More Than a Paycheck,

More Than a Paycheck,

REFUSING to PAY for WAR

February–March 2020

Contents

- International War Tax Resistance Conference in Scotland

By Erica Leigh - I’m Not Sure I Can Tell the Difference

By Chrissy Kirchhoefer - Counseling Notes IRS Wrongly Threatens $5,000 Frivolous Fine… Again • 2020 IRS Standard Deduction and Taxable Income Level • Shrinking IRS • Revamped W-4 is In Use • W-4 Resistance with the New W-4

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network Updates

- Tax Resistance Ideas and Actions Podcast on War Tax Resistance in Canada • Pennsylvania School Still Around Because of War Tax Redirection • IRS Criminal Investigations Continue to Decline • 2020 TAX SEASON INFORMATION • 2020 collective redirection • Consider a Bequest

- NWTRCC News Mark Your Calendars • Literature Revisions • Nominations open for NWTRCC’s Administrative Committee (AdComm)

- Profile Radical History Quiz In remembrance of Larry Gara By Ruth Benn

Click here to download a PDF of the February/March issue

International War Tax Resistance Conference in Scotland

By Erica Leigh

Recently, I traveled to Edinburgh, Scotland to represent NWTRCC at the International Conference for War Tax Resistance and Peace Tax Campaigns, hosted by Conscience: Taxes for Peace Not War. I’m working on a full conference report, but in the meantime, I wanted to highlight the longtime Scottish resistance campaign against the Trident nuclear submarine.

A highlight of the weekend was the Sunday bus trip to HMNB Clyde, the military base at which the U.K.’s Trident-missile armed nuclear submarines are located. The Faslane Peace Camp has been resisting these nuclear weapons since 1982. One of the conference attendees, Willemien, has been living and resisting at Faslane for two years.

Faslane is a beautiful little area along the shores of Gare Loch. With the morning fog still burning off on the shore, and rolling hills reaching down to the water, it was honestly very hard to imagine why people would want to stick a military base here, let alone nuclear submarines.

When our little bus pulled into the visitor’s parking lot at HMNB Clyde, it only took a few minutes for the local police to show up. The police recognized Willemien immediately, since she’s a resident of the peace camp and a frequent protester.

Our trip coordinator spoke with the police at length about our plans, and then we went over to another base entrance, more visible to passing cars, for a short vigil. The police snapped a lot of photographs of everyone present as we lit a candle, and several people spoke about their opposition to nuclear weapons and support for peace. There was a little singing as well.

After we concluded our vigil, an officer asked if I “would like to give your details” and I said “no thanks.” Fortunately, I had been pre-alerted by another attendee that police often ask for your personal information at protests (often less politely, or implying that you have to give your information), but you’re not required to do so unless you’re under arrest.

After the vigil, we briefly visited the Faslane Peace Camp (www.facebook.com/faslanepeacecamp/). The camp is rudimentary—wood stoves provide most of the heat, and campers live in rundown trailer RVs or other makeshift homes. But their spirit is really beautiful—the camp is decorated with many slogans, painted caravans, and artwork.

Fastlane Peace Camp. Photo Courtesy of Erica Leigh

And the Faslane campers and their allies have been maintaining this direct action camp for decades, continuing to put their bodies on the line at significant cost and risk to themselves. Many people demonstrate and are arrested at Faslane every year.

Following the conference, I ended up in London for a day and visited the 56A Infoshop, an anarchist resource center and bookshop in the Elephant & Castle area. The Infoshop, together with a bike repair project and a food cooperative, has occupied the address for over 30 years. They have a fascinating archive of social movement publications, flyers, books, and other resources from the U.K. and other countries. They also possess a partial collection of the publications that have come out of Faslane Peace Camp since its founding, all of which show their rowdy, rebellious nature and commitment to long-term resistance.

