In the modern war tax resistance movement (since World War II), very few people have been brought into Federal court, convicted, or jailed because of their war tax resistance. In fact, only two war tax resisters — James Otsuka (1949) and J. Tony Serra (2005) — were ever jailed for not paying taxes. Most resisters have been taken to court on related charges, such as failure to file, “falsifying” 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) for “fraudulently” claiming too many dependents on their W-4 form.

[Click to see a list of IRS property seizures against war tax resisters]

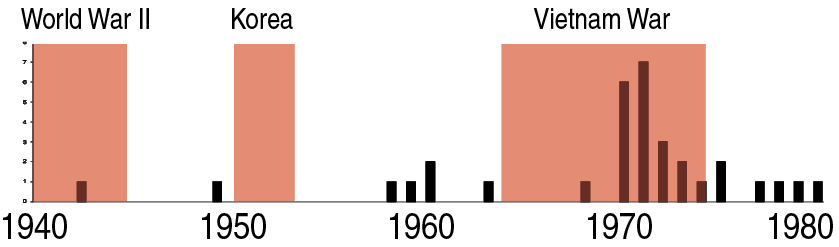

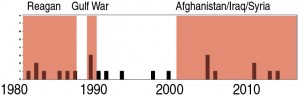

The shortest column represents one person and the tallest is seven people who were taken to court for war tax resistance related cases. The year represents the indictment or initial court appearance. (Data as of October 2024.)

| Year Resister | City, State | |

| Charge | Sentence | Time Served |

| Notes | ||

| 1942 Ernest Bromley | Bath, NC | |

| tax evasion | 2 mo. | 2 mo. |

| refusal to pay $7.09 car defense tax stamp | ||

| 1949 James Otsuka | Richmond, IN | |

| contempt and tax refusal | 3 mo. + $100 | 4.5 mo. |

| refusal to turn over records or pay $4.50 income tax; released 1/16/1950 | ||

| 1958 Maurice McCrackin | Cincinnati, OH | |

| refused summons to produce records for IRS | 6 mo. +$250 | 6 mo. |

| noncooperated with court; jailed (12/58) and released (5/59); conviction overturned | ||

| 1959 Juanita Nelson |

Philadelphia, PA | |

| refused summons to produce records | — | 1 day |

| arrested, taken to court (6/16/59); charges eventually dropped | ||

| 1960 Eroseanna Robinson | Chicago, IL | |

| contempt for refusing summons to produce records | 12 mo. | 3 mo. |

| noncooperated with court; jailed in Alderson, WV; hunger strike; released 3/1 | ||

| 1960 Walter Gormly | Mt. Vernon, IA | |

| contempt | 7 days | 7 days |

| order to show cause for refusal to produce records for IRS | ||

| 1963 Arthur Evans | Denver, CO | |

| contempt for refusal to produce records | 3 mo. | 3 mo. |

| Jefferson County Jail (8/12/63) | ||

| 1968 Neil Haworth | Haddam, CT | |

| contempt for refusal to produce records | 2 mo. | 2 mo. |

| cited First Amend.; Middlesex State Jail | ||

| 1970 Jim Shea | Vienna, VA | |

| false/fraudulent W-4 and bail-jumping | 12 mo. | 9½ mo. |

| after 1970 conviction, jumped bail, then surrendered in 1974 | ||

| 1970 Sally Buckley | St. Paul, MN | |

| false/fraudulent W-4 | 1 mo. | — |

| convicted (11/16) but her tax ($217) anonymously paid by friend | ||

| 1970 Jack Malinowski | Philadelphia, PA | |

| false/fraudulent W-4 | — | — |

| indicted (1970), convicted (1971), sentenced (1972) to 3 mo. probation | ||

| 1970 Dennis Richter | Minneapolis, MN | |

| false/fraudulent W-4 | ? | ? |

| indicted Sept. 1970 for declaring 40 million dependents [disposition unknown] | ||

| 1970 Donald Callahan | Philadelphia, PA | |

| false/fraudulent W-4 | — | — |

| indicted (12/16/70); charges dropped (1972?); deal could have been made | ||

| 1970 James Smith | Springfield, MO | |

| false/fraudulent W-4 | $50 | — |

| arraigned (1970), convicted & sentenced (1971) to $50 fine | ||

| 1971 Karl Meyer | Chicago, IL | |

| false/fraudulent W-4 | 24 mo. | 9 mo. |

| indicted, pled nolo, sentenced (5/21), jailed in Sandstone, MN; released 2/16/72 | ||

