War tax resistance has been practiced in America since long before there was a United States of America, but the modern war tax resistance movement that NWTRCC is a part of began to coalesce in the 1940s. Here are some brief biographies of some of the pioneers of this movement who began resisting by that decade.

- Mary Stone McDowell (1876–1955)

- Fired from her teaching job for refusing to push her students to buy war bonds during World War Ⅰ (a story that would later be featured on the television show Profiles in Courage), McDowell also refused to pay war taxes during World War Ⅱ, making her perhaps the only American to resist taxes through both world wars.

- Benny Bargen (1901–1972)

- An economics professor at Bethel college and a Mennonite, Bargen kept his income deliberately low during the 1930s so that he would not pay taxes for military spending. Later he joined the “Peacemakers” war tax resistance movement that emerged in 1948.

- Margaret E. Dungan (1884?–1982)

- Dungan was one of the founders of the Women’s International League for Peace and Freedom. She began refusing to pay war taxes in 1940.

- Arthur Evans (1920–2009)

- Evans was a Quaker and a physician who began resisting perhaps as early as 1940. In 1963 he was jailed for refusing to turn over records in his tax resistance case. “We doctors have pledged to serve life,” Evans wrote. “I find no way to finance mass murder — be it called war, defense, or security — and be true to this pledge.”

- Ernest Bromley (1912–1997)

- Bromley began resisting war taxes in 1941, when the U.S. government taxed automobile owners. Bromley refused to purchase a “defense tax stamp” for his car. He would eventually serve a 60-day jail sentence for this resistance. He went on to be an important organizer of the emerging American war tax resistance movement.

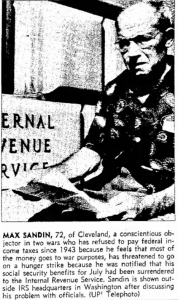

Max Sandin (1889?–1967)

Max Sandin (1889?–1967)- Sandin was sentenced to death for refusing to participate in the U.S. military as a World War Ⅰ draftee, but had his sentence commuted by President Wilson. He was jailed again for refusing to register for the draft in 1943, and began resisting war taxes that year as well. In 1961 he began a sit-down strike at the Treasury building when the government began to seize his pension and social security for back taxes.

- Walter Gormly (1915–2000)

- Gormly served three years in prison as a conscientious objector during World War Ⅱ around the same time as he began resisting war taxes. He was the first war tax resister to have his car seized by the government for back taxes (they auctioned it off for $230). “I do not care to finance the murder of my fellow man nor the possible murder of myself,” Gormly wrote in a letter to the president. “So your income tax men won’t receive any tax payment nor statement of income from me.”

- Dorothy Day (1897–1980)

- Day was central to the Catholic Worker movement in the United States. She refused to file income tax returns either for herself or for the Catholic Worker organization. “‘Render to Caesar the things which are Caesar’s.’ Yes, and we have heard too much of that,” she wrote in 1943. “[I]n these days it would be desirable to go even further, as did Thoreau, to refuse even the taxes which were to be used to pay for the means to kill our fellow man.”

- Ammon Hennacy (1893–1970)

- Hennacy was a conscientious objector in both world wars, and was imprisoned during World War Ⅰ for distributing anti-war literature. He never paid his income tax, usually working as a field laborer in order to avoid tax withholding. He called himself a “one-man revolution” and a Christian anarchist, and like Dorothy Day, was active with the Catholic Worker movement. Each year he would fast and picket the IRS building on the anniversary of the atomic bombing of Japan.

![Won’t Pay “War” Tax: [Cambridge, Mass., March 1] — Mr. and Mrs. Francis B. Riggs go over their federal income tax statement after announcing that for the eighth successive year they would refuse to pay that part of tax they estimate would go for “war.” This year they are refusing to pay 94.2 per cent of their tax. Riggs, 69, a retired school headmaster, says their stand is the “older peoples” equivalent of that taken by young men who go to conscientious objectors’ camps rather than fight. Each year the Riggs have eventually paid up their taxes, plus penalties.](https://nwtrcc.org/wp-content/uploads/2016/02/riggs-186x300.png) Valerie Behn Riggs (1885?–?)

Valerie Behn Riggs (1885?–?)- Francis Behn Riggs (1881–?)

- In 1944 Valerie Behn Riggs began refusing to pay a portion of her income tax in protest against military spending. Valerie explained: “My conscience tells me that the killing of human beings is a criminal act, and that paying for that killing is likewise criminal.” Her husband Francis joined her in resistance in 1948. They felt this to be the equivalent of conscientious objection to military service for people who were too old to be drafted. Usually the IRS would successfully seize the refused taxes, but the Riggses felt that nonetheless their protest had been made successfully.

