More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

June – July 2021

Contents

- Tax Day 2021 Reports

By Lincoln Rice and Chrissy Kirchhoefer - “Watch Your Taxes” By Ruth Benn

- Counseling Notes: Another Court Rules Against Passport Renewal Appeal • IRS Looking to Improve Tax Compliance and Collection

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Charity Online Fundraiser for NWTRCC • Extinction Rebellion Is Launching a “Climate Emergency Council Tax Strike” • Spanish WTRs Send Dried Flowers to Politicians

- NWTRCC News: In Memoriam—Dave Zarembka & Gladys Kamonya • Report from NWTRCC’s Third Online Conference • Mark your Calendars!!!

- Profile: Response to Anonymous about Truthfulness

By Larry Rosenwald

Click here to download a PDF of the June/July issue

Tax Day 2021 Reports

By Lincoln Rice and Chrissy Kirchhoefer

For the second year in a row Tax Day was postponed in the United States. Some groups went out around April 15, some went out around May 17, and some went out for both dates. A summary of reports and photos are included here, but NWTRCC’s website has the full reports and more photos.

Tucson, Arizona

Vigil was held at Davis-Monthan Air Force Base on May 17 to raise awareness of taxpayer money to fund

wars and occupations, the profits made by Raytheon, and to remember those lives lost to drones and

other instruments of war. Veterans for Peace, Women’s International League for Peace and Freedom, and

the Nuclear Resister sponsored the demo. —Felice Cohen-Joppa

Berkeley, California

The People’s Life Fund hosted a redirection ceremony to invest $61,000 in 25 different community organizations addressing needs in the Bay Area. A spokesperson from each group gave a brief intro to their mission and work in small group zoom chats. Members of the People’s Life Fund also shared their motivations for redirection. —Susan Quinlan

