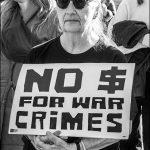

The Streets of New York, The Letter in the Mailbox

One thing about being out in the streets of NYC, it is never dull. Our annual tax day presence at the IRS was a lively affair this year thanks to musical accompaniment of the Raging Grannies and Filthy Rotten System, and an array of passers-by who offered support or challenged our message — some more… Continue reading

My Letter to the IRS

Hi! I hope all’s well on your end. My name’s Murtaza Nek, I’m a math and science tutor at Henry Ford College in Dearborn, Michigan. I usually file my taxes using online e-filing software, but this time felt the need to communicate a message which wasn’t possible using said software. I’ve thus put in much… Continue reading

Busting through the Bottom Line

Under the bright, clear, azure blue skies of Spring, our thoughts turn toward action. There are a number of ways to take action in the upcoming tax season culminating on April 15, 2024 and beyond. NWTRCC has put together a page- Quick Tips for Tax Day that has some resources to activate actions in coming… Continue reading

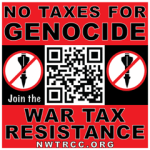

Resisting War Taxes in the Gig Economy

Since the invasion of Gaza in October 2023, NWTRCC has seen an exponential increase of interest in war tax resistance. Much of this new interest is among younger people who participate in the gig economy. There has been a lot of confusion about the gig economy and third-party reporting, so this post is meant to… Continue reading

Tax Day 2024- Here we Come!

Tax Day is soon approaching! We would love to know about your plans for tax day. NWTRCC is hosting an introduction to war tax resistance (WTR 101) session on Saturday March 2nd starting at 1pm Eastern time. Already there are 400 people registered. It is one of the largest registrations that we have had… Continue reading

“Yes, Please”

Sometimes you read something you wrote years ago and think “hey, that’s a pretty good article.” Back in 2005, Ed and I wrote an article for The Catholic Worker covering some reasons for maintaining our war tax resistance (WTR) over the years. At the time we had a combined total of 51 years of refusing… Continue reading

Beyond the Headlines: Finding Hope by Shaping What Comes Next Together

NWTRCC will be hosting a Counselor’s Training on Saturday February 17th. The five hour on-line training is open to anyone who has attended an Introduction to war tax resistance session (WTR 101) and would like to have up to date knowledge for themselves and others. If interested in joining please email nwtrcc@nwtrcc.org to register. In… Continue reading

Time is a Ticking to Take Action

Recently the Bulletin of Atomic Scientists met to share their annual Doomsday Clock. The Council decided to keep the Doomsday Clock, which estimates the probability of a nuclear catastrophe at 90 seconds to midnight. That same time was set a year earlier in 2023, the closest the clock has been set to midnight, the deadline… Continue reading

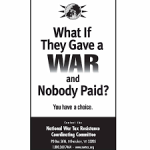

Easing Into War Tax Resistance

There’s something of a learning curve to tax refusal. Maybe for some it’s easier than others, but a lot of us started small, increased our resistance over the years, adjusted our lifestyles, or changed methods as needed or desired. A war tax resistance workshop can hit you with a lot of information. NWTRCC and WRL’s… Continue reading

Celebrate MLK Jr Day with a War Tax Resistance 101 Session

Since the invasion of Gaza, the NWTRCC office has been very busy providing War Tax Resistance 101 sessions online and promoting war tax resistance on social media. In January, we are continuing this trend. On Wednesday January 10, Chrissy Kirchhoefer and I offered a WTR 101 to a group of folks who gathered in person… Continue reading

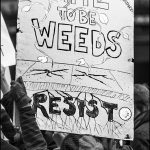

Wake Up to Find that You Are Eyes of the World

People are mobilizing, taking a variety of actions to call for an end to the slaughter in Gaza; making connections of how our struggles for liberation are bound together. It is encouraging that so many people are seeking out information about how to resist paying for war and then collaborating with others to learn more… Continue reading

Finding Hope In Action

I’m working at finding hope in dark times. It helps to be in a city full of activists of one stripe or another — ceasefire, save Gaza, antiwar in one place or another, stop mass incarceration, shut down Rikers, end solitary confinement, house the unhoused, close Guantanamo, Black Lives Matter, etc. And in the midst… Continue reading