| 1971 Bill Himmelbauer | Chicago, IL | |

| false/fraudulent W-4 | 12 mo. | 6 mo. |

| indicted, pled nolo, sentence (6/22); Sandstone, MN | ||

| 1971 Mike Fowler | Chicago, IL | |

| false/fraudulent W-4 | 1 mo. | 1 mo. |

| indicted (4/15), pled guilty, sentenced by Julius Hoffman | ||

| 1971 Ellis Rece | Augusta, GA | |

| false/fraudulent W-4 | 12 mo. + $5,000 | 1½ mo. + $5,000 |

| indicted (Oct. 71) for claiming 53 dependents; guilty (5/22/72); sentenced (5/26/72) | ||

| 1971 Henry Braun | Philadelphia, PA | |

| false/fraudulent W-4 | 3 mo. + $500 | — |

| arraigned (1971), convicted (1972), sentenced (5/15/73) | ||

| 1971 Roy Schenk | Madison, WI | |

| false/fraudulent W-4 | — | — |

| pled nolo, found guilty (11/71) to falsifying W-4; disposition unknown | ||

| 1971 Mark T. Riley | Sacramento, CA | |

| false/fraudulent W-4 | 6 mo. + $500 | 5 mo. |

| indicted (1971); sentenced (1972) prison | ||

| 1972 Carole Nelson | Minneapolis, MN | |

| refusing to produce records | 10 days | 10 days |

| order to show cause (5/2) | ||

| 1972 Lyle Snider | Greensboro, NC | |

| false/fraudulent W-4; contempt for refusing to stand | 9 mo. | — |

| 3 billion dependents claimed on W-4; arrested (1972), convicted (1973); all reversed on appeal (1974) | ||

| 1972 Ron Mitchell | Madison, WI | |

| false/fraudulent W-4 | ? | ? |

| indicted for inflating W-4 but disposition unknown | ||

| 1973 John Leininger | Rochester, NY | |

| false/fraudulent W-4 | 1 hour! | 2 mo. |

| arrested (1973); sentenced (1974) to 1 hr. but spent 2 mo. noncooperating | ||

| 1973 Martha Tranquilli | Clarksdale, MS | |

| tax fraud (Form 1040 dependents) | 9 mo. | 7½ mo. |

| claimed 6 peace organizations as dependents | ||

| 1973 Neil Haworth | New York, NY | |

| order to show cause 9/4/73 | — | — |

| appeared before IRS 12/19/73 and refused to answer based on 5th Amendment | ||

| 1974 J. Tony Serra | ||

| failure to file | 4 mo. | 4 mo. |

| SF attorney defends self and is acquitted on 2 of 3 charges | ||

| 1975 Robin Harper | Philadelphia, PA | |

| order to show cause | — | — |

| won with Fifth Amendment | ||

| 1975 Margaret Haworth | New York, NY | |

| order to show cause | — | — |

| won with Fifth Amendment | ||

| 1977 Richard Catlett | Kansas City, MO | |

| failure to file | 2 mo. | 2 mo. |

| 10 mo. susp., plus 3 years prob.; indicted 1977, sent. 6/14/78, jailed 1/5–3/5/79 | ||

| 1978 Bob Anthony | Philadelphia, PA | |

| order to show cause | — | — |

| judge sat on case until 1982 then ruled against Anthony | ||

| 1979 Bruce Chrisman | Carbondale, IL | |

| failure to file | 12 mo. | — |

| sentenced to a year voluntary service and 3 yrs probation | ||

| 1980 Paul Monsky | Cambridge, MA | |

| false/fraudulent W-4 | — | — |

| sentenced to a year probation | ||

| 1981 Kenneth Pichler | Eau Claire, WI | |

| order to show cause | 19 days | |

| contempt; jailed & released after 19 days when agreed to turn over records | ||

| 1982 Kathryn Kohrman | Brattleboro, VT | |

| order to show cause; contempt | $300 | — |

| cited Nuremburg; ruled in contempt (7/22); turned over records (7/27) | ||

| 1982 Robin Harper | Wallingford, PA | |

| order to show cause | — | — |

| Justice Dept. withdrew subpoena to produce records before trial | ||

| 1983 Leo Volpe | Mays Landing, NJ | |

| failure to file | 4 mo. | 4 mo. |

| Restored Israel of Yahweh, small Bible-study community in NJ that preaches pacifism | ||