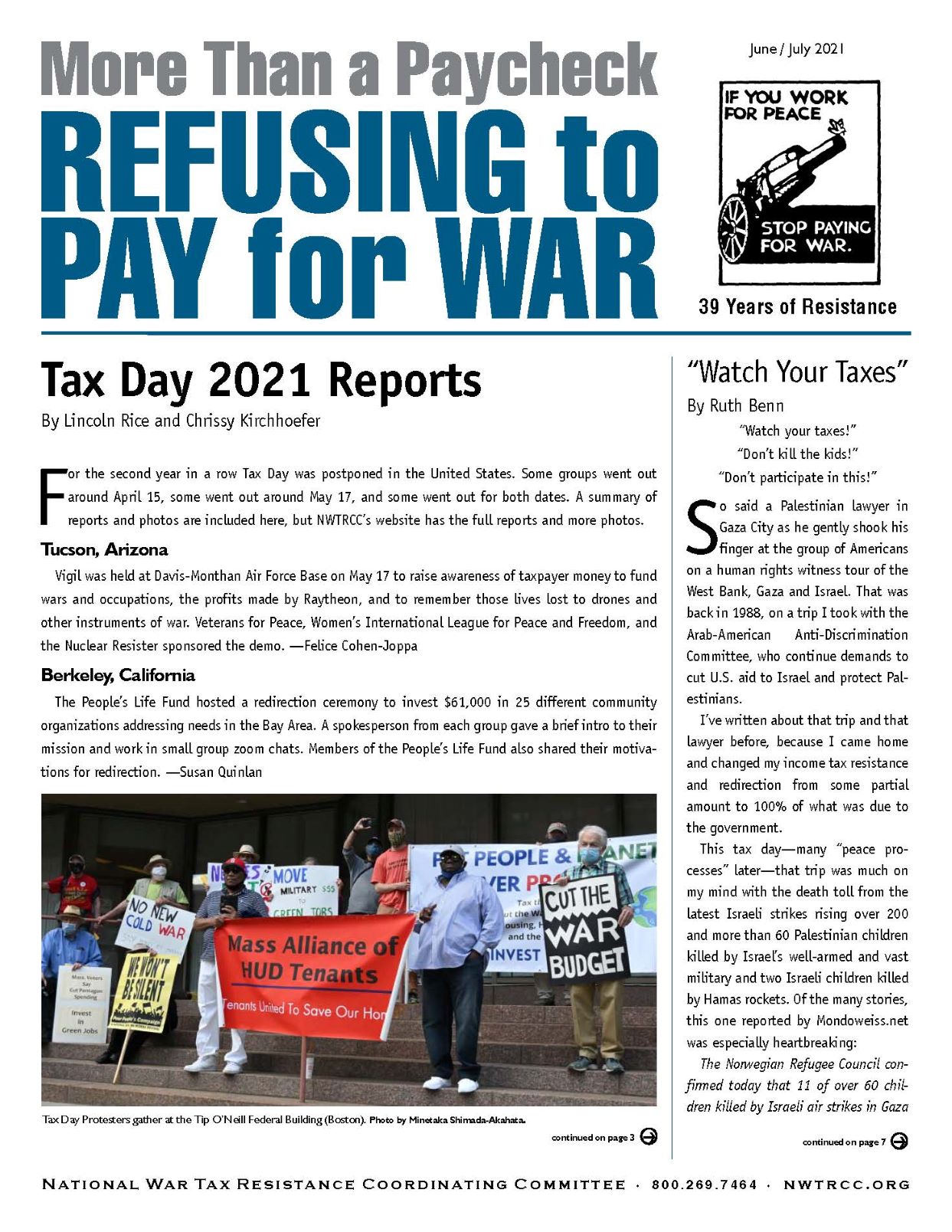

Protesters gather at the Tip O’Neil Federal Building on Tax Day 2021 to demand that their tax dollars go towards the people and the planet and not the profits of the wealthy and corporations. (Photo by Minetaka Shimada / Akahata – Used with Permission)

San Diego, California

An April 15 vigil to mourn the deaths, pain, and suffering caused by U.S. policies at the U.S.-Mexico border and to demand “Free them All” of those detained. Anne Barron, of the Peace Resource Center of San Diego, spoke to the role of U.S. taxpayers in militarizing the Southern border: “Spring is Tax Season, also known as War Tax Season. The federal income tax was originally created as a war tax to pay for our endless wars. What would you spend your tax dollars on? We believe taxes are best used to lift up all peoples, support ALL our communities, and protect our Earth.” —Anne Barron

South Bend, Indiana

Michiana War Tax Refusers held vigils on April 12th and May 17th outside of the federal building to raise awareness that close to 50% of federal tax dollars fund war. The long-established community handed out pie charts, engaged with community members, and encouraged people to question how tax money is spent. —Peter Smith

Boston, Massachusetts

A May 17th rally “Pressing for our Budget Priorities amid Pandemic, Economic and Climate Crises, and New Cold Wars” was held outside the O’Neill Federal Building. There were over 17 speakers and 12 organizations sponsoring the event. Mary Regan spoke for New England War Tax Resistance. The event promoted cuts to the Pentagon’s gargantuan budget as well as defunding new nuclear weapons, F-35 jets, and B-1 bombers. —Cole Harrison

