More Than a Paycheck,

REFUSING to PAY for WAR

February/March 2016

Contents

- War is a Poor Investment

by Jason Rawn

by Jason Rawn - Peg Morton, Presente’

By Sue Barnhart - Counseling Notes 2016 IRS Deductions and Exemptions • Highway Bill and WTRs • W-4 Video

- Many Thanks to everyone who supports NWTRCC with their volunteer time or financial donations and to the following groups for recent donations

- Network List Updates

- International Notes from Great Britain • World Congress on Military Spending • Creative Activists in Bilbao

- War Tax Resistance Ideas and Actions David Gross Makes the Top 10! • On the Road with Coleman Smith • Join WTRs in April

- Resources Tax Season Organizing Support • WRL Pie Chart • Financial Help • Advertise War Tax Resistance! • Jennifer Carr Talk Online

- NWTRCC News Next Gathering • Our New Website • Nominations Needed for Administrative Committee

- PROFILE War Tax Resister Since 2010

By Anne Barron, San Diego

Click here to download a PDF of the February/March issue

War Is a Poor Investment

Broadening the Dive$tment Movement

By Jason Rawn

Tick-tock goes the carbon clock

3 minutes to midnight

(or is it High Noon?)

Dive$t from the Pentagon!

More and more people are acknowledging the shared omnicidal trajectory of war and climate change. War tax resisters can act on this trend and use it to help actualize the changes they have long envisioned. The student-led fossil fuel divestment movement and Naomi Klein’s newest book, This Changes Everything: Capitalism vs. The Climate, shed light on possible collaborators, collaborations, and the economic realities and possibilities of redirecting wealth from war to proactive peace.

Longtime organizer and activist Frances Crowe writes in her memoir, Finding My Radical Soul, of the transformative experience while working on the South African boycott and divestment campaign in the 1980s:

Of course, I had long realized that money finances wars and weapons. Apartheid and U.S. investment in South Africa made it clear to me that money finances injustices of all kinds. Our work with apartheid may have been the beginning of my realization that eventually I would have to stop paying taxes to the U.S. government.

If one activist can make the jump from one divestment campaign to another, other activists should be encouraged to divest their taxes from the war-making government and redirect the money to non-atrocious investments. The student-led fossil fuel divestment movement and the many individuals and institutions that make it up have already divested or secured pledges of divestment of over $50 billion. This is a sum worth celebrating, but it’s not as mouth-watering as the $1.3 trillion spent on war by the U.S. in 2015 alone! For WTRs, frustrated they have yet to succeed in bringing about the changes they envision, this is a significant reason to be inspired to widen the divestment call.

Looking at the shared financial responsibilities among some of the largest industrial climate changers on the planet, Naomi Klein writes:

The U.S. military is by some accounts the largest single consumer of petroleum in the world. In 2011, the Department of Defense released, at minimum, 56.6 million metric tons of CO2 equivalents into the atmosphere, more than the U.S.-based operations of ExxonMobil and Shell combined.… Slashing the military budgets of each of the top ten military spenders by 25 percent could free up another $325 billion… for equitably coming up with the cash to prepare for the coming storms while radically lowering our emissions to prevent catastrophic warming.

War is a poor investment. The highest-rolling big war organization is the Pentagon. The phrase “Dive$t from the Pentagon” first asks a person to consider war as an investment, then as a bad investment, then as a bad investment that can be fixed.

Jason Rawn resists war taxes in Maine when not traveling. He is a member of NWTRCC’s Administrative Committee.

Tax Day, Monday, April 18, 2016.

See the tax day link at nwtrcc.org for resources, action ideas, and an action list.

Global Days of Action on Military Spending, April 5–18, 2016 — from the day the Stockholm International Peace Research Institute publishes the global military expenditure figures for 2015 through tax day in the U.S. See demilitarize.org.

Peg Morton, Presente’

By Sue Barnhart

Peg Morton. Photo by Ruth Benn.

