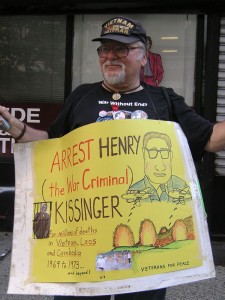

I had a blog piece in mind after seeing Secretary of State John Kerry — once an antiwar hero — cozily meeting with that war criminal Henry Kissinger for advice about Russia and Syria. To add insult to injury the meeting fell on September 11, exactly 40 years from the day that Kissinger’s maneuvering led to the overthrow of a democratically elected head of state in Chile. Looking at Kissinger I see the blood of thousands dripping from his hands.

But you don’t really need to read about him on this blog. Amy Goodman has a good piece, “Kerry, Kissinger and the Other Sept. 11,” and the Willamette Reds blog makes a quick observation also. If you want to read a lot more, Wikileaks goes right to the source with its posting of thousands of documents on the man; look for The Kissinger Cables.

If you are unsure why you should risk your economic health by becoming a war tax resister, do a little reading about Kissinger. Your tax dollars are paying for current wars, but they are also paying to fly that war criminal to DC and who-knows-where-else to spread his special brand of terror.

So I’m not writing about that. On to more mundane things, like….

bank account seizures!

A series of emails to NWTRCC starting in July were from a longtime resister reporting her frustration with the consequences of an IRS levy on her bank account. The IRS wants a lot, but at the time of the levy there was only $100 in the bank account, and the levy applies to what is in the account at the time it arrives. So if you have a tax debt and don’t want the IRS to get the money, don’t keep much in the bank. (Note: Resisters make different choices about collection; some are ok with the money being seized and focus on refusing to pay voluntarily. Others do their best to keep any money from going to war and make it harder for the IRS to collect.)

What happened with our fellow resister was that the bank had a $125 processing fee for the levy (this is not uncommon), so the bank took the $100 and left the resister with a negative $25 balance. The IRS got nothing. Yay! The resister went to the bank and paid the $25 balance due, but the bank would not close the account. That’s where the whole thing got very annoying. Boo! The bank gave her no reason for refusing to close the account except that it had accrued a $15 fee because the balance fell below $100. She wrote board members, called the bank headquarters, and wrote frustrated emails.

In September she finally heard that somewhere hidden in the small type of the IRS levy is something about a 60-day rule. The bank can’t close the account until 60 days after the levy arrives. No one at the bank had told her about this; they just said they could not close the account.

So, a happy ending afterall. The account is closed. The bank is rebating the “low balance” fees. The resister has survived another round and continues to refuse to pay for war. A lot of war tax resistance can be annoying and inconvenient; that’s when I think about Henry Kissinger and it gets me focused on why I’m doing it again.

Tip: Interest of $10 a year and up is reported to the IRS annually by banks. This makes it easier for the IRS to locate your bank account if they are trying to collect. Non-interest bearing accounts make it a bit harder for them. Interest is an interesting topic, by the way.

Post by Ruth Benn