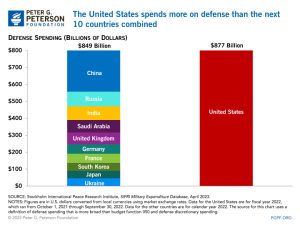

Since World War II, the percentage of Federal funds from income taxes that goes to the military in the United States has varied from about 45% to 90%. While spending on the pandemic has skewed the numbers to the lower end, the average taxpayer paid around $2,200 to the military in 2022. While it is often stated that the US spends more than the next 10 countries on their military, it is staggering to think that the allocation of $877 billion to the Pentagon in 2022 eclipses the that of China, Russia, India, Saudi Arabia, United Kingdom, Germany, France, South Korea, Japan and Ukraine totaling $849 Billion combined. Often these are points that are brought up to the general public around tax day.

Since World War II, the percentage of Federal funds from income taxes that goes to the military in the United States has varied from about 45% to 90%. While spending on the pandemic has skewed the numbers to the lower end, the average taxpayer paid around $2,200 to the military in 2022. While it is often stated that the US spends more than the next 10 countries on their military, it is staggering to think that the allocation of $877 billion to the Pentagon in 2022 eclipses the that of China, Russia, India, Saudi Arabia, United Kingdom, Germany, France, South Korea, Japan and Ukraine totaling $849 Billion combined. Often these are points that are brought up to the general public around tax day.

This past year, the US Campaign for Palestinian Rights launched an effort to #StopArmingIsrael around tax day to raise awareness of how much US taxpayer money is invested there and how it fuels the ongoing catastrophe. The campaign has created a map that allows US taxpayer to enter their information to figure out the future of your city when we take the $25.25 that the average US taxpayer spends in arming Israel and instead invested it in community needs evident all around us.

Since 1948, the US has provided Israel $150 billion in military aid ($260 Billion when adjusted for inflation.) More US taxpayer dollars in Foreign Military Financing (FMF) have gone to Israel since World War II than any other nation. Since 2001, Israel has received 52% of all US FMF with neighbors Egypt (24%) and Jordan (6%) as runners up and also some of the primary brokers of peace between Palestine and Israel.

Since 1948, the US has provided Israel $150 billion in military aid ($260 Billion when adjusted for inflation.) More US taxpayer dollars in Foreign Military Financing (FMF) have gone to Israel since World War II than any other nation. Since 2001, Israel has received 52% of all US FMF with neighbors Egypt (24%) and Jordan (6%) as runners up and also some of the primary brokers of peace between Palestine and Israel.

Beginning with president Clinton, the US has entered into a Memorandum of Understanding (MOU) that has guaranteed that the US will ensure support to Israel’s military for a decade in advance despite any budgetary or political concerns. In 2016, President Obama locked in $38 Billion over 10 years with an additional $500 Million per year for missile defense programs with additional billions being voted on for Israel for the Iron Dome during the pandemic when basic needs within our communities were glaringly evident.

Many aspects distinguish the United State’s support of Israel. One is the fact that Israel receives a lump sum of allocated MOU money in the first month of the budgetary year in which it can be deposited in an interest bearing account with the Federal Reserve which increases the money available to the Israeli military. This allows for more money to be invested in the Israeli military than is currently acknowledged and able to be tracked.

Through the Off Shore Procurement, Israel is also the only country receiving FMF that can invest that money in their own weapons manufacturers which has US taxpayers subsidizing Israeli military weapons industry. This has led to over the past decade of Israel shifting from primarily being an importer of weapons to now being among the top 10 countries to export weapons while ranked 100 in countries by population.

Another aspect of the unique relationship between Israel and the US is the Strategic Partnership Act of 2014 that ensures the Qualitative Military Edge (QME) of Israel over its neighbors. This act was put in place to maintain Israel’s military superiority in the region and to guarantee access to US advanced weapons systems. Already the United States has an estimated 3.4 Billion worth of “emergency” stockpile of weapons in Israel.

Palestine 2009. Israel’s Wall in Bethlehem, West Bank.

We should all know where our money goes. Tax day is a great time to raise that awareness. Daily we hear the news of how resources are being spent, bullets, smart bombs and weaponized drones marked with a ‘Made in the USA’ stamp.Community Peacemakers Teams raise some good questions of these times. Taxpayers deserve to know the true costs of war and our role in it.

Post by Chrissy Kirchhoefer

In order for BDS to be effective there must be strong, active support from U.S. activists, since so much of Israel’s military, political and economic strength depends on U.S. aid.

Mike that is so true! At our recent teach in on US taxpayer money going to Israel’s military, others were sharing how they see that support shifting with more people in the US aware of our role in this situation and how it impacts basic needs in so many communities going unmet.

Nice presentation filled with lots of relevant material that should help us reach the ears of people who need to know!

Larry thanks so much! I learned quite a bit in reseearching this especially from a short video that AFSC put out on the subject which I would encourage everyone to watch https://www.youtube.com/watch?v=AxOLXaKgIxA