| 1985 Larry Bassett | Patchogue, NY | |

| order to show cause | — | — |

| won with Fifth Amendment | ||

| 1986 J. Tony Serra | San Francisco, CA | |

| willfully filing late | 12 mo. | — |

| 1 year suspended, 5 years probation | ||

| 1987 Dale Macurdy | Somerville, MA | |

| order to show cause | — | — |

| cited Fifth Amendment; IRS withdrew Order | ||

| 1989 Max Rice | Comer, GA | |

| order to show cause | 2 mo. | 40 days |

| contempt for not turning over records; used First Amendment | ||

| 1989 Don Mosley | Comer, GA | |

| order to show cause | 2 mo. | 40 days |

| contempt for not turning over records; used First Amendment | ||

| 1989 Bobby Hieger | New York, NY | |

| order to show cause | — | — |

| IRS withdrew Order after Hieger cited Fifth Amendment | ||

| 1990 Allen Moss | Baltimore, MD | |

| order to show cause | — | — |

| won with Fifth Amendment | ||

| 1991 Randy Kehler | Colrain, MA | |

| contempt | 6 mo. | 2½ mo. |

| Nuremburg; contempt for refusing not to return to his and Betsy Corner’s seized house | ||

| 1993 Bill Ramsey | St. Louis, MO | |

| violating terms of probation | 1 mo. | 1 mo. |

| ordered to pay taxes after convicted for leafleting inside IRS; jailed (8/24) | ||

| 1997 Jan Passion | VT | |

| order to show cause | — | — |

| IRS withdrew Order after determining case uncollectible | ||

| 1999 Ed Hedemann | Brooklyn, NY | |

| order to show cause | — | — |

| judge accepted 5th Amend. in refusal to turn over papers to IRS (3/5/99) | ||

| 2004 Inge Donato | Mays Landing, NJ | |

| failing to withhold and pay taxes for employees | 6 mo. | 6 mo. |

| Restored Israel of Yahweh, small Bible-study community in NJ that preaches pacifism; convicted (2004), jailed (2005), released (2006) | ||

| 2004 Kevin McKee | Mays Landing, NJ | |

| attempted evasion of employment taxes and failure to file | 24 mo. | 24 mo. |

| Restored Israel of Yahweh, small Bible-study community in NJ that preaches pacifism; convicted (2004), jailed (2006), released (2008) | ||

| 2004 Joe Donato | Mays Landing, NJ | |

| attempted evasion of employment taxes and failure to file | 27 mo. | 27 mo. |

| Restored Israel of Yahweh, small Bible-study community in NJ that preaches pacifism; convicted (2004), jailed (2006), released (2008) | ||

| 2005 J. Tony Serra | San Francisco, CA | |

| willful failure to pay $44,000 in taxes for 1998 & 1999 | 10 mo. | 9 mo. |

| convicted (2005), jailed (2006), released (2007), plus one month in a halfway house | ||

| 2010 Frank Donnelly | Lamoine, ME | |

| tax fraud, falsifing and lying on his returns | 12 mo. | 4½ mo. |

| Underreported income 2002–2004; ordered to pay $3,000 fine & $90,000 in back taxes; released 12/15/10 to halfway house; released June 2011 | ||

| 2010 Carlos Steward | Asheville, NC | |

| filing false tax returns and failure to file | 24 mo. | 16 mo. |

| pleaded guilty Feb. 2010; sentenced 6/30/10; imprisoned 8/7/10; released to halfway house 12/1/11 until Spring 2012 | ||

| 2012 Cindy Sheehan | Vacaville, CA | |

| order to show cause | — | — |

| cites 1st & 5th Amend. in District court refusal to respond to IRS (4/19/12); Sheehan line-by-line refusal in IRS office (5/9/12) | ||

| 2013 Joseph Olejak | Delmar, NY | |

| willful failure to file | 26 wkends. | 26 wkends. |

| Resister since 1994, sentenced (10/17/13) in Federal District Court to 26 weekends in jail, $240K back taxes, and community service | ||

“Order to Show Cause” — If unsuccessful in finding sufficient assets of a resister, the IRS’s last resort is to convince a U.S. Attorney to issue an Order to Show Cause. This Order asks a U.S. District Court judge why a refuser should not be held in contempt for not giving the IRS the financial information it seeks. The Order often requires the resister to make a written response and appear in court. If the judge does not dismiss the Order and the resister does not provide the required financial information, the resister could be held in civil contempt of court and jailed. Resisters argued their opposition to paying for war and the military based on moral, religious, or political grounds, or on international law; in addition some pled the Fifth or First Amendment.

SOURCES: The Peacemaker, Peacemakers, 1949–1992; Handbook on the Nonpayment of War Taxes, Peacemakers, 1983; Tax Talk, National War Tax Resistance, 1969–1975; Center Peace, Center on Law & Pacifism, 1981–1985; Conscience, Conscience and Military Tax Campaign, 1982–1994; Network News, 1984–1994, NWTRCC; More Than a Paycheck, 1994 to present, NWTRCC