- Mary Bacon Mason (?–1952)

- A music instructor and author of music books, Mary Bacon Mason was one of the early war tax resisters whose resistance predates the formation of “Peacemakers” in 1948, her own resistance going back at least as far as 1946.

- Marion C. Frenyear (1896–?)

![Tax Holdout: The Reverend Marion C. Frenyear, pastor of the Congregational Church at South Hartford, New York, says she paid only one-fourth of federal income tax because “taxes should be used to bring peace and disarmament to [the] world.”](https://nwtrcc.org/wp-content/uploads/2016/02/MarionFrenyear-127x300.png)

- Frenyear was a Congregational Church pastor (later a Quaker) who began refusing to pay a portion of her income tax in 1946 because she felt that “taxes should be used to bring peace and disarmament to the world.” She also worked with the Fellowship of Reconciliation.

- Marion Coddington/Bromley (1912–1996)

- Marion Coddington began refusing to pay war taxes in 1947, and, with her new husband Ernest Bromley (see above), helped to found the first war tax resistance group of the modern era, “Peacemakers,” in 1948. She wrote: “I do not accept the notion that the State can choose an enemy for me and force me to help annihilate the State’s enemy.”

- Wally Nelson (1909–2002)

- During World War Ⅱ, Wally Nelson was imprisoned for refusing to cooperate with the draft. He became a “freedom rider” and an organizer with the Congress of Racial Equality. He helped to found “Peacemakers” in 1948.

- Juanita Nelson (1923–2015)

- Juanita Nelson was a journalist who met her lifelong partner Wally by interviewing him when he was in prison for resisting the draft. She helped to found “Peacemakers” in 1948. She is one of the few war tax resisters to have been arrested and taken to court for her resistance.

- Irwin Hogenauer (1912–1984)

- Hogenauer was imprisoned during World War Ⅱ for noncooperation with the military draft. He helped to found “Peacemakers” in 1948 and was an active war tax resistance counselor thereafter. He refused to file tax returns with the IRS because he felt that even filing a return was too much cooperation with the war system.

- Walter Cook Longstreth (1881–1975)

- Emily Corson Poley Longstreth (1887–1975)

- Walter Longstreth was an attorney who assisted draft resisters during World War Ⅱ. The Longstreths announced in 1948 that they would be refusing to pay the portion of their income taxes they believed to be destined for war expenses, donating that amount instead to charity.

- Caroline Foulke Urie (1874–1955)

![Widow Defies Government. Yellow Springs, Ohio, March 14 [1949] — Mrs. Caroline Urie, 75-year-old widow, deducted 32.3 per cent of the first installment of her income tax because she said “war and preparation for war in the atomic era is a crime against nature.” The percentage deducted — the amount she estimated would go for military purposes — will be donated to three non-profit agencies working for peace and abolition of war, she said.](https://nwtrcc.org/wp-content/uploads/2016/02/CarolineUrie-117x300.png)

- Caroline Urie wrote to President Truman, saying: “As a Christian, I must henceforth refuse to contribute in any way to maintaining the institution of war.” Urie was one of the founding members of the Tax Refusal Committee of “Peacemakers” in 1948.

- William Bacon Evans (1875–1964)

- Evans was a Quaker poet who left a mark on the Philadelphia Yearly Meeting, of which he was clerk for a time. He had begun refusing to pay war taxes by 1948.

- Ralph T. Templin (1896–1984)

- Ralph Templin was a missionary stationed in India, and an admirer of Gandhi’s techniques. The British government expelled him because of his support for Gandhi’s movement. Back in the U.S., he helped to form the “Harlem Ashram” and its Non-violence Direct Action Committee, which concentrated on non-violent actions to fight racial discrimination, and was active with “Peacemakers”.

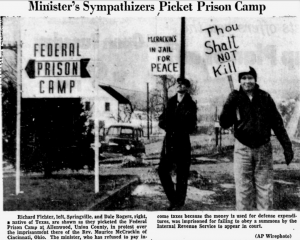

Maurice McCrackin (1905–1997)

Maurice McCrackin (1905–1997)- Rev. McCrackin was imprisoned in 1958 for contempt of court after practicing total noncooperation during his trial for refusal to respond to an IRS summons. In 1962, the Cincinnati Presbytery defrocked him for his war tax refusal (the General Assembly of the Presbyterian Church unanimously reversed this decision in 1987).

- James Otsuka (1921–1984)

- Katsuki James Otsuka was a Nisei Japanese American Quaker who was imprisoned many times: for being a Japanese-American during World War Ⅱ, as a conscientious objector to the military draft, for his war tax resistance, and for infiltrating a nuclear weapons facility to leaflet.

- Horace Champney (1905–1990)

- “I would rather go to prison or be shot than to grant my support to the military establishment of any country,” Champney wrote in his letter to the IRS. He became particularly outspoken in promoting war tax resistance during the Vietnam War.