One of my favorite pieces was a list, I think in the 2000 issue, of all the arrests at Faslane in 1999. This list featured such gems as the arrest of a person called Fungus on November 13 at a Ploughshares action, “‘for being a pain in the arse’ near the Faslane fence.” Teapot was arrested “for snogging a police van” at a Ploughshares action on August 24. There were many more serious entries on the list too—climbing fences, cutting fences, blocking traffic. And from what I can glean online, this spirit of direct action and resistance persists to this day.

For different ways to support the Faslane Peace Camp, check out their website: faslanepeacecamp.wordpress.com/support-us/.

I’m Not Sure I Can Tell the Difference

By Chrissy Kirchhoefer

In an extrajudicial drone missile strike, Iranian Major General Qasem Soleimani was killed. Soleimani (an Iranian) was assassinated at Baghdad International Airport on Iraqi soil without the permission of Iraq, where the U.S. had been engaged in active warfare for decades. The U.S. escalation comes after Trump walked away from nuclear negotiations with Iran and imposed strict economic sanctions. Iran has now threatened revenge as the U.S. Army deploys an estimated 3,000 additional troops in the 82nd Airborne Brigade to the area. The U.S. has ordered all Americans to leave Iraq—civilian contractors and oil corporation executives have boarded planes out of the country.

Before traveling to Iraq with Voices in the Wilderness (now Voices for Creative Nonviolence), I was trying to explain to family about my motivations for going. It was the time of the economic sanctions on Iraq, which were primarily affecting the vulnerable, the young, and those who were sick or poor. Since it was not an “active war,” many were not aware of the impact of U.S. policies, especially in the form of economic sanctions and bombing in the “no-fly zone,” primarily in the north and south of Iraq by the U.S. and U.K. for years. My aunt brought up the country song by Alan Jackson that stated, “I’m not a real political man. I watch CNN, but I’m not sure I can tell you the difference in Iraq and Iran.”

I would not have known much of the difference between the neighboring countries had it not been from members of Voices who traveled and spoke about their delegations to Iraq and the stories of the people they met and stayed with during their travels throughout the country. They were so moving that I decided I wanted to go and see for myself. In May of 2002, I traveled to Iraq with Voices U.S. and U.K. as well as the Veterans for Peace Iraqi Water Project.

During my two weeks traveling throughout Iraq, I made a close friendship with a man Ibraheem. He helped me laugh through some of the most challenging of experiences. We laughed as we sat crammed in the back of the plane as we flew through the “no-fly” zone. Members of Voices U.K. had expressed worry of boarding a plane in Baghdad to Basra, concerned that the plane may not have gotten parts since the sanctions were put in place in 1990. Oddly enough, Boeing—the same Company that was creating the smart bombs for the no-fly zone—was able to bypass the sanctions and sell brand new planes to fly through the no-fly zones.

While there was much laughter, there was much heartbreak as well. I met a young one who had the remnants of a Boeing smart bomb lodged in his pelvis. I held a young one who was dying of marasmus, severe malnourishment, because of limited medicine. The doctor told us about how hard it was for him to decide which child would receive medicine and which would die. We met mothers who were afraid of giving birth because the depleted uranium that caused deformities in babies. We also visited al-Amiriya, a shelter that was targeted by the U.S. in the first Gulf War, killing over 400 people—mostly women and children. Some of those who came together to attempt to seek refuge from the bombings were incinerated.

Revived Button from Neighbors for Peace in Chicago. Photo by Chrissy Kirchhoefer

Prior to the Shock and Awe campaign in 2003, my friend Ibraheem sent me an email from Baghdad. He was concerned that he and his family would not survive. I read his letter to the crowd gathered in the same metro area that was manufacturing those bombs. In the lead up to the bombing campaign, I fulfilled a promise to him that I would deliver a message he had for the Boeing executives. His message: “Hemingway says ’to live is to fight.’ This slogan was raised by the American. It should be replaced by this phase ‘to live is to love.’ Producing weapons is a violation of this new slogan.”