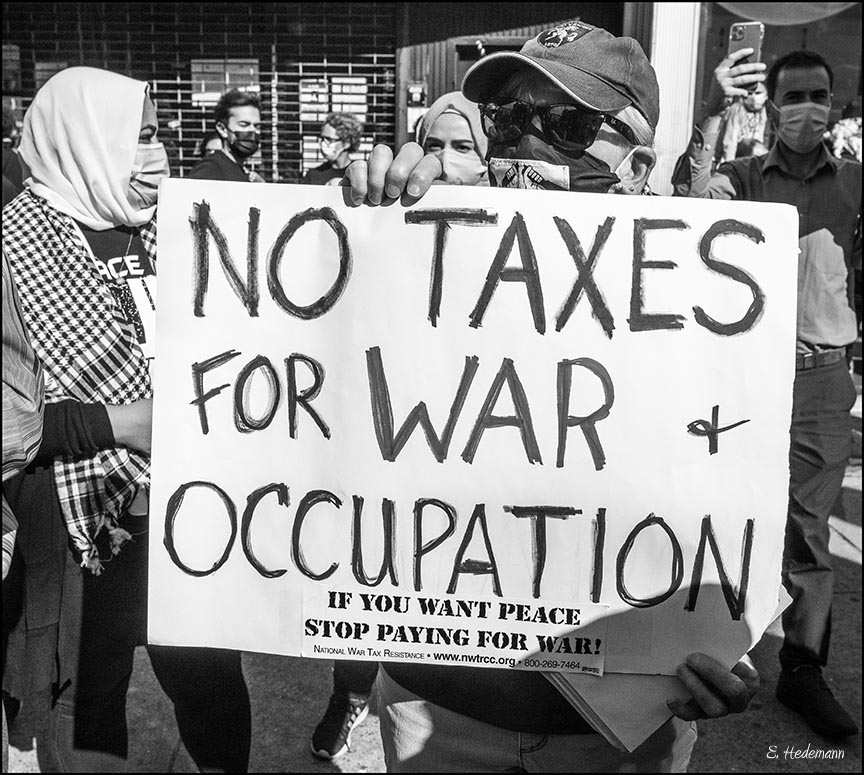

New York, New York

April 15th vigil outside the IRS office. “On this cold, soggy, ‘traditional’ final day to file income taxes, 25 to 30 ‘hard core’ antiwar activists stood in front of the IRS building in Manhattan. Even though the deadline this year has been pushed to May 17, we thought it worth reinforcing the message that too much money—desperately needed for health care, climate issues, jobs, housing, education—was being spent on war and the military.” The coalition of groups also demonstrated on May 17 where 50 people turned out at the Armed Forces Recruiting Center in Times Square before marching to the General Post Office. —Ed Hedemann

May 17 Tax Day protest at the military recruiting station in New York’s Times Square.

Photo by Ed Hedemann

Cleveland, Ohio

April 10th online discussion on Dr. King’s triple evils of racism, militarism, and excessive materialism with war tax resister Frida Berrigan. The event was cosponsored by the Cleveland Nonviolence Network, Cleveland Peace Action, Northeast Ohio Sierra Club, and the Inter Religious Task Force on Central America and Colombia. —Maria Smith

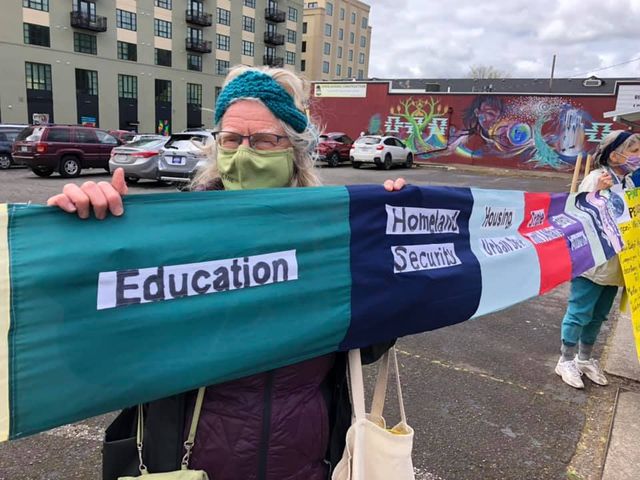

Eugene, Oregon

Sue Barnhart holding a long banner of Federal Budget in Eugene, Oregon

Photo Courtesy of Sue Barnhart

Over tax season we went to the farmer’s market twice and held banners and talked with shoppers. We also held banners at the federal building in Eugene that houses the IRS office on the traditional tax day and on tax day for 2021. We did public education to environmentalists at a 350 event and a Sunrise event by unrolling our long banner that shows a graph of the federal budget and how much goes to the military, with a sign explaining how the military is the biggest contributor of the climate catastrophe. —Sue Barnhart

Akron, Pennsylvania

On April 14th, 1040 for Peace hosted an online Service of ”Lament & Dedication.” Participants lamented the portion of federal taxes that support the military and dedicated letters of dissent to the U.S. government as well as conscientious objector contributions to peacebuilding organizations. On May 12th, they hosted an online gathering with Attorney Peter Goldberger. The discussion explored the feasibility of taking war tax resistance/redirection through the courts in light of the Religious Freedom Restoration Act. —H. A. Penner

Philadelphia, Pennsylvania

For their May Tax Day event, the Granny Peace Brigade asked passers-by near City Hall where they want their tax dollars spent. Passersby were given coins representing their tax dollars and chose where their tax dollars should go: education, health, or military. Philadelphians want their taxes used for helping people. Three local TV stations (3, 5 and 7) reported on the event. —Granny Peace Brigade Philadelphia

Milwaukee, Wisconsin

Milwaukee War Tax Resisters, with the Casa Maria Catholic Worker & Peace Action Wisconsin, held a vigil to protest federal tax dollars for war and environmental harm outside the U.S. Army Reserve on Saturday April 10th. —Lincoln Rice