Peg Morton, a long-time war tax resister and peace and social justice activist, died peacefully in Eugene, Oregon, on December 19, following an intentional end-of-life fast. She was born in Cambridge, Massachusetts, on October 31, 1930. She spent her childhood summers in Maine and developed a life-long love of nature. As a young adult she became a Quaker and passionate in peace and social justice issues. She raised three daughters in Carbondale, Illinois, and was active in the civil rights movement and protesting against war. As soon as Peg divorced she became a war tax resister, something she felt she couldn’t do while she was married, since her husband was not in favor of it. She had a career as a mental health worker, and began to resist 50% of her taxes.

Peg moved to Eugene, Oregon, in 1989, since two of her daughters lived here, and became a full time activist. Soon after arriving she got my name and phone number from NWTRCC. The war tax support group she was a member of in Carbondale was important to her, so we started a group in Eugene and named it Taxes for Peace Not War. We met in her living room and shared food, planned events, educated folks about war tax resistance, provided support to members who were being levied and ended each meeting with a group hug. Peg kept notes of every meeting and our decisions on where our resisted money went. Every year we gave away the resisted money to local causes on the steps of the post office on Tax Day.

Peg gave away money that she inherited so that she could keep her income low. Some years her income was low enough that she did not owe any taxes, but she still gave away money at our tax day event. Peg loved counseling people who were interested in becoming war tax resisters and in providing support and advice to folks who were facing levies. She organized us to write letters to the editor about war tax resistance and helped us to write an opinion editorial in both our local daily and weekly papers. She also organized tabling at local events and having workshops about war tax resistance, always working on outreach to fellow activists to try to convert them to war tax resistance. Peg is one of the few of us who still had a landline telephone, and she continued to resist the federal tax on that line. She also encouraged us to keep our resisted money in an escrow account where it could help other causes until it was needed when we got levied.

Peg also enjoyed having fun while we protested and educated folks about the atrocities of war and our support of war through paying taxes. She organized exciting marches and demonstrations involving singing and pageantry.

Peg was also interested in Latin American affairs. She was active in Witness for Peace and traveled to Latin America several times. She participated in many acts of civil disobedience, sometimes resulting in arrest. In 2004 she served a 3-month term in a federal prison for illegally crossing the line onto the grounds of the School of the Americas in Fort Benning, Georgia.

She was a devoted member of a few peace vigil groups and could be seen outside protesting in all kinds of weather. In one recent action, she fasted on the steps of the state capitol building to protest budget cuts to health coverage for people with disabilities. Peg loved to sing and joined the local chapter of the Raging Grannies. Peg was also an active member of Eugene Friends Meeting, her spiritual home for more than 25 years.

Peg was a remarkable woman who leaves behind a legacy of commitment to social justice and peace. Throughout her adult life, she was guided by the Quaker principles of simplicity, pacifism, equality, and integrity. Peg was a wonderful listener and her love of life shined through her. She was someone who could get along with everyone and will leave a big hole in our community.

Sue Barnhart is a war tax resister and peace, justice and environmental activist from Eugene, Oregon.

Quaker Books carries  Peg’s memoir. Peg would have loved donations being made in her honor to NWTRCC, an organization that was very important to her. Other ways to honor Peg’s memory include live more simply; take time to absorb the beauty of the natural world; speak out in support of people who are marginalized or oppressed; reach out in friendship to someone who is different from you; sit in silence, listening to the still, small voice within you.

Peg’s memoir. Peg would have loved donations being made in her honor to NWTRCC, an organization that was very important to her. Other ways to honor Peg’s memory include live more simply; take time to absorb the beauty of the natural world; speak out in support of people who are marginalized or oppressed; reach out in friendship to someone who is different from you; sit in silence, listening to the still, small voice within you.

