Most war tax resisters who refuse federal income taxes will eventually (or quickly) get a letter from the IRS. Here I describe some of the most common letters one tax-return-filing resister has gotten over the past few years. Resisters who do not file tax returns may get letters more slowly or not at all, until or unless the IRS system determines that a return has not been filed and issues the appropriate paperwork. (Do you want to write about IRS letters you’ve gotten as a non-filer? Write us a blog post! E-mail wartaxresister at nwtrcc dot org.) And you personally may receive all, some, or none of these letters. For more about the collection process and how it affects war tax resisters, see our Practical War Tax Resistance #3 pamphlet.

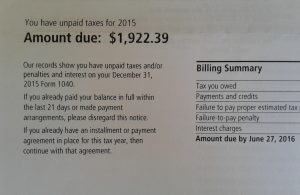

The first letter has always been a notice of unpaid taxes. IRS Topic 201, The Collection Process, explains,”The first notice you receive will be a letter that explains the balance due and demands payment in full. It will include the amount of the tax, plus any penalties and interest accrued on your unpaid balance from the date the tax was due.” This first letter, titled “You have unpaid taxes for [tax year],” is marked as Notice CP14 in the upper right-hand corner. Receiving this letter does not mean that collection is imminent – this is your first notice and you will likely receive at least one more notice before the IRS threatens collection.

The first letter has always been a notice of unpaid taxes. IRS Topic 201, The Collection Process, explains,”The first notice you receive will be a letter that explains the balance due and demands payment in full. It will include the amount of the tax, plus any penalties and interest accrued on your unpaid balance from the date the tax was due.” This first letter, titled “You have unpaid taxes for [tax year],” is marked as Notice CP14 in the upper right-hand corner. Receiving this letter does not mean that collection is imminent – this is your first notice and you will likely receive at least one more notice before the IRS threatens collection.

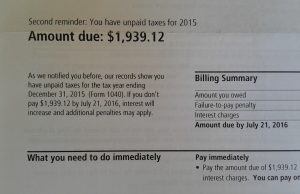

The second letter is very similar, just another notice of unpaid taxes, but with additional interest and penalties added since the last letter. This resister has received two different second letters in different tax years – one is marked Notice CP501, and the title below the address line is “You have unpaid taxes for [tax year],” while the other is marked Notice CP503, with a title of “Second reminder: You have unpaid taxes for [tax year].” In either case, it functions as a reminder that taxes are unpaid, and again, receiving this letter does not mean you are about be collected on.

The second letter is very similar, just another notice of unpaid taxes, but with additional interest and penalties added since the last letter. This resister has received two different second letters in different tax years – one is marked Notice CP501, and the title below the address line is “You have unpaid taxes for [tax year],” while the other is marked Notice CP503, with a title of “Second reminder: You have unpaid taxes for [tax year].” In either case, it functions as a reminder that taxes are unpaid, and again, receiving this letter does not mean you are about be collected on.

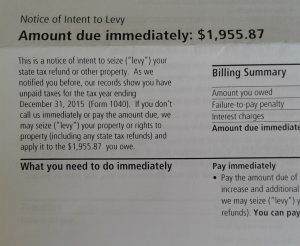

This resister has usually, a month or two later, received a third letter, called Notice of Intent to Levy, Notice CP504, sent by certified mail and requiring a signature to receive it. This letter is the final notice before the IRS may take enforcement action, such as levying bank accounts or garnishing wages. It does not mean that a levy will happen.

This resister has usually, a month or two later, received a third letter, called Notice of Intent to Levy, Notice CP504, sent by certified mail and requiring a signature to receive it. This letter is the final notice before the IRS may take enforcement action, such as levying bank accounts or garnishing wages. It does not mean that a levy will happen.

This resister has only sometimes received a fourth letter for any tax year. Other common types of communication they have received from the IRS are:

- Taxpayer’s Copy of Notice of Levy, informing you that the IRS has levied some account of yours for back taxes (Form 8519)

- a notice of garnishment of wages (which this resister has never received)

- “Please Call Us About Your Overdue Taxes or Tax Returns,” a letter from the IRS Automated Collection Service (ACS) Support office (Letter 2050)

- “Call Immediately To Prevent Property Loss – Final Notice of Intent to Levy and Notice of Your Right to a Hearing,” from the IRS ACS Support office (Letter 1058)

- letters regarding “frivolous filings”

If you get a letter with a notice number from the IRS in the upper right hand corner, you can look up that specific letter on their website. (Note: letters from ACS Support don’t seem to be in their database.)

How will you deal with these letters? War tax resisters have many different ways of communicating with the IRS: some keep it businesslike, some don’t communicate at all, and some aim to be friendly and communicative with all IRS personnel. Again, read our guide on collection for more stories of how war tax resisters have responded. How you handle these letters is up to you, but our war tax resistance counselors may be able to help if you have questions.

P.S. Although resisters may fear an audit, they are relatively rare, especially for resisters with uncomplicated returns.

P.P.S. Those who enjoy trying to understand the puzzle of IRS bureaucracy might also want to peruse David Gross’ posts on the communications (“nastygrams”) and levies he has received from the IRS over the years (all linked under the heading I., subheading G).

Post by Erica

You can link directly to my “nastygrams” outline index entry with this anchor: https://sniggle.net/TPL/index5.php?entry=outline5#Bcbdc6d33