In meeting with a new war tax resister recently, his first questions were about what will happen when he refuses to pay. “I expect an agent will come to my door, and I’ll be audited,” he said.

There was a time some decades ago when many war tax resisters (WTRs) were audited, but that is no longer the case. Back in those days the IRS tended toward “field audits,” which did involve meeting in person with an IRS auditor. These days if the IRS audits, the vast majority are “correspondence audits,” meaning they are carried out by mail. The Transactional Records Access Clearinghouse (TRAC) at Syracuse University keeps data on IRS enforcement, which shows this trend.

Tax experts note the odds of being audited at 1-in-104 chances, especially if your return includes income from a business, rental real estate or a farm, or employee business expense write-offs. Otherwise your chances drop to 1-in-250.

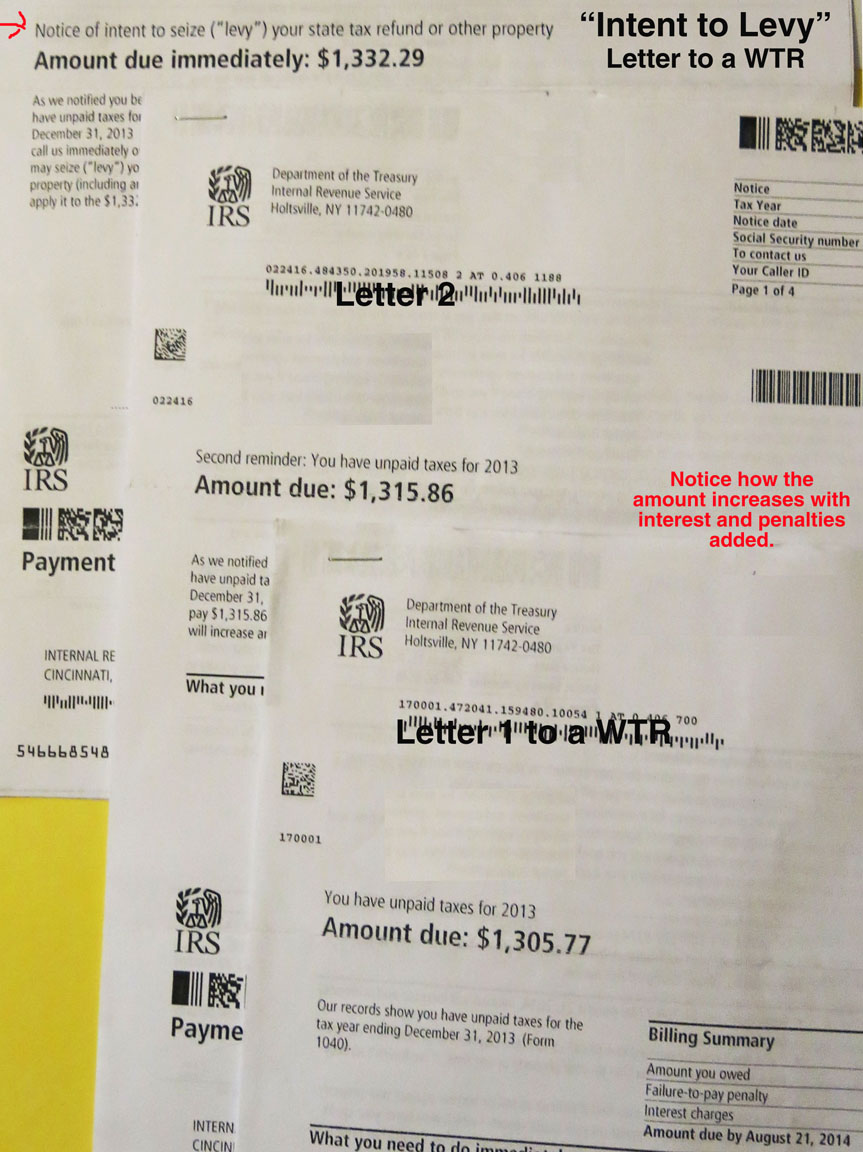

The returns for WTRs who file and refuse to pay some or all of their taxes to the IRS tend to get sent straight to collection. At this point interest (compounded daily) and penalties (up to 25% of the tax) begin to add up.

New WTRs can expect to receive a series of collection letters from the IRS that get more demanding if payment is not made. These letters are computer generated and usually marked “ACS” for automated collection system. An IRS return address tends to inspire fear — letters are seen as the IRS’s best collection tool. Some WTRs ask to open the letters while meeting with a support group or WTR counselor, which helps to overcome fear and strengthen one’s resolve.

New WTRs can expect to receive a series of collection letters from the IRS that get more demanding if payment is not made. These letters are computer generated and usually marked “ACS” for automated collection system. An IRS return address tends to inspire fear — letters are seen as the IRS’s best collection tool. Some WTRs ask to open the letters while meeting with a support group or WTR counselor, which helps to overcome fear and strengthen one’s resolve.

After the IRS sends a letter with “Intent to Levy” in the headline they are empowered to seize assets. (Generally the IRS just has to show they sent the letter; they do not necessarily have to prove you received it.) The most common forms of collection at this point are seizure of bank accounts, salaries, state tax refunds, and federal payments like Social Security. There is no indication of when this might happen: could be weeks, months, or years, depending on how easily they can find your assets.

Employers and banks get the notice before the resister. A bank account levy is only for the money that is in the account at the time. If the IRS wants $1,000 and you have $100 in your account that is all they can get (after bank fees). They must issue another levy before seizing the account again.

A salary levy is a standing levy until the IRS gets what they want, and it can be difficult to deal with. Here are some options.

- Allow the levy to happen; at least you aren’t paying voluntarily.

- Quit the job, or quit and work as a volunteer until the IRS gives up and withdraws the levy.

- Reduce your hours or ask to have your salary lowered to the level that is exempt from levy (sometimes part-time employees find their salary is below the levy amount).

- Ask your employer to write a letter to the IRS requesting release of the levy because they do not want to force collection from a conscientious objector on behalf of the government.

- Use the levy as an opportunity to let coworkers, friends, and family know that you are being levied because you refuse to pay for war voluntarily.

- A sympathetic employer can risk the penalties and choose to not respond to a levy.

- Join the War Tax Resisters Penalty Fund now to support others and offer a little protection for yourself in the event of a seizure.

- Read through some WTR profiles to get some ideas about how to face a collection.

When faced with an intractable collection it is a good time to reflect on why you started resisting in the first place. This article about the cost to U.S. taxpayers for the government’s torture program is one — among many — reminders hitting us on a daily basis.

— Post by Ruth Benn