Counseling Notes:

2016 IRS Deductions and Exemptions

| Category | Standard Deduction | Personal Exemption |

|---|---|---|

| Single | $6,300 | $4,050 |

| Married, filing jointly | $12,600 | $4,050 |

| Married, filing separately | $6,300 | $4,050 |

| Head of household | $9,300 | $4,050 |

For each married taxpayer who is at least 65 years old or blind, an additional $1,250 standard deduction may be claimed. If the taxpayer is single, the additional standard deduction amount is $1,550. The personal exemption phases out with adjusted gross incomes that begin at $259,400.

The taxable level for a single person is $6,300 plus $4,050 = $10,350 (federal income tax; social security taxes are due at a much lower level). You may be able to make significantly more than the amounts indicated above and owe no income taxes. NWTRCC’s Practical #5, Low Income/ Simple Living as War Tax Resistance ($1 from the NWTRCC office), includes information on legal ways to reduce taxable income and owe no federal income taxes. We suggest that nonfilers fill out the forms and keep their receipts for reference in case their circumstances change or the IRS comes calling.

Highway Bill and WTRs

The highway bill mentioned in our previous issue passed Congress in December and included the two provisions affecting war tax resisters. The IRS itself was against this provision, but the new law requires them to enter into contracts with qualified private debt collectors by early March 2016. In the future telling the difference between a scam collection call and one of the private companies working under this law may be difficult.

The other provision in effect now allows the State Department to block renewal, issuance of new passports, or possibly rescind passports of people with more than a $50,000 tax debt (including interest and penalties). The IRS is required to have sent many notices, and either attempted to levy accounts or filed a lien against a taxpayer, and advised that a passport may be revoked before they send names of seriously delinquent taxpayers to the State Department, which has the power over passports.

W-4 Video

Thanks to Justin Becker, who assisted in the NWTRCC office from September to mid-January, we have a short “how-to” video about filling out the W-4 form when taking a new job or changing current withholding allowances. You can find it with our other videos at youtube.com/user/nwtrcc.

Many Thanks

Affiliate fees, support from alternative funds, and individual donations are a fundamental part of NWTRCC’s durability. We are grateful to each of you for end-of-year donations and to these groups who have sent in dues recently:

- Maine War Tax Fund for Life

- Milwaukee War Tax Resistance

- Pioneer Valley War Tax Resistance

- War Resisters League

Network List Updates

The Network List of Affiliates, Area Contacts, Counselors, and Alternative Funds is updated and online at nwtrcc.org, or contact the NWTRCC office (nwtrcc@nwtrcc.org or (800) 269-7464) if you would like a printed list by mail.

Advertise to Activists! See the advertising rates for this newsletter or contact the editor at (800) 269‒7464.

Remembrances

Jasiu Milanowski (1946–2015), co-founder Michigan Peace Teams, founder Ammon Hennacy Catholic Worker House in Grand Rapids, Michigan, longtime nonviolent activist and war tax resister. Jasiu attended the NWTRCC gathering in Chicago in May 2012.

Ruth Kirk of Philadelphia died on November 11, 2015. Lifelong Quaker and activist for peace, she and her daughter Carol Dotterer provided a profile for our newsletter in the April 2012 issue. It’s also on our website at nwtrcc.org/2012/04/05/committed-radicals. Ruth was a NWTRCC supporter for some years and active with the Granny Peace Brigade in recent years.

INTERNATIONAL

Notes from Great Britain

Staff and members of Conscience: Taxes for Peace Not War, based in London, are full of excitement about the election of one of their longtime supporters to Labour Party leadership. Jeremy Corbyn was selected to lead the party in December. In addition, his shadow chancellor, John McDonnell, backs the group’s Taxes for Peace Bill. Holly Wallis, parliamentary officer at Conscience, writes in an article for Morning Star, “Both of them have been among the most dedicated advocates for peace in Parliament I have ever known.”