- Aleck D. Dodd

- Ruth Dodd

- Rev. Aleck Dodd began refusing to pay war taxes in 1949. When the government filed a lien against him, the Toledo, Ohio Council of Churches fired Dodd from his position, leading several other pastors to protest. The Dodds stated that they “are paying part of our income tax because we believe in supporting all constructive things the Government is doing, but we are declining to pay that percentage of it which we understand goes for purposes of war.”

- Robert C. Friend

- Friend was a Unitarian religious education director and reformer who also battled racial discrimination through his work with the Fellowship of Reconciliation. He signed the Peacemakers war tax refusal pledge in 1949.

- Alexander Katz (1918? 1924?–1988?)

- Katz was an anti-war activist who was imprisoned for refusal to cooperate with the draft during World War Ⅱ and then again in 1948. He was active with the Committee for Non-Violent Revolution.

- Abraham Johannes “A.J.” Muste (1885–1967)

- A.J. Muste was a peace and labor activist who was head of the Fellowship of Reconciliation when he began to refuse to pay war taxes in 1949. From then on, he would send the government a bible and a copy of Thoreau’s Civil Disobedience in lieu of his tax return. Later, he would become the chairman of the Committee for Nonviolent Action, and would help to organize that group’s mass war tax resistance actions.

- Ross W. Anderson (1900?–?)

- Anderson was a peace, civil rights, and civil liberties activist who engaged in multiple acts of civil disobedience to disrupt American deployments of weapons of mass destruction, and who signed the 1949 Peacemakers war tax resistance pledge.

- Marilyn Blaise Neuhauser (1922–2004)

- Marilyn Blaise Neuhauser, a Quaker from North Carolina, signed the 1949 Peacemakers tax refusal pledge and the No Tax for War Committee protest in 1967.

- Lindley J. Burton (1921?–?)

- Emma Burton

- Lindley was an Bryn Mawr mathematics professor and was active with the Fellowship of Reconciliation. He signed the 1949 Peacemakers tax refusal pledge and the No Tax for War Committee protest in 1967.

- Miriam Keeler Cornelius (1897?–1998)

- Cornelius was an economist who wrote and edited publications at the U.S. Department of Labor, she was active with the Fellowship of Reconciliation, and signed the 1949 Peacemakers tax refusal pledge. She resigned from the Fellowship of Reconciliation staff when they refused to honor her request not to have income tax withheld from her paychecks.

- Caleb Foote (1917–2006)

- Hope Foote (1911–2011)

- Caleb was imprisoned for draft resistance twice during World War Ⅱ, eventually receiving a pardon from President Truman. He served as executive director of the Central Committee for Conscientious Objectors, and also worked with the Fellowship of Reconciliation. He went on to work for reforms in the criminal justice system. He and Hope, a peace and community activist who raised the couple’s children while Caleb was imprisoned, were signers of the 1949 Peacemakers war tax resistance pledge.

- George M. Houser (1916–2015)

- Houser was part of the conference at which Peacemakers was formed, and signed its tax resistance pledge. He also co-founded the Congress of Racial Equality and the Committee for Nonviolent Revolution, was an early freedom rider, and was active with the Fellowship of Reconciliation.

- Milton Mayer (1908–1986)

- Mayer brought a legal suit to recover war taxes seized from him that went as far as the Ninth Circuit Court of Appeals, which denied his claim. One of the judges in that case asked his attorney: “Counsel, is your client aware that if this Court holds in his behalf the Court itself will be laying the axe to the root of all established government?” The attorney responded: “I think he is, your honor.”

- James Peck (1914–1993)

- Peck was a labor activist and World War Ⅱ conscientious objector who was active with the War Resisters League. He was also a civil rights activist who was severely beaten by racists while on a freedom ride.

- Grace E. Rhodes

- Rhodes was a Quaker who attended the 1950 World Peace Conference in India soon after signing the 1949 Peacemakers war tax resistance pledge.

- Igal Roodenko (1917–1991)

- Roodenko was a conscientious objector who was imprisoned during and after World War Ⅱ for his refusal to cooperate with the military draft. He was also active with the War Resisters League and the Committee for Nonviolent Revolution.

- Laurence “Larry” Scott

- Scott was a founder of A Quaker Action Group, which attempted to deliver humanitarian aid to North Vietnam and pushed for other forms of organized direct action beyond what existing Quaker activist groups were willing to try. He also worked with the Committee for Nonviolent Action.

- Beverly White

- J. William Hawkins

- Raymond E. Kinney

- Paula Back

- Caroline Phillips

- Lydia Phillips

- Louise Thomas

- Additional signers of the 1949 Peacemakers war tax resistance pledge.