severe staff cuts at the IRS there is more reliance on private companies. Just a guess.

Legislation back in 2015 forced the IRS to hire a few private collection agencies that began work in 2017. The main things to know are:

- The IRS will give taxpayers written notice of accounts being transferred to a private collection agency (PCA). The agencies will send a separate letter to the taxpayer confirming this transfer. The initial contact will not be by telephone.

- Private collection agencies will identify themselves as contractors of the IRS and must follow the Fair Debt Collection Practices Act. To be sure it’s not a scam make sure the assignment is to one of these 3 IRS contractors: CBE, Waterloo, IA; Coast Professional, Inc., Geneseo, NY; ConServe, Fairport, NY.

- The PCAs have no power to collect money from you or levy salaries, bank accounts, etc. Their task is to convince you to clear your debt by sending $$ to the IRS. Whether the tactics are polite or border on harassment may depend on the individual collector.

- If you do not wish to work with the assigned PCA, you must put your request in writing to that agency. Then your case goes back to the IRS.

When writing this I ran into a 2019 quote from an experienced resister: “And when they ‘assigned’ my case to a private collection agency, their ability to harass me or take my money decreased.” So I emailed him to ask if he stands by the quote today. He said: “I stand by that quote. I waited them out, and it was reassigned back to the irs after a couple of years.”

— Post by Ruth Benn