The Taxes for Peace Bill is to be introduced on the centenary of the Military Service Act 1916, which included a “conscience clause” that enshrined the first inclusive right of conscientious objection in UK law. The Taxes for Peace Bill would allow conscientious objectors to redirect the military portion of their income tax to peaceful forms of security. Follow their news at conscienceonline.org.uk.

World Congress on Military Spending

The International Peace Bureau with the Global Campaign on Military Spending will hold a major world congress in Berlin, September 30 – October 3, 2016. “Disarm! For a Climate of Peace: Creating an Action Agenda” aims to bring the issue of military spending, often seen as a technical question, into broad public debate and to strengthen the global community of activism. A top priority is a shift in government spending as one element in a much broader global transformation towards a green, socially just and peaceful society. See ipb2016.berlin for more information.

Creative Activists in Bilbao

Sinkuartel Konpartsa Antimilitarista activists, part of Movimiento de Objeción de Conciencia (KEM-MOC) in Bilbao, Basque Country, hung protest signs from the gate of the military base there, including a large figure labeled €890, the amount the group estimates each Spanish taxpayer spends annually on military spending. “This huge amount of money comes from our taxes,” said the KEM-MOC, “so every year in Bilbao we open our tax resistance office where we give people the opportunity to disobey this injustice and refuse to pay the part of taxes dedicated to military spending and give them to social purposes.”

Sinkuartel Konpartsa Antimilitarista activists, part of Movimiento de Objeción de Conciencia (KEM-MOC) in Bilbao, Basque Country, hung protest signs from the gate of the military base there, including a large figure labeled €890, the amount the group estimates each Spanish taxpayer spends annually on military spending. “This huge amount of money comes from our taxes,” said the KEM-MOC, “so every year in Bilbao we open our tax resistance office where we give people the opportunity to disobey this injustice and refuse to pay the part of taxes dedicated to military spending and give them to social purposes.”

War Tax Resistance Ideas and Actions

David Gross Makes the Top 10!

Shareable is a nonprofit online news service that covers the movement aimed to connect people, reduce our environmental impact, put idle goods to use, and challenge the idea that there’s no alternative to capitalism as we know it today. In December 2015 they named their “Top 10 Stories of All-Time” (since they began in 2009), and among the ten they chose California resister and author David Gross’s article “How to Not Pay Taxes.”

On the Road with Coleman Smith

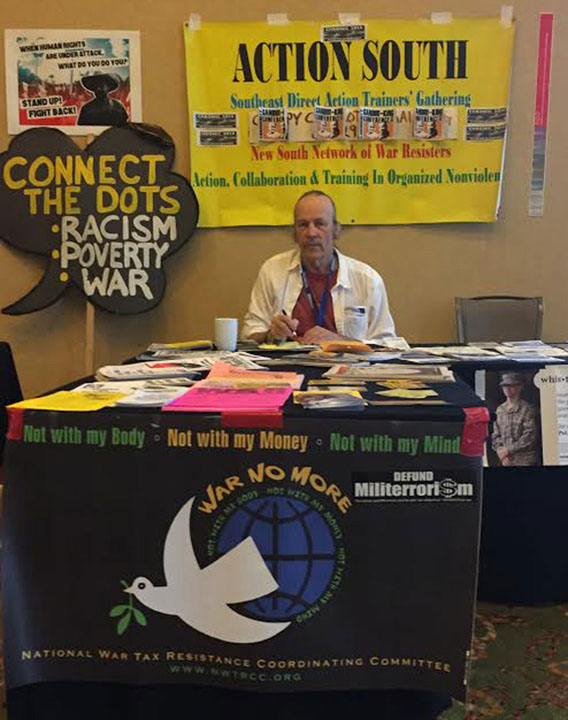

A 2,000-mile road trip from Asheville, North Carolina, to Austin for the 6th Biannual U.S. Human Rights National Conference and back included networking, story-telling, high times and overnights in Freedonia, Alabama, with long time war tax resisters Judy Collins and Jim Allen; hospitality in Baton Rouge with long haul antiwar activist and Veterans for Peace member Ward Riley and wife Melissa; and four nights in Austin with new friend and war tax resister Susan Van Haitsma.