Fortunately Ibraheem survived and I spoke with him recently. He and his family are refugees, no longer able to return home as a result of war. So often when we speak of war and the war budget, we lose sight of the humanity behind it—like the people seeking shelter together, seeking peace, and trying to hold on to dear life. While I have learned more of the historical differences between Iraq and Iran, I learn more and more people are fundamentally the same.

Counseling Notes:

IRS Wrongly Threatens $5,000 Frivolous Fine… Again

A WTR couple on the East Coast received an IRS letter threatening a $5,000 frivolous fine if they did not “correct” their tax return within 30 days. This is very different from the situation where some WTRs receive the IRS’s General Warning Letter, stating that their correspondence contains frivolous arguments. These latter letters can be ignored.

A couple months ago, a WTR on the West Coast also received an IRS letter threatening a $5,000 frivolous fine if he did not withdraw his tax return within 30 days.

In both cases, the WTRs did send a letter with their tax forms, but they did not take any “frivolous” deductions or credits on their tax form. The West Coast WTR called the IRS and discovered that he was sent the letter because he did not provide documentation for the legal charitable donations he had made. He also confirmed that that was the only reason he received the letter. So he put documentation in the mail and the situation was resolved.

The East Coast WTR couple responded by sending a letter to the IRS Director of Return Integrity Verification Operations, indicating that the fine was in error. About six weeks after sending this letter, they received another letter from the IRS stating that the couple’s letter had been received and was under consideration. Hopefully, this issue will be resolved in time for us to include the resolution of this incident in the next newsletter.

Both IRS letters threatening a $5,000 frivolous fine were inappropriately sent. This letter should only be sent out if someone takes a deduction or credit based on a frivolous argument. The above WTRs only made valid deductions, but simply refused to pay their tax debt.

If you find yourself in a similar situation, or if anyone else has had something similar happen, please contact the NWTRCC office. We’re not sure if this was a “two-time” misuse of the frivolous warning letter or if it is the start of a new pattern.

2020 IRS Standard Deduction and Taxable Income Level

The tax overhaul bill eliminated the personal exemption. Now there is only the Standard Deduction figure that sets the taxable income level.

For each married taxpayer who is at least 65 years old or blind, an additional $1,300 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,650.

A single person can earn up to $12,400 and owe no federal income tax. You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/Simple Living as War Tax Resistance, includes information on legal ways to reduce taxable income and owe no federal income taxes ($1 from the NWTRCC office; read it free at nwtrcc.org). We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Payroll taxes, for Social Security and Medicare apply at a lower rate. If you do not file or pay estimated taxes, you may be liable for Social Security taxes. If you are an employee, payroll taxes are automatically withheld as a percentage and you cannot resist those taxes.

| Category | Standard Deduction |

|---|---|

| Single | 12,400 |

| Married, filing jointly | $24,800 |

| Married, filing separately | $12,400 |

| Head of household | $18,650 |

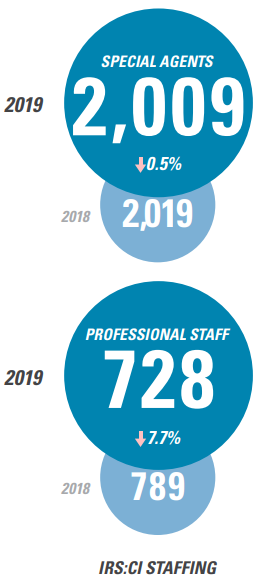

Shrinking IRS

A recent report from the IRS states: “The IRS lost more than 29,618 full time positions between FY 2010 and FY 2019… These losses directly correlate with a steady decline in the number of individual audits during the past nine years.” In addition, “The IRS anticipates up to 31 percent of its current workforce (about 19,719 full-time employees) will retire within the next five years, creating a significant risk of a large knowledge and experience gap for the nation’s tax agency.”

[Thanks to David Gross for sharing this piece of information.]