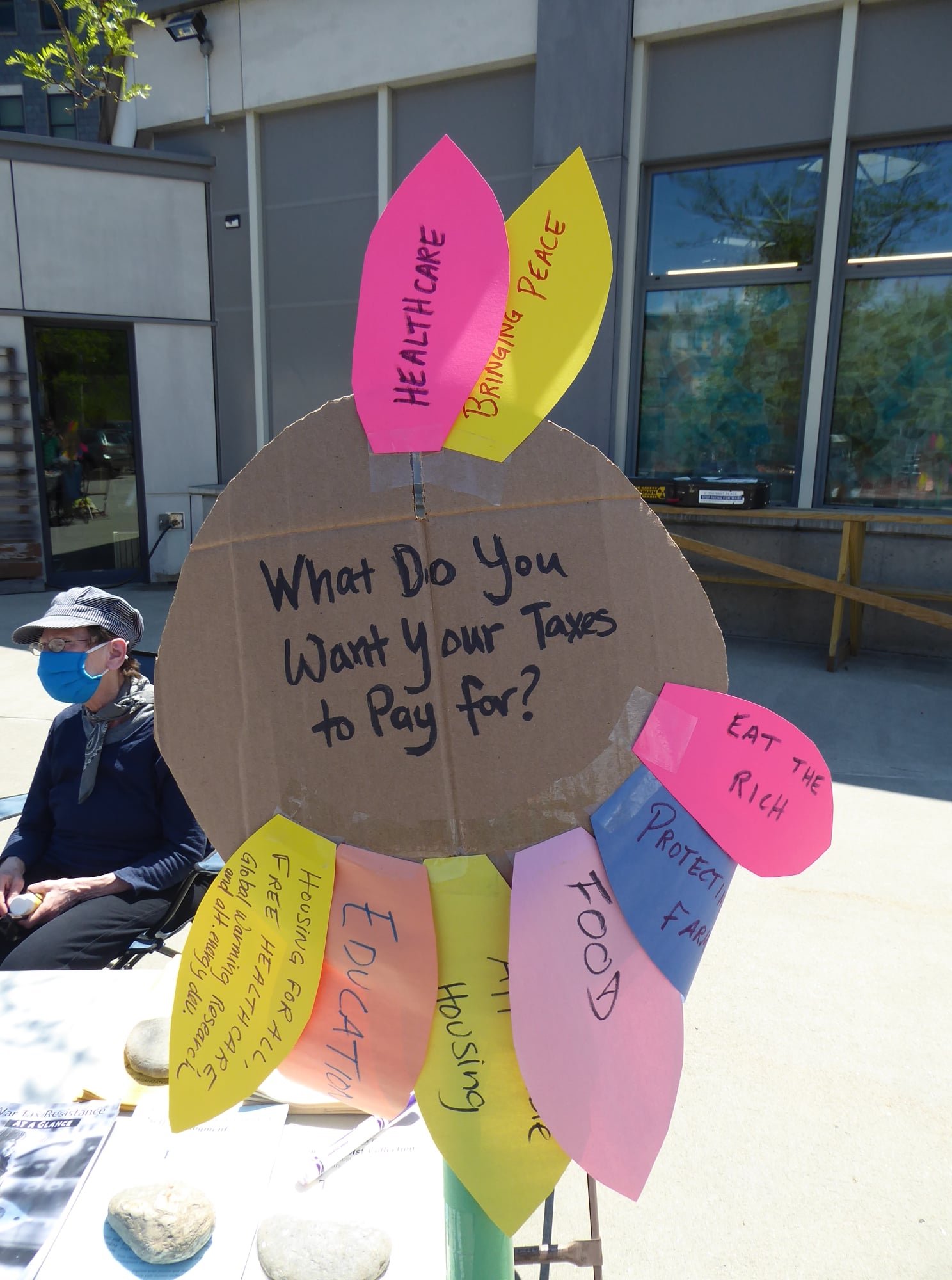

Brattleboro, Vermont

Flower Petals from Brattleboro Tabling Photo by Lindsey Britt

On Monday May 17th, Pioneer Valley War Tax Resistance tabled outside the Brattleboro Food Coop. We had a great time sharing information with folks (masked except for when we took pictures). We received answers to the question “What do you want your taxes to pay for?” and then put them on flower petals until we had a full flower! —Lindsey Britt

“Watch Your Taxes”

By Ruth Benn

“Watch your taxes!”

