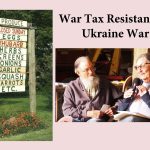

One thing about being out in the streets of NYC, it is never dull. Our annual tax day presence at the IRS was a lively affair this year thanks to musical accompaniment of the Raging Grannies and Filthy Rotten System, and an array of passers-by who offered support or challenged our message — some more… Continue reading