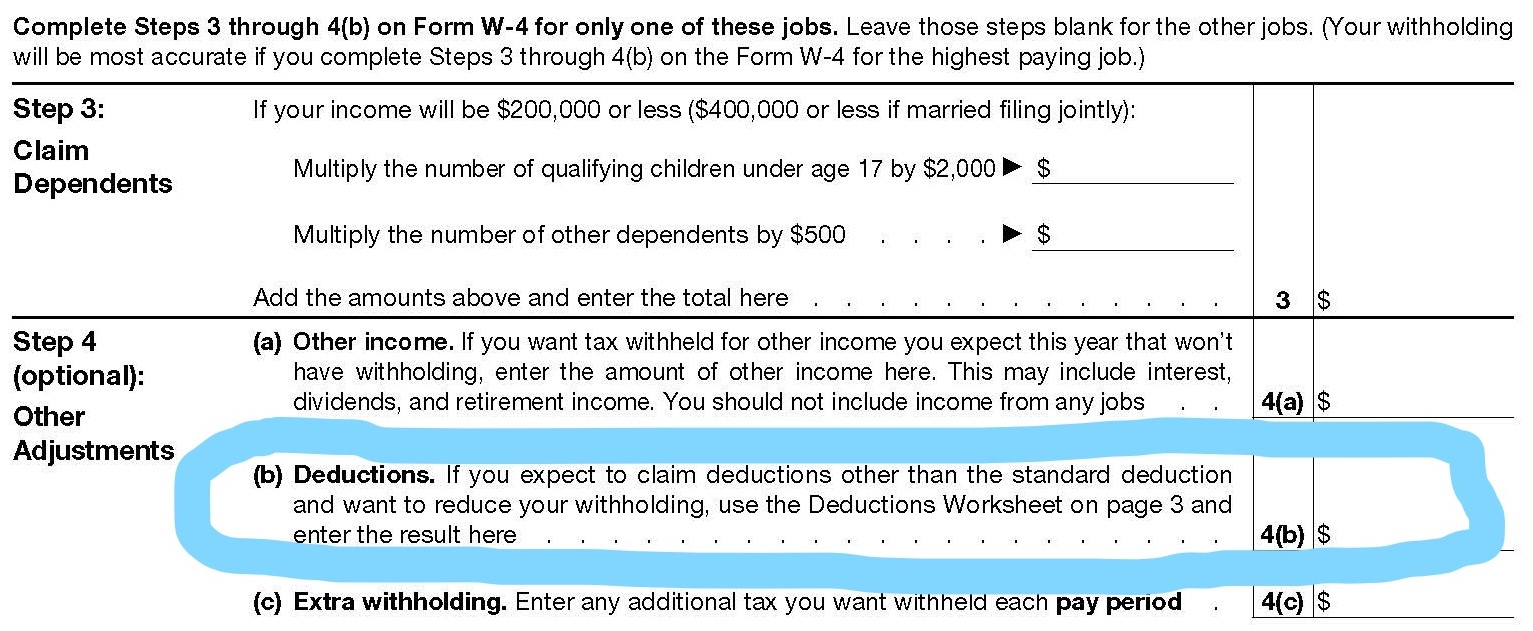

Revamped W-4 is In Use

The IRS has issued the final version of 2020 Form W-4. Form W-4 is completed by employees to instruct their employers as to how much federal income tax should be withheld from their pay. The previous version calculated a taxpayer’s income tax withholding using a withholding allowance based on the personal exemption amount. In 2017, the Tax Cuts and Jobs Act eliminated personal exemptions and increased the standard deduction. The mismatch between the old Form W-4 and the new tax law caused some taxpayers to be over- or under-withheld.

Beginning in 2020, all employers must use the new form for new employees. Also, old employees must use the new form if they wish to adjust their withholding. If an old employee does not submit a new Form W-4, employers must continue to withhold based on the W-4 previously submitted. Most obviously, the 2020 form differs from the 2019 form in that the 2020 form is a full page and the form does not contain withholding allowances (which is why the title of the form changed to “Employee’s Withholding Certificate”).