“Don’t kill the kids!”

“Don’t participate in this!”

So said a Palestinian lawyer in Gaza City as he gently shook his finger at the group of Americans on a human rights witness tour of the West Bank, Gaza and Israel. That was back in 1988, on a trip I took with the Arab-American Anti-Discrimination Committee, who continue demands to cut U.S. aid to Israel and protect Palestinians.

I’ve written about that trip and that lawyer before, because I came home and changed my income tax resistance and redirection from some partial amount to 100% of what was due to the government. This tax day — many “peace processes” later — that trip was much on my mind with the death toll from the latest Israeli strikes rising over 200 and more than 60 Palestinian children killed by Israel’s well-armed and vast military and two Israeli children killed by Hamas rockets. Of the many stories, this one reported by Mondoweiss.net was especially heartbreaking:

The Norwegian Refugee Council(NRC>) confirmed today that 11 of over 60 children killed by Israeli air strikes in Gaza over the last week were participating in its psycho-social programme aimed at helping them deal with trauma.

“We are devastated to learn that 11 children we were helping with trauma were bombarded while they were at home and thought they were safe,” said NRC>’s Secretary General Jan Egeland. “They are now gone, killed with their families, buried with their dreams and the nightmares that haunted them. We call on Israel to stop this madness….”

Of course, the list of reasons to refuse to voluntarily support the U.S. government with our tax dollars is long and extends far beyond the borders of Israel and Palestine. At our tax day demonstration people spoke of nuclear weapons, Yemen, endless war in Iraq and Afghanistan (including contractors who will remain even if U.S. troops leave), war on drugs, drones, militarization of the police here at home, border walls and troops at the border with Mexico, the military-industrial-congressional complex—and more.

On the other side, the list of services that need our redirected tax dollars is equally long. All of us love to imagine a world where those billions spent on war could be used instead to heal the wounds of war, take care of people, work to reverse the climate crisis.

It felt good to be out in the streets making our protests to the public and supporting each other, even as I fight the urge to throw up my hands and bury myself in novels as the wars rage on and the bodies of so many innocents of all ages pile up.

Ruth Benn on Nakba Day during protest for Palestinian rights, Brooklyn (May 15, 2021).

Photo be Ed Hedemann

Counseling Notes:

Purpose of this Section

This section serves as a hub for war tax resisters to keep abreast of the kind of actions the IRS is taking to collect federal tax debt. It also aids WTR Counselors, who are war tax resisters who volunteer to support existing and potential resisters. These counselors have undergone a day-long training to non-directively counsel individuals and aid them in determining their goals in regards to WTR, to discover the options most appropriate to their situation, and to assess realistically the possible consequences of those options. A current list of counselors by state can be found on the NWTRCC website (go to the “About Us” tab and click on “Local Contacts & Counselors”).This training is usually offered once a year and the next training will be online in early 2021. If you would be interested in attending one of these trainings, please contact the NWTRCC office at nwtrcc@nwtrcc.org or (800) 269-7464.

Another Court Rules Against Passport Renewal Appeal

In a recent case not involving a war tax resister, a Tax Court determined that the IRS properly certified to the Treasury Secretary that a taxpayer’s tax debt was “seriously delinquent.” The taxpayer argued that being certified with a “seriously delinquent tax debt” violated the Fifth Amendment Due Process Clause and the Universal Declaration of Human Rights’ protection of the right to international travel.

A “seriously delinquent tax debt” is an individual’s unpaid federal tax liability, which has been assessed at greater than $54,000. When someone has a seriously delinquent tax debt, the IRS is required to notify the taxpayer of the certification and notify the State Department, ensuring that the taxpayer cannot apply for a new passport or renew a current passport until the debt is paid.

The Court held that Code Sec. 7345 does not impose any restriction on international travel, but merely provides a way for the IRS to certify the existence of a seriously delinquent tax debt and for the Treasury Secretary to transmit that certification to the State Department. All passport-related decisions are left to the State Department and their authority to revoke a passport doesn’t derive from Code Sec. 7345, so the code doesn’t restrict the right to international travel.

IRS Looking to Improve Tax Compliance and Collection

In April, the IRS Commissioner outlined steps for the IRS to close the Tax Gap—the difference between the amount of tax owed by taxpayers for a given year and the amount that is actually timely paid for that same year.