A 2,000-mile road trip from Asheville, North Carolina, to Austin for the 6th Biannual U.S. Human Rights National Conference and back included networking, story-telling, high times and overnights in Freedonia, Alabama, with long time war tax resisters Judy Collins and Jim Allen; hospitality in Baton Rouge with long haul antiwar activist and Veterans for Peace member Ward Riley and wife Melissa; and four nights in Austin with new friend and war tax resister Susan Van Haitsma.

This outreach could not have happened without the financial support of NWTRCC, the U.S. Human Rights Network, the School of Americas Watch, and a small group of local donors who have contributed to the regional field organizing of the New South Network of War Resisters. We act and collaborate in organized nonviolence on the militarization of our society and culture. Some have called it “militerrorism.”

Everywhere I go I set an info table with an eclectic mix of materials from years of crisscrossing the South, meeting scores of activists and organizing efforts, all who agree that “War Is Not The Answer.” The conference program stated:

If Human Rights are Indivisible, then our Movements must be Intersectional. When we think holistically of human rights, there is an understanding that economic, social, cultural, political, civil, environmental, sexual, and development rights are all interwoven and interconnected rights — each one depends on the realization of another.

Sitting at the combined information table for all the groups I represented, I had wonderful and meaningful exchanges with an amazingly diverse population at the conference. Yet, when I looked at the combined lists of Working Groups, there was no specific heading to cover the work that so many of us do to oppose war and the usurping of our bodies, minds, and money to that end. Someone pointed to the National Security Working Group as a catch all. I responded that the national security and police state are the results of militarization — more an effect, not the cause.

I chose not to debate the full membership on this, but instead offered up an attempt to describe through short narratives how militarism intersects with working group topics such as criminal justice, health, education, housing, environment, immigration, and state repression. Interestingly, having offered up a solution to clarify what is meant by militarization of our society rather than to argue the issue, the U.S. Human Rights Network membership became enthusiastic to learn more about what we do as war and war tax resisters. Anyone else who would like to help think through this initiative can contact me by phone or email (below).

Coleman Smith is a Field Organizer for New South Network of War Resisters, a member of the NWTRCC Administrative Committee, active with the SOAW Puppetista Collective and the Carolinas Human Rights Organizing Conference. Contact him at newsouthnetwork@gmail.com or (828) 301-6683

Join WTRs in April

A coalition of groups is planning April actions under the name Democracy Spring. As explained on the website, democracyspring.org, they are demanding that Congress take immediate action to end the corruption of big money in politics and ensure free and fair elections in which every American has an equal voice. The campaign will begin on April 2 with a march from the Liberty Bell in Philadelphia to Washington, D.C. where thousands will gather to reclaim the U.S. Capitol in a powerful, peaceful, and massive sit-in that no one can ignore. Over 1,500 people have already pledged to risk arrest between April 11–16 in what will be one of the largest civil disobedience actions in a generation.

CodePink is promoting a contingent focused on corporations fueling the military industrial complex, and war tax resisters will form an affinity group and fit in to some part of the D.C. actions. Some are expressing interest in declaring our war tax redirections at the IRS. Contact the NWTRCC office asap if you are interested!

Resources

Tax Season Organizing Support

2016 Lit Kit: Once again NWTRCC plans to offer free literature between now and tax day for those who promise to distribute the contents. See the flyer for details and ordering information or call the office at 800-269-7464.

2016 Lit Kit: Once again NWTRCC plans to offer free literature between now and tax day for those who promise to distribute the contents. See the flyer for details and ordering information or call the office at 800-269-7464.

WRL Pie Chart

President Obama releases the budget proposal for the next federal fiscal year on February 9, and the elves at War Resisters League will work quickly to analyze the details and create a new “Where Your Income Taxes Really Go” flyer by the end of February. NWTRCC will be happy to take orders for 200 or fewer flyers

(10 cents each plus postage). Order larger quantities from the War Resisters League store at warresisters.org, or call WRL at (212) 228-0450.