The form also contains instructions about privacy concerns: “If you prefer to limit information provided in Steps 2 [Multiple Jobs or Spouse Works] through 4 [Other Adjustments], use the online estimator (https://apps.irs.gov/app/tax-withholding-estimator), which will also increase accuracy.

Excerpt from Page 1 of New W-4

W-4 Resistance with the New W-4

The intent of the new Form W-4 is to make the withholding formula more accurate so that one will neither owe taxes nor receive a refund when it comes time to file. The new form is similar to filling out one’s taxes. The paper version of the form includes worksheets on page 3 where one can figure out the final numbers that need to go on page 1. The worksheets on page three are for people with a simple situation. If your situation is more complicated, there is an online worksheet on the IRS website (https://apps.irs.gov/app/tax-withholding-estimator). Only page 1 needs to be turned into one’s employer, not the worksheets that will contain a lot of personal information and are similar to filling out your tax forms. The anticipated changes to the form should not affect one’s ability to practice W-4 resistance.

The new form asks for one’s filing status and one’s expected income tax deductions. For example, let’s say a single WTR earned $50,000 per year and wanted to prevent 100% of their withholding. They would already receive a $12,400 standard deduction, so they could put $37,600 ($50,000 – $12,400) on line 4(b) for additional deductions. The person would need to provide a new W-4 to their employer if they would be receiving a raise that would increase their income over and above the deductions listed on the form. The form does not supply your yearly income amount or ask for it, but the employer, who will be using the form to determine withholding, will know it. If someone wants to resist 50% of their federal income taxes, they would need to estimate their taxable income for the year, divide that number by 2, and put a deduction on line 4(b), that when subtracted from their total income that will equal half of their taxable income.

Lastly, there is an exempt option. There is not an explicit space on the new form for this like on the previous form. But in the instructions for the form, it states that you simply need to write “Exempt” under line 4(c). For more information on the W-4, see NWTRCC’s Practical #1, Controlling Federal Income Tax Withholding, ($1 from the NWTRCC office; read it free at nwtrcc.org).

Many Thanks

Thanks to each of you who donated for the November Appeal 2019! Remember, you can also donate online through PayPal (not tax deductible) or Resist (tax deductible) by clicking on the “Donate” button at nwtrcc.org. (Please let the NWTRCC office know if you use Resist.).

We are very grateful to these alternative funds and WTR groups for their redirections and Affiliate dues:

Las Vegas Catholic Worker;

Milwaukee WTR/Casa Maria Catholic Worker;

Birmingham War Tax Objectors; Fools of Conscience (Asheville, NC);

War Resisters League; WRL New England

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464), if you would like a printed list by mail.

Don’t forget, you can find us on

Facebook • Twitter • YouTube • Instagram

or join our discussion listserve

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Tax Resistance Ideas and Actions

Podcast on War Tax Resistance in Canada

Talking Radical Radio published a podcast (December 2019) about conscientious objection to military taxation in Canada, featuring Doug Hewitt-White, Murray Lumley, and Scott Albrecht of Conscience Canada. Conscience Canada is our sister organization north of the boarder. A link to the podcast can be found here: https://rabble.ca/podcasts/shows/talking-radical-radio/2019/12/conscientious-objection-military-taxation

[Thanks to David Gross for sharing this information.]

Pennsylvania School Still Around Because of War Tax Redirection

A retrospective of the history of the Project Learn School notes that the school, an independent cooperative, got a $5,000 loan from a war tax resistance redirection fund at a critical moment at its founding, and has been in operation for fifty years now. A local newspaper article that shares this story can be found here: <href=”https://www.chestnuthilllocal.com/2019/12/27/project-learn-a-school-community-celebrates-50-years-in-2020/” target=”_blank”>https://www.chestnuthilllocal.com/2019/12/27/project-learn-a-school-community-celebrates-50-years-in-2020/

[Thanks to David Gross for sharing this information.]