Three scenarios represent the majority of the Tax Gap: non-filing by those legally required to file, underreporting on filed returns, and underpayment on filed returns.

IRS studies have consistently suggested that overall tax compliance is holding steady in the 82% to 84% range.

The study further estimated “that 36% of federal income taxes unpaid are owed by the top 1%.” About 60% of the Tax Gap comes from underreporting of income, including business income, on individual tax returns. Tax compliance is far higher when reported amounts are subject to third-party information reporting. The IRS calls the “visibility” or “transparency” of income sources and financial transactions a significant contributor to increasing the compliance rate.

To help close the Tax Gap, the Commissioner suggests:

- Improving IRS customer service • Focusing on high wealth noncompliance.

- Investing in IRS enforcement. (The Biden administration has proposed an $80 billion funding boost for the IRS over the next decade, aiming to strengthen tax enforcement, particularly with respect to high earners and large corporations.)

- Legislative changes to expand the scope of information returns, requiring withholding on certain Form 1099 income, especially 1099-MISC income and 1099-NEC, simplifying worker classification rules; and making repeated willful failure to file a tax return a felony.

These are only proposals, but NWTRCC will keep you up-to-date on any legislative changes.

Many Thanks

Thanks to everyone who donated for the May Appeal 2021! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc@nwtrcc.org. (Please let the NWTRCC office know if you use Resist.)

We are very grateful to these WTR groups and alternative funds for their redirections

and Affiliate dues:

- Taxes for Peace Not War (Eugene, Oregon)

- Boulder War Tax Info Project (Colorado)

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve.

Click on the icons at nwtrcc.org

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Consider a Bequest

NWTRCC accepts bequests which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arrangements through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC.

More information: nwtrcc.org/bequests, (800) 269-7464, or nwtrcc@nwtrcc.org.

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, 800-269-7464. Thank you!

Tax Resistance Ideas and Actions

Charity Online Fundraiser for NWTRCC

NWTRCC will hold another charity auction at the end of June. All items will be online and on display at Flood Gallery Fine Art Center (www.floodgallery.org) in Black Mountain, North Carolina. A link to the Auction is on the NWTRCC Homepage (www.nwtrcc.org). Please check out some art and let your friends know! All proceeds benefit NWTRCC.

Extinction Rebellion Is Launching a “Climate Emergency Council Tax Strike”

Extinction Rebellion U.K. recently stated, “Our movement has only scratched the surface of what non-violent civil disobedience can achieve. While they deceive and seek to oppress us further, we can take a stand against their ecocidal leadership—by simply withholding council tax then telling the world why we’ve done it.” The campaign is asking local groups in the U.K. to demand that their local councils declare a climate emergency and suspend projects that are ecologically irresponsible. [Thanks to David Gross for alerting the NWTRCC office to this news.]

Spanish WTRs Send Dried Flowers to Politicians

War tax resisters in Spain, organized under the Tortuga Antimilitarist Group, have sent letters to various political figures. The letters, accompanied by dried flowers, encourage the recipients to “stop collaborating with their respective institutions or roles in the service of violence and injustice and to join the 2021 war tax resistance campaign.” The flower-bearing messages were meant as a peaceful contrast to letters with death threats and accompanying bullets that were sent to the same figures last month by parties unknown. [Thanks to David Gross for alerting the NWTRCC office to this news.]

NWTRCC News

In Memoriam — Dave Zarembka & Gladys Kamonya

Dave Zarembka and Gladys Kamonya

By Bill Ramsey

Dave Zarembka died of Covid-19 on April 1 in his beloved Kenya. Gladys Kamonya, his wife of 21 years, succumbed to the virus a week earlier. Dave leaves behind a life devoted to deeds of nonviolence and seeds of healing change. The St. Louis Post- Dispatch memorial noted that Dave’s heart “was always in Africa.” In 1998, Dave founded the African Great Lakes Initiative of the Friends Peace Teams. Alongside African Quakers, he helped develop Healing and Rebuilding Our Communities programs in Rwanda, Burundi, Congo, and Kenya.