Financial Help:

As agreed at the November 8 NWTRCC meeting, we have budgeted $2,000 to help local affiliate groups with tax season organizing. Send a letter with your plans and how a little money from NWTRCC would help. NWTRCC can also help create flyers and templates for your local actions. Send us your graphics, text, or slogans for design. Be sure to let us know what you are doing so we can post actions on our website.

Advertise War Tax Resistance!

NWTRCC is creating new ads for both print and online to tie in with the “divest” slogan. The ads are available in color and black and white versions. Contact the NWTRCC office or look for resources on our tax day web pages.

Jennifer Carr Talk Online

“Complicity and Collection: Religious Freedom and Tax,” a talk by University of Nevada — Las Vegas law professor Jennifer Carr is now available as an audio recording online at nwtrcc.org/2015/12/30/complicity-and-collection-jennifer-carr. Jennifer spoke at the November 2015 NWTRCC gathering about her research on the peace tax fund legislative effort and her ideas for making the effort more effective. The talk is synced up with her Powerpoint slide presentation.

NWTRCC News

Next Gathering

We are still working on the May gathering location and dates. We expect to be in or near Philadelphia, Pennsylvania, either May 6–8 or May 13–15. Stay tuned. Call the office or watch the website for further details.

Our New Website

Traffic is up on our website. The stats for mid-January show over 900 visitors, which is a big jump for us from a total of 743 in all of November. The new site launched on December 10, and the big change is that the viewing area adjusts for smartphones to tablets to desk top monitors, bringing us into the current era at last. We are grateful to the design and tech team at MuseArts in Brattleboro, Vermont, for their affordable price and hard work on this over about six months. Thanks to the team of David Gross, Peter Smith, Erica Weiland, Ed Hedemann, and Justin Becker for updating many of our web pages, transferring them to the new site, adding graphics, fixing links, etc. You can still find older newsletters, and tax day and gathering reports at archives.nwtrcc.org.

Nominations Needed for Administrative Committee

NWTRCC’s Administrative Committee (AdComm) seeks two new members, who will be chosen from nominees at the May 2016 meeting. We are looking for two alternates (terms are three-years: one as alternate and two as full members). The AdComm oversees the work of NWTRCC, plans the Coordinating Committee meetings, and helps with decisions and oversight between meetings. Full members are asked to attend two meetings a year, and all members participate in two conference calls between meetings.

Current members are Ari Rosenberg* (Penn.), Jason Rawn* (Me.), Cathy Deppe (Calif.), Rachel Soltis (Az.), and alternates Coleman Smith (N.C.) and Bill Glassmire (Ore.).

Affiliate groups should make a special effort to offer nominations, and self-nominations are welcome too. Refer nominations to the office, and we will follow up with further details: NWTRCC, P.O. Box 150553, Brooklyn, NY 11215 or (800) 269-7464, nwtrcc@nwtrcc.org. Deadline: March 14, 2016.

*Terms end after the May 2016 meeting

PROFILE

War Tax Resister Since 2010

By Anne Barron, San Diego

My sister was a war tax resister. She was the first person I knew who actively resisted war and an oppressive government by refusing to fund them. Still, it was hard for me to take that first step, to actually withhold taxes. I’ve always loved taxes; I even campaigned for higher taxation. (Since taxes paid my salary as a public school teacher, you could say I had a direct interest in taxation.)

So it is odd to me now to be on the other side some ten years later, where I withhold 47% of what the IRS tells me is my bill for the USA. I still believe in taxes but after decades of marching against war, after seeing the effects of war on my father, my family and my neighborhood, I’ve finally had to accept my country doesn’t use taxes for the social good but for endless war and domination. That realization did take a while, longer than it should have.

