President Trump’s major budget and tax legislation was signed into law on July 4, 2025. There were several items in the bill that may interest war tax resisters. Some of the new tax laws affect 2025 taxes (filed in 2026), but most will start in 2026 or later.

Overtime Pay & Tips: Starting in tax year 2025, certain workers can claim a dollar-for-dollar deduction for a designated amount of overtime pay and tips. But there is a cap on both and both exclude the deduction for those filing Married Filing Separately.

Overtime Pay & Tips: Starting in tax year 2025, certain workers can claim a dollar-for-dollar deduction for a designated amount of overtime pay and tips. But there is a cap on both and both exclude the deduction for those filing Married Filing Separately.

1099-K: This column has been plagued with changes to the 1099-K, which reports payments from third-parties (eBay, PayPal, Venmo, Airbnb, Uber, etc.). The reporting requirements had been lowered in recent years from the original requirements of over $20,000 income and over 200 transactions. Beginning immediately in 2025, the 1099-K reporting requirements are reverting back to the original rule.

1099-NEC: Beginning in tax year 2026, the reporting requirements for self-employed people receiving income from businesses will change. Previously, businesses were required to report payments of $600 or more during a calendar year to self-employed people. In tax year 2026, this threshold will rise to $2,000 and go up each year with inflation. This rule is expected to reduce by 30% of the amount of 1099-NECs that are issued.

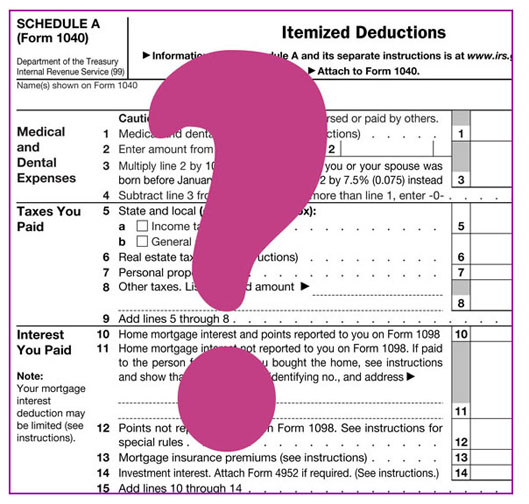

Schedule A form with a question mark on it.

Charitable Deductions: Currently, charitable deductions can only be taken by people forgoing the Standard Deduction to itemize their deductions on Schedule A. Beginning in tax year 2026, single filers will be able to deduct up to $1,000 in cash donations even if they take the Standard Deduction. (Married-Jointly filers up to $2,000.) Property donations will not qualify.

Cuts to IRS: Between the Trump administration’s 20% cut to appropriated IRS funding and the reduction in supplemental funding under the Inflation Reduction Act, the IRS will face an overall 37% reduction. These cuts will make collection from war tax resisters more difficult.

Lastly, just a reminder that our monthly War Tax Resistance Social Hour on Zoom will be this Sunday August 17th at 6p Eastern. This social hour will be an opportunity for war tax resisters and those interested in war tax resistance to socialize between our gatherings and outside of an official program. If you have previously registered, you should receive a reminder with a unique Zoom link shortly. Otherwise, you can register here.

~Post by Lincoln Rice