Randy Kehler, also a longtime WTR, recalls that Dave’s heart was first taken with Africa in 1964 when he and Dave, as college students, traveled together to East Africa as part of a student-run project to provide volunteer teachers in newly independent Tanganyika (now Tanzania). For 15 months they taught in a mudbrick school filled with eager but half-starving Rwandan youth — Tutsis who had fled a genocide attempt that preceded the more infamous one of 1995. Their experience among these young refugees planted in them some of the seeds that would grow into their life-long commitments, including to war tax resistance and redirection.

Randy also remembers that when the home he shared with Betsy Corner and their daughter Lillian was seized by the IRS as a result of their years of WTR, “Dave and his wonderful [then teenage] children, Tommy and Joy, spent a weekday and night vigiling with us, and many others, outside our house.”

Joy is now the Associate Director of the Institute for Peace Studies in Washington, DC and author of the book The Pigment of Your Imagination: Mixed Race in a Global Society. Tommy is the Strategic Partnerships Director at Food & Friends, which provides healthy food to people living with HIV/AIDS, cancer, and other life-challenging illnesses in Washington, DC. David’s other son, Douglas Kebengwa, is an IT consultant at Joseph’s House, which offers compassionate end-of-life care for homeless individuals with HIV and cancer in Washington, DC.

Randy adds, “As parents, activists, and war tax resisters, David and I heard many cautions about the possible detrimental impact of our resistance on our children’s lives. Joy, Tommy, and Douglas — as well as our daughter Lillian, are living proof that many children of active WTRs go forward to live healthy, productive, and inspiring lives.”

Karen Marysdaughter, who served as NWTRCC’s Coordinator from 1991 to 1999, says: “What I remember most about Dave during his time on NWTRCC’s administrative committee was his steadfastness, down-to-earth practicality, and sense of humor. He was one of a core group of tax resisters that I depended upon when I felt overwhelmed, discouraged, or lonely, which was fairly often. He supported me and my work unfailingly.

“When my partner Larry and I bought a fixer-upper house in rural Maine, Dave came to stay with us not once, but twice, to help work on the house. Talk about going above and beyond! Dave was passionate about peace and justice, but never dramatic about it — one of those work horses of the movement that everyone counts on. Dave Zarembka—presente!”

Dave and I share histories in St. Louis. He was born and raised there; I lived and worked there for 32 years. Knowing him from NWTRCC meetings, I wondered if he would bring renewing energy to our local work when he and Gladys, newly married, returned to St. Louis to care for his mother in 1999. Had this “work horse” arrived to help us carry on? Yes, he had indeed! His most generous gifts to us during those years in St. Louis were his care for his mother, the opening of a St. Louis office to coordinate the work in Africa, and the application of his skills in renovating the World Community Center to open a stairway, creating a third floor and four new office spaces for our collective workplace.

A life of deeds and seeds! Randy and I echo Karen’s “Dave Zarembka—presente!”

Report from NWTRCC’s Third Online Conference

By Lincoln Rice

NWTRCC held its third online conference April 30 – May 2, 2021. Slightly over 40 people attended the conference, which began on Friday evening with a social hour.

Saturday featured two panels. The first was a “Panel on the New Treaty on the Prohibition of Nuclear Weapons & Paths Forward for Resistance,” featuring Mari Inoue (an attorney and cofounder of the Manhattan Project for a Nuclear-Free World), Dr. Linda Richards (historian of science and a grassroots activist since the 1986 Great Peace March for Global Nuclear Disarmament), and Jack Cohen Joppa (cofounder of the Nuclear Resister newsletter in 1980). A recording of both panels can be found on NWTRCC’s YouTube page (www.youtube.com/nwtrcc).

The second was a “Panel on Organizing with Younger War Tax Resisters,” featuring Lindsey Britt (Vermont), Jerry Maynard (Texas) and Allison McGillivray (Oregon). The younger war tax resisters shared stories about how they each came to WTR and their suggestions for spreading WTR among younger activists. Both panels featured a lively Q∧A which are included on the YouTube recordings. Saturday concluded with concurrent WTR 101 & 201 sessions.

The Sunday business meeting began with reports from both NWTRCC consultants (Coordinator & Outreach consultant) and a financial update (which included news about our upcoming charity auction and push for more church donations [www.nwtrcc.org/church]).

Next, we unanimously approved the nominations of Lindsey Britt and Erica Leigh to begin serving three-year terms on NWTRCC’s Administrative Committee. (A huge thank you to both DeCourcy Squire and Sam Leuschner, who finished their three-year terms!)