IRS Criminal Investigations Continue to Decline

The annual report of the IRS investigations division has had to do more with less in recent years. Budgets and staff have dropped, while responsibilities (such as Obamacare enforcement, figuring out how bitcoin works, and combating increasingly organized and international identity theft and refund fraud) have grown.

Regarding non-filers, the criminal investigations division investigated 271, recommended 128 for prosecution, and managed to bring down the hammer of justice on 111 this year. Here are there total numbers for the previous three years:

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| Investigations Initiated | 3,019 | 2,886 | 2,485 |

| Prosecution Recommendations |

2,251 | 2,130 | 1,893 |

| Sentenced | 2,549 | 2,111 | 1,726 |

[Thanks to David Gross for sharing this information.]

2020 TAX SEASON INFORMATION

NWTRCC offers a free Lit Kit, including 100 pie charts and other flyers and palm cards. Check if you would like one for your local actions:

I will use the Kit on Tax Day, Monday April 15, 2020

I need the Kit by

Name/Contact Person

Group

Address

City State Zip

Telephone Email

Website

NWTRCC lists tax day events in our April newsletter, on our website (shared with the Global Day of Action on Military Spending), and in a national press release listing actions around the country before tax day. Please use this form to add yours:

Who/sponsors:

What:

When:

Where:

* Please include workshops, film showings, protests, rallies, leafletting, penny polls — whatever you are doing!

Reporters often ask for local contacts — war tax resisters willing to talk to the press and tell their story.

Let us know if you are willing to talk to the press and have my name used in a press release.

Return to

NWTRCC, PO Box 5616, Milwaukee, WI 53205, or email any info to: nwtrcc@nwtrcc.org

2020 collective redirection

Use this form to report group or individual redirections.

NWTRCC will report totals on or shortly after Tax Day.

Names/Group Name:

Address/City/State:

Phone/Email:

Please put me in touch with others in my area who are interested in Collective Redirection

I/We are redirecting to these resistance groups led by Black, Brown, and/or Indigenous People:

Group:

Group:

Group:

Total Amount Redirected:

Return to

NWTRCC, PO Box 5616, Milwaukee, WI 53205, or email any info to: nwtrcc@nwtrcc.org

Consider a Bequest

NWTRCC accepts bequests, which can be arranged through your will or other estate plan.

Simply name NWTRCC as the beneficiary of a portion of your estate or of particular assets in your estate, or contact the NWTRCC office for arranging a bequest through one of our 501c3 fiscal sponsors. A bequest costs nothing now, yet it may give you great satisfaction to know that your gift will live on in NWTRCC. More information: (800) 269-7464 or nwtrcc@nwtrcc.org.

NWTRCC News

Mark Your Calendars

The next NWTRCC gathering, May 1–3, 2020, will be in Chicago!

We will be hosted by the Su Casa Catholic Worker on Chicago’s South Side (5045 S Laflin Street). If flying, Please fly into Midway. Midway is only 5 miles from Su Casa. It can take up to 2 hours to drive to O’Hare from Su Casa! More info will be posted on the web in the near future. The NWTRCC business meeting is Sunday morning, May 5 (open to all). Please submit proposals for the May business meeting to the NWTRCC office by March 21.

Literature Revisions

Revised Earth Palm Card

Several NWTRCC resources have been revised in preparation for Tax Day 2020. If your local WTR group plans on collaborating with local environmental activists, you can employ our revised Earth Palm Card, with a backside that connects military spending and environmental degradation. Download the card at nwtrcc@nwtrcc.org or order cards from NWTRCC for 10 cents each. Complimentary cards will also be included with Tax Day Kits.

We have also updated the Peace Tax Return. Just as the IRS has simplified its tax forms, NWTRCC has revised its Peace Tax Form so that it can be printed on a standard sheet of paper (11″×8½″). It now connects federal incomes taxes more closely with environmental harm, U.S. border patrol, and the militarization of police.

Lastly, in response to the complete reworking of the IRS Form W-4 (see more about this update in the Counseling Notes), NWTRCC has updated it W-4 flyer and Practical 1: Controlling Federal Income Tax Withholding. Both of these resources can be ordered on the NWTRCC website or downloaded for free.