So it is odd to me now to be on the other side some ten years later, where I withhold 47% of what the IRS tells me is my bill for the USA. I still believe in taxes but after decades of marching against war, after seeing the effects of war on my father, my family and my neighborhood, I’ve finally had to accept my country doesn’t use taxes for the social good but for endless war and domination. That realization did take a while, longer than it should have.

I was on my way to a year-stay in Switzerland when 9/11 happened. I was shocked by the government’s attack on Afghanistan and the follow-up “Shock & Awe” on Baghdad, but none of my Swiss neighbors were. They had warned me the USA would attack; so my education about my country came from foreigners who understood the USA very well. I returned to a New Jersey town where liberals were the majority and an active antiwar group, the Central Jersey Coalition Against Endless war, kept us all on the march. Like peace activists around the world, we marched. And marched. The marches got smaller and the wars got bigger. My moral horror grew as we added more names to the Vietnam Memorial-styled Wall a creative friend made to make visible the horror of the Iraq War. Veterans for Peace refer to the moral injury of war, and I was experiencing it.

There was some inspiring direct action, such as the blockade of a Department of Defense-funded video arcade in Pennsylvania that offered violent games. When I heard about active war tax resisters, I thought “Of course.” My partner at the time was not convinced, and so I finally began my own resistance after our split in 2011. I began war tax resistance as a supporter, sending letters of conscientious objection off with my tax “debt.” A NWTRCC counselor gave me a crash course on ways resisters practice their WTR when I visited the War Resisters League office in New York. I opted to be public about my resistance. I think that provides some protection against the dreaded IRS (my working hypothesis to be proven or not).

Since I made below the taxable income my first year filing taxes singly, my letter stated my intention to begin withholding war taxes. These letters (cc’d everywhere, elected officials and press) usually began:

Dear President Obama,

I have up to now paid my taxes willingly. Fairly collected and distributed taxes are essential to our national security. A nation that shares its wealth and resources for the good of the whole will prosper.

Then I got a job, work that I actually got paid for, work that included benefits, and also required that I complete a W-4. The NWTRCC support and advice was crucial. I used the website resources a lot as I figured out what to do. NWTRCC tells us there is no one way, that each of us has our own needs and circumstances when figuring out the 1-2-3s of our war tax resistance.

Excited and terrified, I withheld 47% of my tax “debt” in 2013. My letters to the IRS, the President, and the press laid out my conscientious objection to war:

I can no longer finance my country’s misguided policy of national supremacy. I cannot pay for preemptive wars to take another country’s oil. I cannot pay for unchecked military force that harms our national security through indiscriminate killing, torture and gross mismanagement.

Sure enough, I received the IRS letter demanding full payment. I again declined, copying everyone I could think of. It turns out the IRS has an ombudsman to help the public with tax problems, so I also wrote to that office to claim my right as a conscientious objector.

I did receive an intent-to-levy letter from the IRS. Since I don’t have much, I wasn’t worried about that. I am still a little worried about being jailed, but since my current tax “debt” is much less than all the corporations who continue to withhold their taxes and they haven’t been arrested, I think I’m OK. And I can depend on the strength and resources of the NWTRCC network (i.e., the War Tax Resisters Penalty Tax Fund, wtrpf.org) if and when the IRS takes the money and the mounting interest and penalties.

The biggest challenge is that the accrued interest and penalties will substantially increase what the IRS says I owe. While there are ways to protect your assets (living below the poverty line is an option for me), most likely the IRS at some point way in the future will get what they demand if the law isn’t changed to honor tax conscientious objection. I’ve thought about that a lot — I resist and the war gets more money. However, this is more than civil disobedience for me; it is a moral issue for me. I have worked and advocated for peace for many years, so how can I actively support the war machine?

I will be supporting the 2016 Days of War Tax Action, Invest in People, Divest from the Pentagon, here in San Diego, intersecting with Occupy, Black Lives Matter, climate action, the homelessness coalition and the Fight for $15.