There were two proposals on our agenda. The first was an update to our statement of purpose, which simplified our previous statement and made it more succinct. We reached consensus on adopting the new statement, which can be found here: https://nwtrcc.org/about-nwtrcc/statement-of-purpose/

The second proposal was to choose a new logo from among three options. No consensus was reached on this item. If you have any ideas for a new logo for NWTRCC, please contact the NWTRCC office. Minutes from NWTRCC’s business meeting can be found online at https://nwtrcc.org/nwtrcc-business/.

The conference featured attendees from Alaska, Hawaii, both Portlands, and everywhere in between. It was great to host such great panels with panelists from all over the country. It would be better meeting in person, but I am glad we were able to make the best of what technology has to offer.

Mark your Calendars!!!

Our next National War Tax Resistance Gathering & Coordinating Committee Meeting

November 5-7, 2021

As of this printing, our next national conference will be online. Meeting in person is definitely preferred, but we also have to ensure that our next meeting does not recklessly put anyone in harm’s way.

If it becomes clear in the near future that we can meet in person, we will begin looking for a meeting location. If you are interested in hosting a future NWTRCC meeting, let us know!

PROFILE

Response to Anonymous about Truthfulness

By Larry Rosenwald

The April/May issue of MTAP had a piece on war tax resistance by an anonymous writer, called “Questioning the Need for Truthfulness in Resisting War Taxes.”

Much of that piece felt to me like a critique of my mode of doing war tax resistance. I appreciate the critique; it’s good to be urged to reconsider one’s own practices. But I mostly dissent from it.

Anonymous and I do agree on some things. I too like Millay’s “Conscientious Objector.” I too would not betray by excessive truth-telling a fugitive I was harboring, or a friend I was harboring. (I admire the Hebrew midwives who lied to Pharaoh. Pharaoh said, “Kill all the male Israelite babies.” And the midwives, who feared God, did not do that; they told Pharaoh, “The Israelite women are like animals, they bear their children so fast that by the time we get there the children are already born.”) And I agree that it’s impossible, or at any rate very difficult, to live above the taxable level and keep all your war tax money away from the government.

On other things we sharply disagree. This is the crucial paragraph in the piece: “What is the value in someone living above the taxable income level, getting taxed, refusing to pay a portion or all of the taxes, having wages garnished or a bank account seized, and then considerate support people reimburse the money that went to the government?”

Anonymous is describing pretty much what I do, so the question has a lot of force for me. What follows is my answer.

I cannot, I should note, speak to the last point; I’ve seldom applied for reimbursement. I can say that when I’ve been among the “considerate support people” in question, I’ve counted that role as an honorable one, a means of nurturing community — like-minded people are in need, and we do what we can to help them out. I found myself wondering whether Anonymous places as high a value on community as I do; most of the time Anonymous seems to be standing alone.

I take it that Anonymous’s answer to the general question is basically there is no value at all in doing those things, the things that I’ve been doing since 1987. My answer is predictably different. What I do does not have the value of keeping one’s money from the war-making government. It has other values, though. Conversations with family and friends and colleagues and institutions, for one thing, and I’m grateful for all the conversations my war tax resistance over the last thirty-five years has led to, for what I’ve learned from them, for what I’ve been able to say in them, as well as in more public statements: essays, talks, words in print and on screen and in speech. And above all, the simple act of witnessing: the public, unconcealed choice to refuse payment of taxes that support the masters of war has a great value, even apart from any words I find to describe it, a value for me and I think a value for those beholding it.

Anonymous writes, “Personal acts of conscience occupy a significant place in resisting empires.” I agree. But the acts I know about are the ones done by people who have done them openly, who have spoken truth to power in their own person, ready to accept consequences, bringing to their action their whole self. The Austrian conscientious objector Franz Jägerstätter refusing to swear an oath of loyalty to Hitler; Claudette Colvin and Mary Louise Smith and Rosa Parks refusing to give up their seats on Montgomery buses; Camilo Mejía’s refusal to continue to serve in the American army during the Iraq War, though the war continued. All of these actions took more courage than my own sheltered one. I am not comparing myself to those heroes. I am claiming that their actions, “personal acts of conscience [that] occupy a significant place in resisting empires,” are impossible without sincere public witness and that we as war tax resisters should hold to the value of such witness.

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Paper Subscriptions are $25 per year. Digital subscriptions are free.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org