Help keep NWTRCC Strong and Growing!

Nominations Open for NWTRCC’s Administrative Committee (AdComm)

The AdComm gives oversight to business operations, helps plan two gatherings each year, keeps in touch with consultants between meetings, and meets face-to-face at the May and November gatherings (and by phone in February and August). We need to fill two seats, and new members will be selected from nominees at the May 2020 meeting. They serve as alternates for one year and full members for two years; travel to meetings is paid for full members and alternates filling in for full members who cannot attend. Each nominee will receive a nomination letter from the NWTRCC office with more details about what’s involved as a member of this important committee.

Call, email, or mail your nomination(s) to

NWTRCC, PO Box 5616, Milwaukee, WI 53205

(800) 269‒7464 or nwtrcc@nwtrcc.org

Deadline: March 15, 2020

Become a Sustaining Member of NWTRCC

“I have been donating quarterly to NWTRCC for many years, because as a life-long war tax resister I feel I definitely need NWTRCC to be there and to be strong.”

— Becky Pierce, Dorchester, Mass.

Please join Becky as an annual, monthly, or quarterly pledger to NWTRCC. See the donate page on our website to pledge through Paypal (any amount monthly) or through Resist (monthly, quarterly, and annual options). If you would like a pledge packet to give by check, please contact the NWTRCC office, (800) 269‒7464. Thank you!

PROFILE

Radical History Quiz

In remembrance of Larry Gara

Larry Gara at a WRL event, May 1984 Photo by David McRenolds

By Ruth Benn

As many readers know, we date the “modern war tax resistance movement” to World War Ⅱ, when hundreds of amazing people refused to participate with their bodies and/or their taxes. These resisters tended to be committed pacifists, many of them already involved with War Resisters League or the Fellowship of Reconciliation or members of peace churches, such as the Society of Friends.

Larry Gara was one of them. I knew and worked with him during my time on staff at the War Resisters League and was sad to learn of his death at age 97 on November 23. After the war years he became a history professor and retired in 2002 from 40 years of teaching at Wilmington College in Wilmington, Ohio. You can read his resistance and prison story in a lovely book, A Few Small Candles: War Resisters of World War Ⅱ Tell Their Stories, which Larry co-edited with his wife Lenna Mae Gara, who survives him.

Thinking about all the ways that Larry contributed to war resistance and to War Resisters League, reminded me of the Radical History Quiz he used to write for WRL’s Magazine, The Nonviolent Activist. So I decided to pull out questions from some of his quizzes that appeared in the magazine between 1989 and 2002.

Most of these questions or answers relate to WTR somehow. If the answer is a person, it is usually someone who was a war tax resister, and you can find references to them on NWTRCC’s history pages or on the “Pioneers of the Modern American War Tax Resistance Movement” page collected by David Gross. A few are just good war resistance stories.

Answers below.

1. Who was the Quaker pacifist tortured for his refusal to obey orders during the Civil War, and whose wartime diary became a peace classic?

A. Cyrus Pringle

B. Alfred Love

C. William Lloyd Garrison

D. Thomas Garrett

2. In 1940, eight theological students refused to register for the first U.S. peacetime draft. Their action was organized by:

A. Igal Roodenko

B. Devere Allan

C. David Dellinger

D. Tracy Mygatt

3. An international pacifist community founded in 1940 near Cleveland was called:

A. The Bruderhof

B. Ahimsa Farm

C. The Newark Ashram

D. Koinonia

4. Radical pacifist movement, favoring non-registration and war tax resistance was founded in 1947:

A. Fellowship of Reconciliation

B. Women Strike for Peace

C. American Friends Service Committee

D. Peacemakers

5. Christian anarchist and self-styled “one man revolution” who picketed the IRS offices each Tax Day and fasted a day for each year that had passed after the bombing of Hiroshima:

A. Harold Gray

B. Ammon Hennacy

C. Scott Nearing

D. Ernest Bromley

6. Missionary who was ousted from British-controlled India for supporting the Gandhian independence movement, he also wrote Democracy and Nonviolence:

A. Ralph Templin

B. Allan Knight Chalmers

C. Holmes Smith

D. Harry Emerson Fosdick

7. Labelled by Time Magazine as America’s best known pacifist, he had briefly belonged to the Trotskyist Workers Party:

A. Norman Thomas

B. A.J. Muste

C. J. Holmes Smith

D. John Nevin Sayre

8. A theater group founded by Julian Beck and Judith Malina, and involved with the nonviolent movement was called:

A. Bread and Puppet Theater

B. New York Mime Theatre

C. Greenwich Village Players

D. The Living Theater

9. A poet who served time in jail rather than pay a fine for an act of civil disobedience in the Redress demonstration against the Vietnam War was:

A. Anais Nin

B. Sylvia Plath

C. Muriel Rukeyser

D. Denise Levertov

10. In what song did the Hello People tell of going to prison for war resistance?

A. “How Does it Feel to be Free?”

B. “This Land is Your Land”

C. “Anthem”

D. “White Winged Doves”

11. A founder of Peacemakers whose war tax resistance led to the threatened seizure of her land trust home in Cincinnati:

A. Marion Bromley

B. Barbara Deming

C. Marjorie Swann

D. Dorothy Day

12. Folksinger/Founder of the Institute for the Study of Nonviolence:

A. Bernice Reagon

B. Judy Collins

C. Holly Near

D. Joan Baez

13. For which war tax resister(s) did dozens of supporters create a kind of war tax resistance camp in Colrain, Massachusetts, to block IRS efforts to seize a home?

A. Wally and Juanita Nelson

B. Randy Kehler and Betsy Corner

C. Maurice McCracken

D. Ernest and Marion Bromley

14. Which celebrated U.S. writer and activist started both careers in Washington Square Park?

A. Tillie Olson

B. Amiri Baraka

C. Grace Paley

D. Meridel LeSeuer

15. How much money was redirected in the year 2000 from the Pentagon to progressive causes by “peace tax” funds and individual war tax resisters (according to NWTRCC)?

A. $10,000

B. $50,000

C. $100,000

D. $250,000

Bonus Question! A Prothonotary Warbler plays an important part in the case of:

A. Alger Hiss

B. the Rosenbergs

C. Arthur Miller

D. Frederick Remington

(Ok, the bonus question has nothing to do with WTR, but Larry was an avid birdwatcher so I had to throw that in. More on that case at:

algerhiss.com/history/the-hiss-case-the-1940s/the-hiss-chambers-relationship/the-prothonotary-warbler/)

Answers for Radical History Quiz: 1 – A; 2 – C; 3 – B; 4 – D; 5 – B; 6 – A; 7 – B; 8 – D; 9 – C; 10 – C;

11 – A; 12 – D; 13 – B; 14 – C; 15 – C; Bonus – A

More than a Paycheck

Editor Lincoln Rice

Production Rick Bickhart

More Than a Paycheck: Refusing to Pay for War is a bimonthly publication of the National War Tax Resistance Coordinating Committee, a clearinghouse and resource center for the conscientious war tax resistance movement in the United States. NWTRCC is a coalition of local, regional and national affiliate groups working on war tax related issues.

NWTRCC sees poverty, racism, sexism, homophobia, economic exploitation, environmental destruction and militarization of law enforcement as integrally linked with the militarism which we abhor. Through the redirection of our tax dollars, NWTRCC members contribute directly to the struggle for peace and justice for all.

Subscriptions are $15 per year.

NWTRCC

P.O. Box 5616, Milwaukee, WI 53205

(800) 269‒7464

(262) 399‒8217

nwtrcc@nwtrcc.org

social media: socialmedia@nwtrcc.org

newsletter: wartaxresister@nwtrcc.org

www.nwtrcc.org