Catholic Worker logo

[Editor’s Note: A longer version of this article was first published the April 2024 edition of the Agitator, the newspaper of the Los Angeles Catholic Worker.]

“‘Inasmuch as ye have done it unto the least of these my brethren, ye have done it unto me’ with napalm, nerve gas, our hydrogen bomb… Should one pay tax which supports this gigantic program?” –Dorothy Day (1954)

Franklin Roosevelt’s Revenue Act of 1942 expanded the application of the federal income tax beyond the richest Americans to then include 75% of all Americans. The following year, when Catholic Worker cofounder Dorothy Day was writing for the New York Catholic Worker about the evil of conscription, she added, “in these days it would be desirable to go even further, as did Thoreau, to refuse even the taxes which were to be used to pay for the means to kill our fellow man [sic].” With the growing proliferation of US nuclear weapons in the aftermath of Hiroshima and Nagasaki, Dorothy’s calls for war tax resistance increased.

Ammon Hennacy. Photo from wikisource.

During the spring of 1972 at the New York Catholic Worker, tension could be felt in the air. The IRS notified the New York house that it owed $296,359 in fines, penalties, and unpaid income tax for the previous six years. Part of the issue was the New York house, like many Catholic Workers, is not tax-exempt.

Despite concerns of how the situation might resolve, Dorothy used the publicity to highlight war tax resistance. After the situation had received national attention, the IRS wrote a two-sentence letter in July stating that the matter was being dropped and no action was required by the New York house.

Dorothy’s strong stance in favor of war tax resistance was likely influenced by anarchist Ammon Hennacy. Her war tax resistance articles in the 1950s often cite his example. Though Ammon did not move into the New York house until the early 1950s, he had first stopped by the New York Worker in 1938 and wrote several articles for the paper during the 1940s and 1950s.

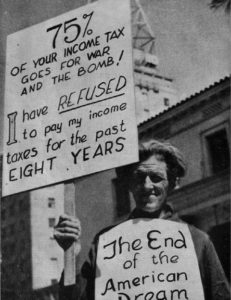

Ammon had refused paying the federal income tax during World War II after the passage of Roosevelt’s Revenue Act. When it became clear that federal law would require his employer to begin withholding taxes from his wages, he switched to working agricultural jobs in the fields, which were not subject to federal tax withholding. All the while he never tried to evade the IRS’ notice. Quite the opposite, he would regularly picket the IRS and promote war tax resistance in his writings.

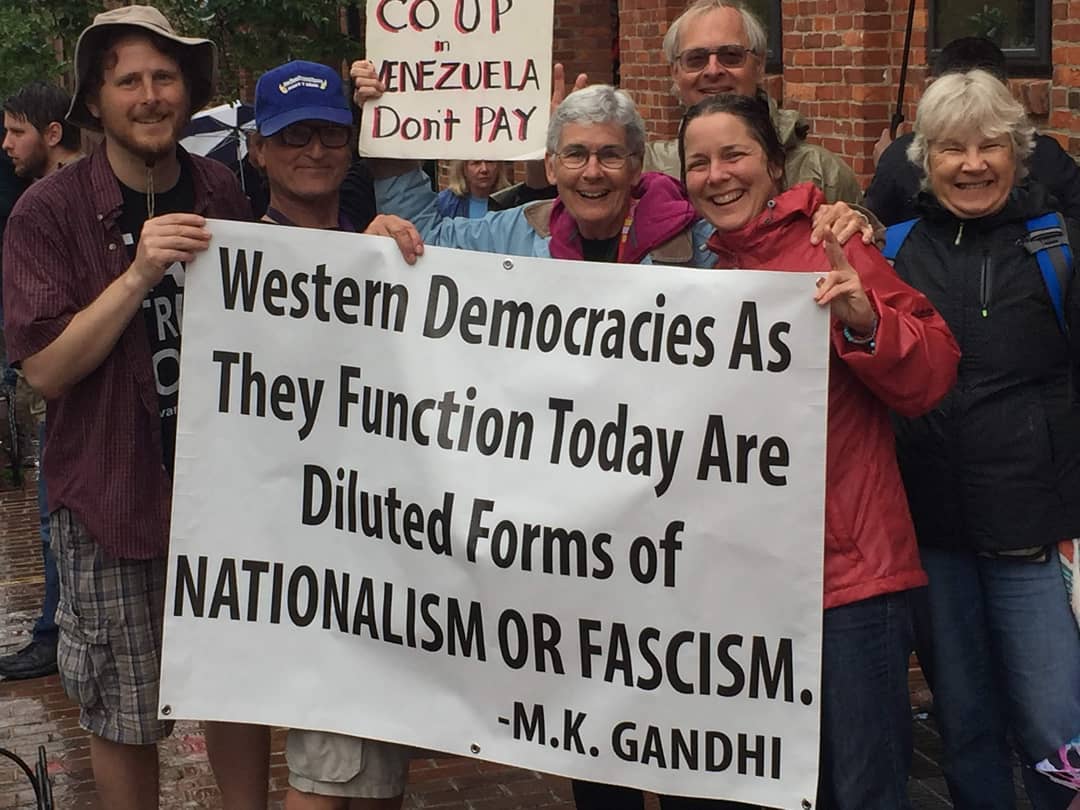

NWTRCC & DC Catholic Workers at the Venezuelan Embassy after the Sunday business meeting in May 2019. Photo courtesy of Chrissy Kirchhoefer.

Most Catholic Workers who resist war taxes, do so by earning under the taxable income limit ($14,600 for a single person; $29,200 for a married couple). But many others have also made more than that and refused to pay. By happenstance, the two people acting as part-time paid consultants for NWTRCC right now are both Catholic Workers—myself and Chrissy Kirchhoefer. We see our war tax resistance as carrying on a long and rich history within the Catholic Worker movement.

~Post by Lincoln Rice

I withheld $357 and included a photo of my check for $357 payable to Doctors Without Borders. No reply from IRS .

Thank you for this wonderful commentary. As someone who decided at age 14 (in 1978) that I would refuse to pay into the war machine, I love being reminded about the roots of my decision. Of course, living and working with Wally and Juanita Nelson for many years helped me maintain my resolve. Now, at 60, I find ever more reasons to resist. Thank you for giving me pause in a busy day to reflect on what became for me a lifelong path. I appreciate your work and cheer you on. It’s an honor to be fellow travelers with you folks.

Eveline

I love NWTRCC, Chrissy and Lincoln do an amazing job of keeping this group stronger than ever! I am proud to know that there is a group that live their lives in line with their values! And together we are stronger!

“No troublesome incidents of any kind developed in the course of the day, although the customary band of pickets turned up outside the Forty-Fifth Street headquarters for an hour at noon. Recruited by members of the Tax Refusal Committee of Peacemakers, of Sharonville, Ohio, were representatives of the War Resisters League, 5 Beekman Place [sic, Street], and The Catholic Worker, 223 Christie Street.

“They either refused to pay Federal income Taxes or sympathized with those who did not because ‘the huge program of armaments can only lead to a third world war.’ Weapons, it was claimed, eat up seven-eighths of the national budget. In Philadelphia, other groups of pacificists [sic] objected on the same grounds.”

“Tax Plums Juiciest on the Final Day,” report on tax day events (formerly March 15), New York Times, March 17, 1953